Tesla (TSLA) stock is closing in on the $500 mark. The recent rally was sparked by a reported Waymo outage, which left many of the company’s autonomous vehicles stranded on the streets. This brought back attention to Elon Musk’s full self-driving and autonomy. With the stock struggling to break the $500 barrier in the last week’s trading, investors have started wondering whether it is a psychological resistance and therefore worth selling the stock in the short term.

The arguments for buying or selling the stock are both valid. Tesla’s valuation is so high that it almost doesn’t make any sense. Yet the company is developing technology that could significantly alter the way we pursue work and live our lives. It comes down to whether someone is investing in the short term or for the long run. The $500 level is behaving like a profit-taking level, so the bearish case remains strong. If one can ignore this short-term investor behavior, the same level could very well be a stepping stone to a multi-trillion-dollar valuation.

About Tesla Stock

Tesla is mainly known for its electric vehicles and an outspoken and controversial CEO in the form of Elon Musk. However, the company does much more, including in AI, robotics, and energy generation and storage. It is headquartered in Austin, Texas.

Tesla’s 19% year-to-date (YTD) returns have barely outperformed the S&P 500 Index's ($SPX) 17.58% returns this year. Considering how important AI and robotics have become, one can expect the stock to continue gaining as more previously deemed impossible achievements become a reality thanks to its increasing investments in those fields.

TSLA stock trades at an extreme premium when we consider most of the conventional valuation metrics. After gaining 15% in just a month, this valuation has stretched further. Even when compared to its own five-year history, the stock is overvalued. For instance, its forward P/E of 377.87x is 1.5 times higher than its five-year average forward P/E of 148.54x. The forward EV/EBIT ratio is over 3 times the historic average of 115.69x.

The stock is clearly overvalued. But how do we price in Elon Musk’s statement that people soon may not even need to work because of humanoid robots? How do we cater to Elon Musk’s plan of making car ownership redundant, because one could just call a robotaxi from an app without having to worry about owning a car? The answer to these questions is not simple and depends heavily on how seriously you take Musk's word.

As an investor, one needs to decide what risk they are willing to take on. If buying at an all-time high makes you wonder about the downside if the broader market takes a turn for the worse, it's better to stay away. If you are excited about the company’s prospects and lead in AI and robotics, buying below $500 could turn out to be a bargain, especially when the FOMO crowd gets back into the stock once it crosses that psychological level of $500.

Tesla Misses Earnings Estimates

Tesla announced its Q3 2025 earnings on Oct. 22 and failed to beat earnings estimates. It reported an EPS of $0.5 vs. an estimated EPS of $0.54. It did beat the consensus estimates on revenue, reporting $28.1 billion during the quarter against estimates of $26.37 billion. This was a 12% year-over-year (YoY) increase in revenue. The company’s automotive segment grew at a modest 6%, though.

The bottom line shrank significantly compared to the same period last year. While lower EV prices were to blame, a major reason was the operating expenses, which have gone up due to AI pursuits and similar R&D projects.

On the earnings call, Elon Musk restated the importance of having a decent-sized fleet on the roads, which could be turned into fully autonomous vehicles based on just a software upgrade. He expects that in less than two years, the company could be producing cars at an annualized rate of 3 million.

Tesla also continues to face challenges bringing its humanoid robot Optimus to the market. Issues related to hand dexterity continue to take more resources, but supply chain problems are also adding to the mess. Regulatory hurdles for full self-driving and robotaxis also remain.

What Analysts Are Saying About TSLA Stock

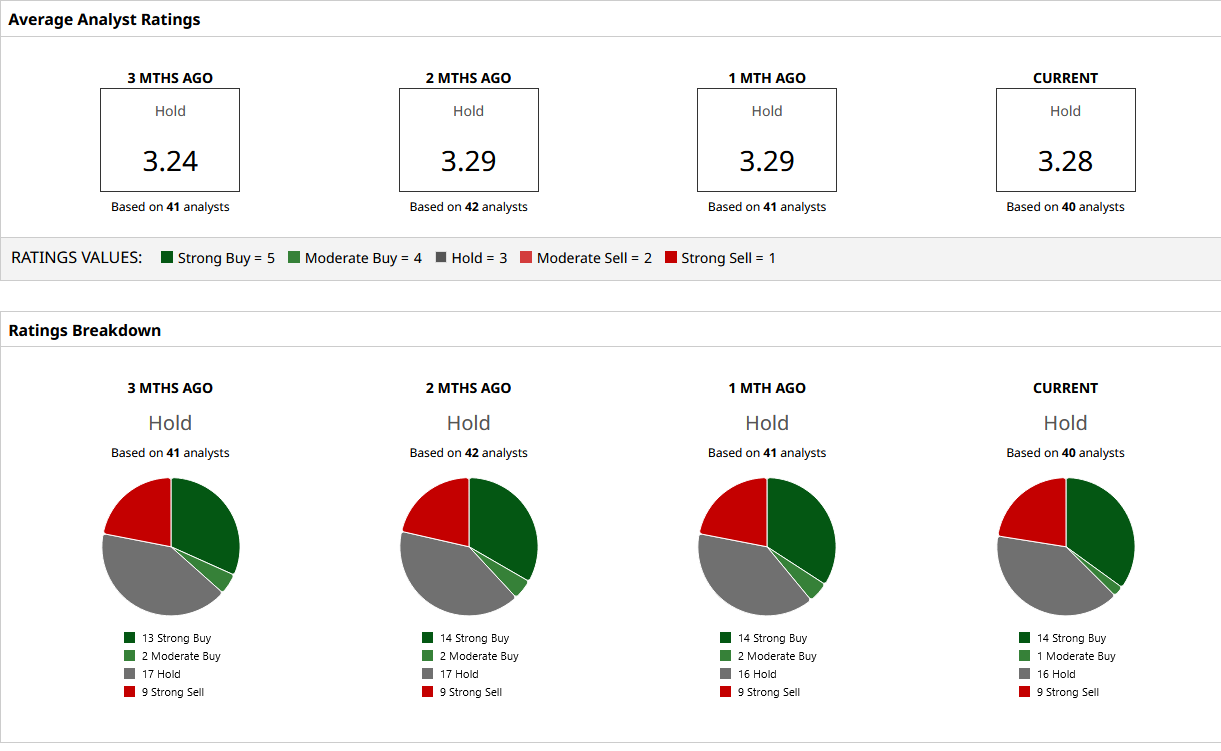

TSLA has always received mixed opinions when it comes to valuation, with analysts sometimes claiming price targets that seem ridiculous. The stock remains a consensus “Hold,” but out of the 40 analysts who cover it on Wall Street, 14 have a “Strong Buy” rating while nine call it a “Strong Sell.” The stock continues to trade around the halfway mark of the mean target price of $389.76 and the highest target price of $600.

On the date of publication, Jabran Kundi did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Dan Ives Is Betting That Apple and Google Will Partner in 2026. Should You Buy AAPL Stock First?

- Should You Sell Netflix Stock Before It Wins the Warner Bros Takeover?

- 1 Broadcom Insider Just Dumped $12 Million in AVGO Stock. Should You Sell Too?

- Disney Insider James Gorman Just Bought $2 Million of DIS Stock. Should You Load Up on Shares Too?