Fortinet, Inc. (FTNT) is a leading U.S.-based cybersecurity company headquartered in Sunnyvale, California, that provides a broad range of security solutions for enterprises, service providers, and government clients worldwide. Its offerings include next-generation firewalls, cloud and network security, endpoint protection, VPNs, zero-trust access, and threat detection services, all integrated through its Fortinet Security Fabric platform.

Companies worth $10 billion or more are generally described as “large-cap stocks,” and FTNT perfectly fits that description, with its market cap exceeding this mark, underscoring its size, influence, and dominance within the software-infrastructure industry. Beyond hardware and software, Fortinet delivers managed security services, threat intelligence, and consulting, making it a comprehensive cybersecurity partner. With strong profitability, a growing global customer base, and a robust product ecosystem, Fortinet is well-positioned to capitalize on the rising demand for unified and scalable cybersecurity solutions.

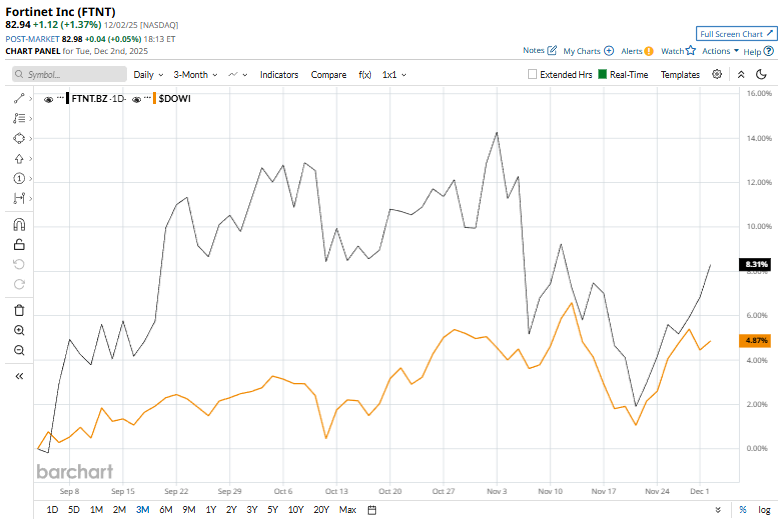

Despite its notable strength, FTNT slipped 27.8% from its 52-week high of $114.82, achieved on Feb. 18. Over the past three months, FTNT stock has gained 7.8%, underperforming the broader Dow Jones Industrial Average’s ($DOWI) 4.8% rise during the same time frame.

In the longer term, shares of FTNT dipped 12.2% on a YTD basis and 13% over the past 52 weeks, underperforming $DOWI’s YTD gains of 11.6% and 6% returns over the last year.

FTNT’s continued trading below its 50-day moving average since late July and its 200-day moving average since early August underscores the ongoing bearish momentum.

On Nov. 12, Fortinet shares fell over 1% following a downgrade by Daiwa Securities, which lowered its rating on the stock from “Outperform” to “Neutral.” The brokerage cited concerns over near-term growth momentum and valuation pressures in the cybersecurity sector as reasons for the adjustment.

In the competitive arena of the software industry, Palo Alto Networks, Inc. (PANW) has taken the lead over FTNT, showing resilience with a 4.4% uptick on a YTD basis and 2.7% drop over the past 52 weeks.

Wall Street analysts are cautious on FTNT’s prospects. The stock has a consensus “Hold” rating from the 41 analysts covering it, and the mean price target of $86.31 suggests a potential upside of 4.1% from current price levels.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Deere Got Hit by Tariffs... Again. Should You Buy the Blue-Chip Dividend Stock on the Dip?

- The Tesla Europe Sales Rout Keeps Going. Is It Time to Sell TSLA Stock?

- Dear Nuclear Energy Stocks Fans, Mark Your Calendars for December 3

- Nvidia Just Lit a Fire Under Synopsys Stock But Its Chart Is Waving Red Flags. Here’s the Only Way I’d Trade SNPS Here.