Arcus Biosciences (RCUS) entered late 2025 with growing optimism around its oncology pipeline, supported by encouraging clinical data, multiple upcoming catalysts, and a balance sheet strong enough to fund years of development. For a time, the company looked like a high-upside growth stock.

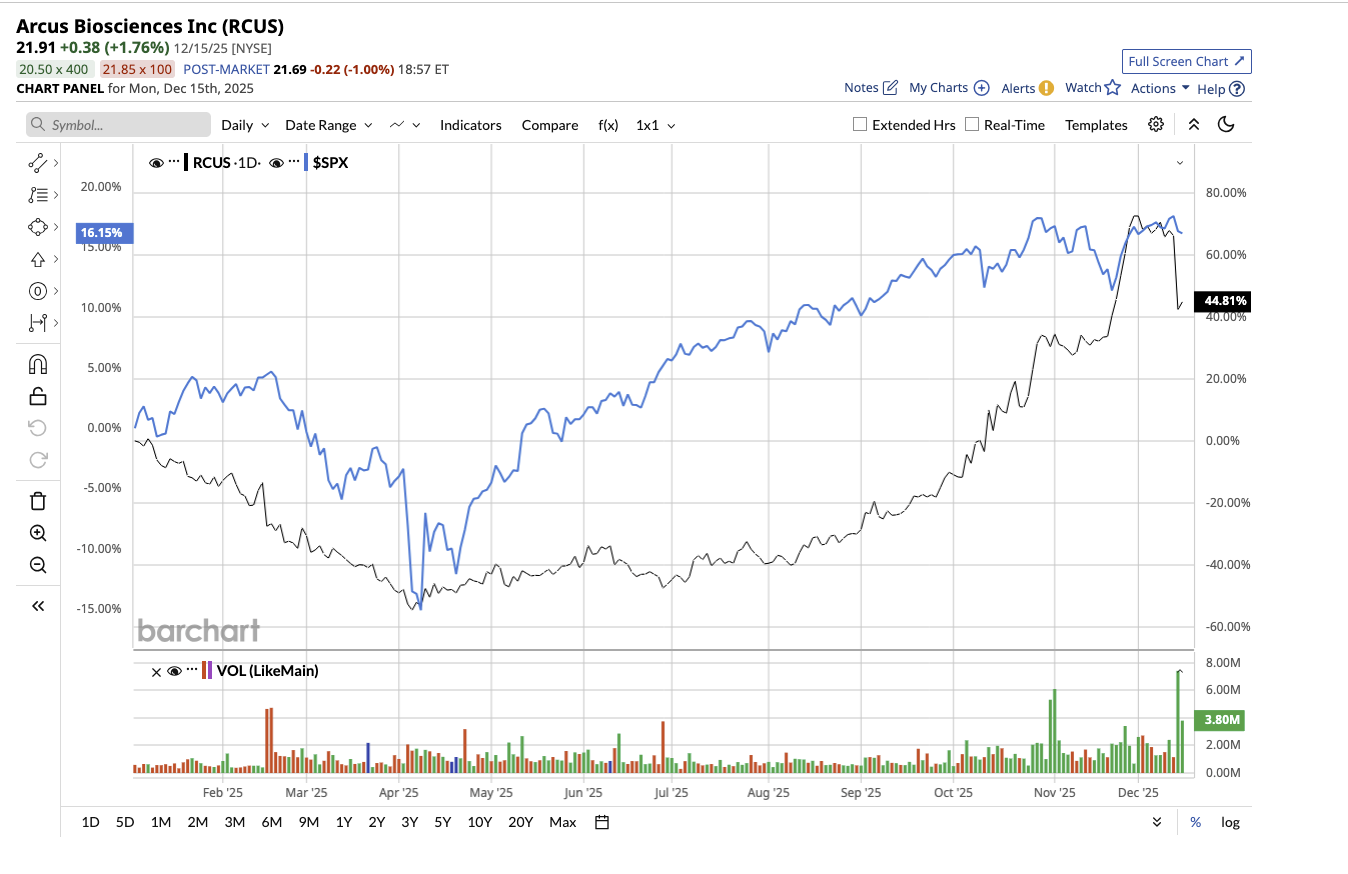

However, that story was put to the test in December, when Arcus announced the cancellation of its Phase 3 STAR-221 research due to inefficiency. While the stock is up 49% year-to-date (YTD), it has plunged 16% from its 52-week high of $26.40. So, has this setback weakened the investment case for Arcus, or does it signal that Arcus' path forward has been sharpened? Here’s how investors should think about the stock now.

About Arcus Biosciences

Valued at $2.7 billion, Arcus Biosciences is a clinical-stage biopharmaceutical company that develops new medicines for cancer and inflammatory and autoimmune diseases. It does not yet sell approved medicines.

Its key oncology programs include Casdatifan, a small-molecule drug for clear cell kidney cancer; Quemliclustat, a small-molecule drug being studied in pancreatic cancer and immunotherapy combinations that modulate the immune system to attack tumors.

STAR-221 Discontinuation: A Near-Term Setback

STAR-221 was a big, global Phase 3 study that enrolled over 1,000 participants from approximately 30 countries. It investigated if combining domvanalimab, an Fc-silent anti-TIGIT antibody, with zimberelimab and chemotherapy could enhance survival rates in advanced upper gastrointestinal cancers.

Recently, the company announced that the Phase 3 STAR-221 trial, which was testing domvanalimab plus zimberelimab and chemotherapy in first-line gastric and esophageal cancers, would be discontinued due to futility. The conclusion was made after an interim review revealed no overall survival improvement over standard therapy.

A Rich Roadmap Through 2026

Following the STAR-221 decision, Arcus clarified that its capital and R&D efforts will now be focused on casdatifan and the emerging I&I portfolio. Casdatifan is a small-molecule inhibitor of HIF-2α, a confirmed biological target in ccRCC. Positive results from the Phase 1/1b ARC-20 study have boosted Arcus' belief that casdatifan might become a best-in-class medication for kidney cancer.

In addition, Arcus is pursuing a multifaceted strategy to optimize casdatifan's potential in various therapy scenarios. The global Phase 3 PEAK-1 study, testing casdatifan with cabozantinib against cabozantinib alone in immunotherapy-experienced metastatic ccRCC, is presently enrolling. While STAR-221 is gone, casdatifan ensures that Arcus remains very much a catalyst-driven stock.

Arcus' oncology journey does not stop with kidney cancer. The company has completed enrollment in PRISM-1, a Phase 3 trial looking at quemliclustat, a small-molecule CD73 inhibitor, in first-line metastatic pancreatic cancer. One of the most underestimated parts of Arcus' reset is its inclusion of inflammatory and autoimmune disorders.

Arcus expects its first I&I candidate, an MRGPRX2 small-molecule inhibitor, to start clinical trials in 2026, followed by a TNF program in late 2026 or early 2027. If effective, these oral treatments might eventually expand Arcus' portfolio outside oncology and minimize single-asset risk over time.

Importantly, Arcus has the financial resources to absorb the STAR-221 letdown. At the end of the third quarter, Arcus reported $1 billion in cash and investments and expects to fund planned operations until at least the second half of 2028. This runway enables Arcus to explore numerous Phase 3 programs, advance new disease areas, and weather clinical volatility without putting immediate pressure on its balance sheet.

RUCS Stock: Buy, Hold, or Sell?

The STAR-221 discontinuation is a genuine setback and a reminder that late-stage biotech stocks carry significant risk. Investors with a low appetite for risk could see this as a reason to stay on the sidelines. However, Arcus today is more focused, not weaker. Casdatifan now stands clearly at the center of the story, backed by compelling early data and an extensive lineup of upcoming milestones. With a healthy cash position and a developing I&I platform, the company continues to provide significant long-term upside for investors prepared to take the risk of investing in a clinical-stage biotech.

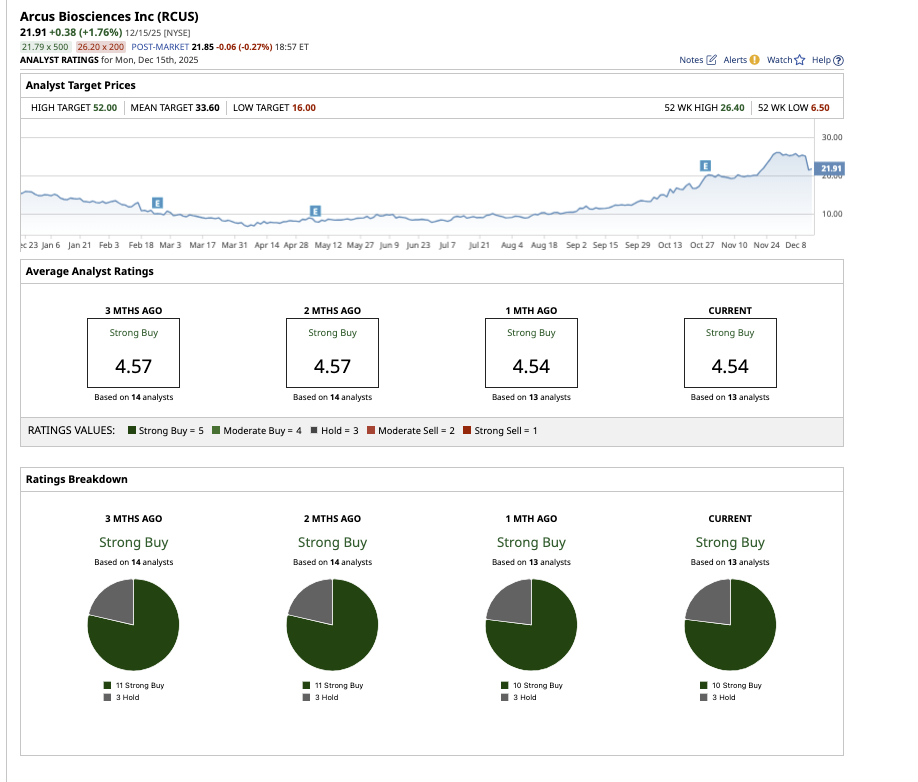

Despite this temporary setback, overall, Wall Street remains strongly bullish about RCUS stock. However, Citi analyst Yigal Nochomovitz lowered the target price for the stock to $44 from $56 while holding a “Buy” rating. Similarly, a Truist Financial analyst also lowered the price target to $30 from $39. The analyst maintained the “Buy” rating, stating that Arcus is well positioned to streamline R&D spending and advance casdatifan toward several key clinical milestones expected in 2026.

Out of the 13 analysts that cover the stock, 10 rate it a “Strong Buy,” and three say it is a “Hold.” The stock’s average price target of $33.60 suggests an upside potential of 53% from current levels. Plus, its high target price of $52 implies potential upside of 137% in the next 12 months.

On the date of publication, Sushree Mohanty did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- This Growth Stock With 137% Upside Faces New Challenge: Buy, Hold or Sell?

- How to Buy CSCO for a 2.5% Discount, or Achieve a 19% Annual Return

- S&P Futures Gain as Investors Weigh U.S. Jobs Data, Fed Speak and Micron Earnings in Focus

- This High-Yield Dividend Stock Trades at a Third of Its Record Highs: Is It a Buy for 2026?