Valued at a market cap of $41.1 billion, TKO Group Holdings, Inc. (TKO) is a sports and entertainment company based in New York. It owns and operates a few of the world’s most prominent live-event sports brands, generating revenue through media rights agreements, live events, sponsorships, merchandising, and licensing.

Companies worth $10 billion or more are typically classified as “large-cap stocks,” and TKO fits the label perfectly, with its market cap exceeding this threshold, underscoring its size, influence, and dominance within the entertainment industry. The company leverages strong intellectual property, loyal fan bases, and long-term media contracts to drive scalable, recurring revenue growth.

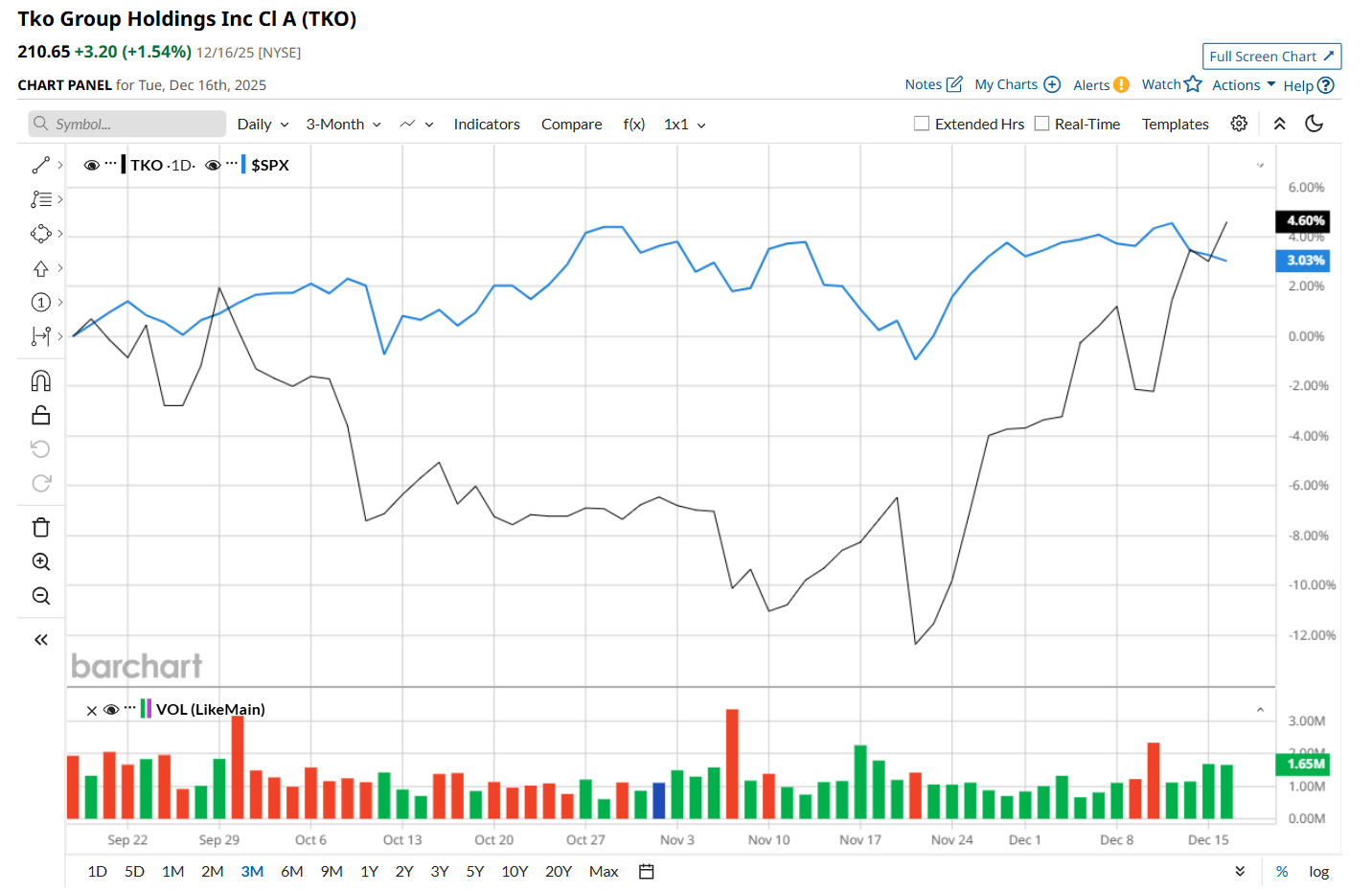

This entertainment company touched its 52-week high of $213.23 in the last trading session. Shares of TKO have gained 5.2% over the past three months, outperforming the S&P 500 Index’s ($SPX) 2.9% rise during the same time frame.

In the longer term, TKO has rallied 43.3% over the past 52 weeks, considerably outpacing SPX’s 12% uptick over the same time frame. Moreover, on a YTD basis, shares of TKO are up 48.2%, compared to SPX’s 16.6% return.

To confirm its bullish trend, TKO has been trading above its 200-day moving average over the past year, and has remained above its 50-day moving average since late November.

TKO reported mixed Q3 results on Nov. 5, and its shares fell 3.3% in the following trading session. The company’s revenue declined 27.3% year-over-year to $1.1 billion, but topped analyst estimates by 3.7%. However, its adjusted EPS of $0.50 missed consensus expectations of $0.55.

TKO has notably outpaced its rival, Live Nation Entertainment, Inc. (LYV), which gained marginally over the past 52 weeks and rose 6.6% on a YTD basis.

Given TKO’s recent outperformance, analysts remain highly optimistic about its prospects. The stock has a consensus rating of "Strong Buy” from the 23 analysts covering it, and the mean price target of $221.65, suggests a 5.2% premium to its current price levels.

On the date of publication, Neharika Jain did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- This Growth Stock With 137% Upside Faces New Challenge: Buy, Hold or Sell?

- How to Buy CSCO for a 2.5% Discount, or Achieve a 19% Annual Return

- S&P Futures Gain as Investors Weigh U.S. Jobs Data, Fed Speak and Micron Earnings in Focus

- This High-Yield Dividend Stock Trades at a Third of Its Record Highs: Is It a Buy for 2026?