U.S. electric vehicle (EV) companies look set to end 2025 on a sour note, continuing their dismal run since the bubble peaked and burst in 2021. Specifically, Lucid Motors (LCID)—which completed a reverse stock split earlier this year, helping it exit the penny stock category—is down 57% year-to-date (YTD).

Lucid shares have fallen every year after the hyped listing in 2021, and 2025 looks no different, unless, of course, something dramatically changes over the next four weeks. Meanwhile, Lucid has historically traded at a premium to its U.S.-based EV peer Rivian (RIVN), but now trades at a slight discount. While both companies are currently posting net losses (and should continue to do so for the next few quarters at the least), rendering the traditional price-to-earnings ratio useless, Lucid’s forward enterprise value-to-sales multiple of 3.01x is now below that of Rivian, which trades at 3.16x. But then, does being relatively cheap make Lucid a better buy? Let’s explore.

What’s Ailing Startup EV Stocks?

To be sure, both Rivian and Lucid have been ailing under similar issues. The demand for EVs hasn’t been to the extent that companies planned for while pouring billions of dollars into building new plants. Things look set to worsen further as the Trump administration has phased out the EV tax credit that helped lower the acquisition price of electric cars by as much as $7,500. Even Tesla (TSLA) CEO Elon Musk has warned of a “few rough quarters” following the withdrawal of the tax credit, but I suspect the slump would be a bit elongated.

The massive EV capacity and demand-supply mismatch have fueled a price war, with companies undercutting each other on pricing to boost shipments. While legacy automakers can absorb the EV losses given the stellar earnings their legacy internal combustion engine (ICE) business is generating, and Tesla has its once industry-leading margins and other businesses to fall back on, startup EV companies don’t have any such luxury.

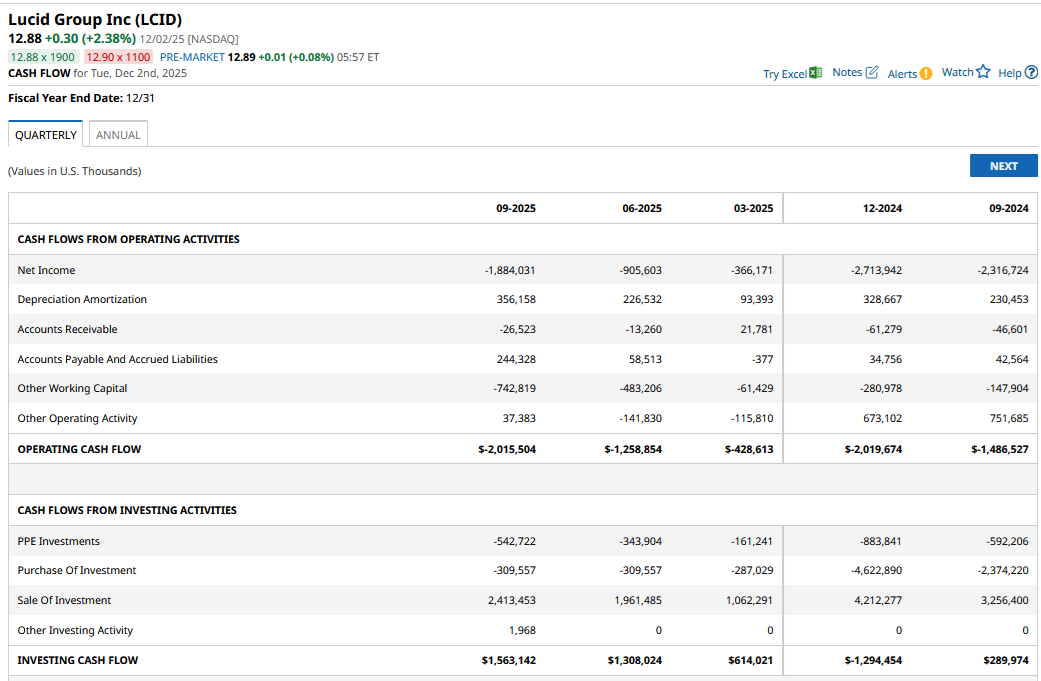

Both Rivian and Lucid Motors are reeling under perennial losses and cash burn, which necessitates frequent capital raises, leading to dilution for existing shareholders. However, Rivian has fared a lot better than Lucid on both profitability and capital management.

Lucid’s Gross Margins Are Negative

Lucid Motors' cost of revenues in the third quarter of 2025 was nearly twice the revenues it earned during the quarter. That’s a gross loss margin of around 100%, and one need not be a finance wizard to tell that the number is hideous and unsustainable.

Add in all other operating expenses, and the company posted an operating loss of over $942 million in the quarter, pushing its operating loss in the first nine months of the year to over $2.4 billion, slightly ahead of what it posted in the corresponding period last year.

In contrast, Rivian, which posted its first-ever gross profit in Q4 2024, has repeated the feat in three of the last four quarters. While arguably the gross profit did not come from the automotive division but from software and services sales, it's still noteworthy given the state of the EV industry.

Lucid Motors Has Been on a PIF Dopamine

Lucid Motors continues to burn billions of dollars in cash every year, which has mostly been funded by Saudi Arabia’s sovereign wealth fund, its biggest shareholder. The country’s Public Investment Fund (PIF) has poured billions directly into the cash-guzzling EV startup by participating in every stock sale since the 2021 listing. It has also opened a delayed draw term loan credit facility for Lucid and raised its size by $750 million to $2 billion in Q3. Most recently, the PIF virtually provided a backstop in Lucid’s convertible bond sale by entering into a privately negotiated prepaid forward transaction.

This dopamine of PIF money, for lack of a better word, has helped Lucid fund its burgeoning cash burn and stay afloat. EV startups that did not have backers with deep pockets simply went out of business, as beyond a point, investors refused to pour money into them.

To be sure, the Saudi partnership is a win-win, and Lucid built The Kingdom’s first car manufacturing facility, which it is expanding further. The country sees EVs as a key part of its strategic goals and a hedge against the expected fall in oil demand amid the EV transition. Partnering with Lucid, which, despite its massive losses, has one of the best products in the market, makes sense for the oil-rich nation.

Rivian, too, is backed by Amazon (AMZN), but the Seattle-based tech giant hasn’t and perhaps cannot pour unending money into the company as it is answerable to shareholders—unlike the PIF.

Is LCID a Better Buy Than RIVN?

Despite Lucid now trading cheaper compared to Rivian and its stock languishing near record lows, I continue to prefer the latter given its better track record on execution. While Lucid is long overdue for a rebound, I believe on a comparative basis Rivian still looks the better bet.

On the date of publication, Mohit Oberoi had a position in: LCID , RIVN , TSLA , AMZN . All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Cathie Wood Is Buying Up Google Stock at Record Highs. Should You?

- MicroStrategy Is Turning to a U.S. Dollar Reserve Amid Bitcoin Volatility. Should You Buy, Sell, or Hold MSTR Stock Here?

- This ‘Strong Buy’ AI Stock Could Jump 56% —Time to Buy?

- Microsoft May Be an AI Tech Giant, But It Is Also One of the Safest Stocks to Own Now, According to Wall Street