A slowdown in China’s electric vehicle (EV) sales has revived murmurs of another blow to Tesla (TSLA). While September saw the company’s EV sales grow 15.5% year-over-year, the growth rate slowed down to just 7.3% in October. In fact, overall car sales in China declined by 0.8% year-over-year, compared to a 6.6% increase in October.

So, is this a cause for worry for the world’s largest automaker? Not really, simply because Tesla's sales in China have been weak for a while now. Tesla's sales saw a year-over-year decline in six out of the first 10 months in 2025. In October, the company reported sales of just 26,006 vehicles in the country. Not only was this down 36% from the previous year, but it was also a three-year low for the Elon Musk-led company.

Is China a Lost Cause for Tesla?

This begs the question: Like Nvidia (NVDA), is Tesla giving up on the world's largest EV market? Not at all, as the company is taking initiatives to stem the decline.

For instance, the introduction of a longer-range rear-wheel-drive Model Y variant in China yielded tangible results in November 2025, with registrations rising 9.9% compared to the same month in 2024. Tesla also launched a six-seat configuration of the Model Y tailored for the Chinese market, aiming to appeal to families and buyers seeking greater interior flexibility, a priority frequently highlighted by domestic competitors.

Furthermore, reports indicate that Tesla is developing a more affordable version of its top-selling Model Y. This version is designed to achieve production costs roughly 20% below those of the refreshed Model Y introduced in 2024, enabling sharper pricing to protect market share amid fierce competition from Chinese EV manufacturers.

Finally, the Shanghai Gigafactory continues to serve as a strategic asset, producing all Tesla vehicles sold in China. Local manufacturing delivers clear cost and supply-chain benefits relative to imported rivals, while providing the flexibility to ramp production swiftly in response to demand shifts and to export vehicles to additional regions, thereby helping balance global inventory and sales volatility.

Financials Stable Despite Mixed Q3

Notwithstanding its China issues, Tesla remains locked in on artificial intelligence, which will power its automobile, energy and humanoid robot ambitions. But are the company's financials in a position to support these ambitions? I think it is.

Looking at the company's Q3 results, Tesla's revenue outperformed consensus expectations, but profitability marked its third-straight year-over-year decline. Total revenue advanced 12% to $28.1 billion, driven largely by faster-growing non-vehicle businesses. The energy generation and storage segment surged 44% to $3.4 billion, and services revenue increased 25% to $3.5 billion. Automotive revenue, historically the core driver, rose a more modest 6% to $21.2 billion, benefiting from a last-minute lift as the $7,500 federal EV tax credit phased out.

Earnings per share fell 31% to $0.50, missing estimates of $0.56. Operating cash flow remained resilient at $6.2 billion, and Tesla ended the quarter with $41.6 billion in cash and equivalents compared with only $1.9 billion in short-term debt, maintaining substantial financial flexibility.

Vehicle deliveries reached 497,099 units, up 7% from the prior year, while production slipped 5% to 447,450 units. The widening gap between output and shipments reflects a combination of uneven demand patterns and proactive inventory adjustments as competition in the EV market intensifies.

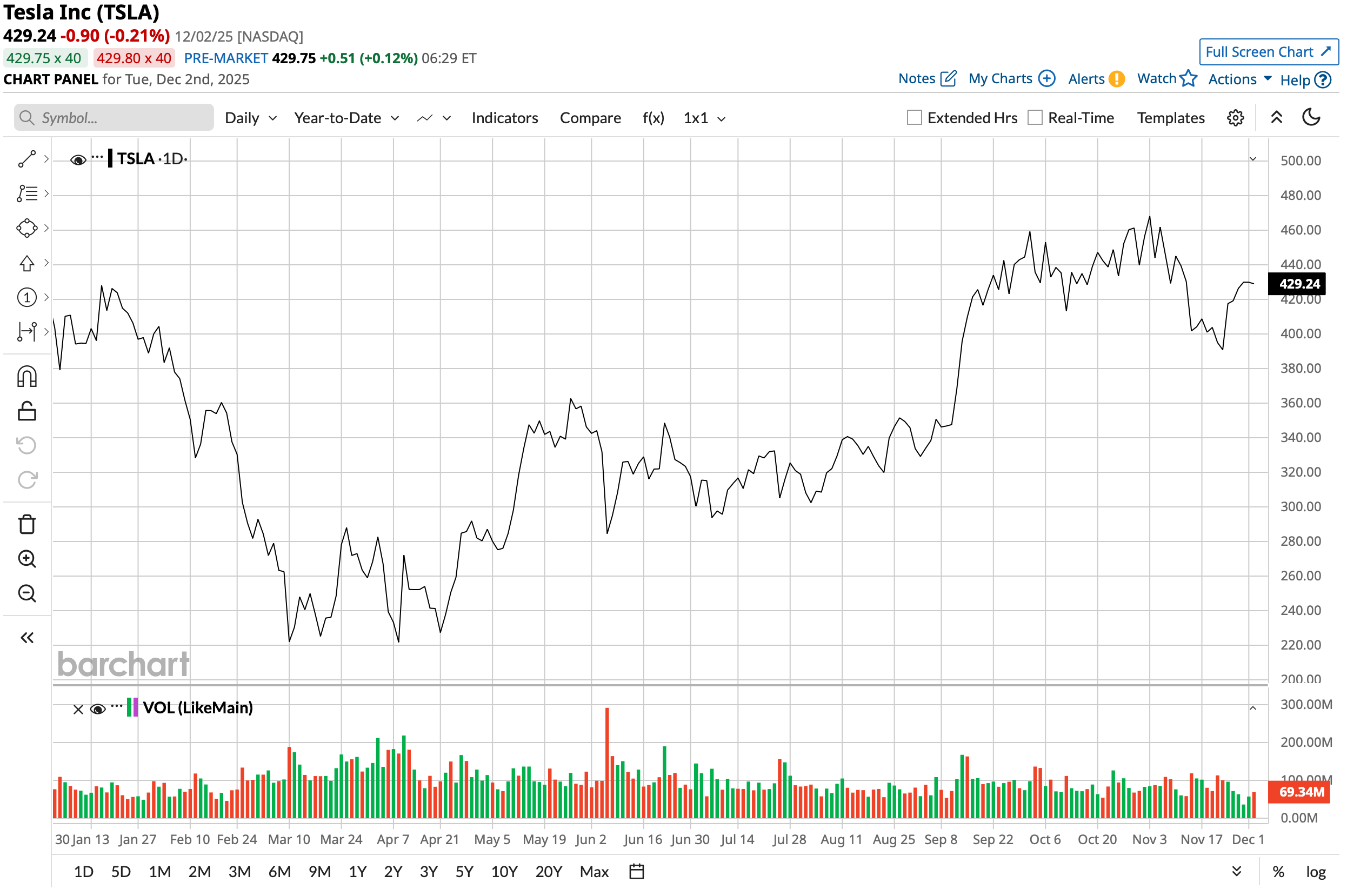

With a current market cap of $1.43 trillion, TSLA stock is up 6.3% on a YTD basis.

Analyst Opinion

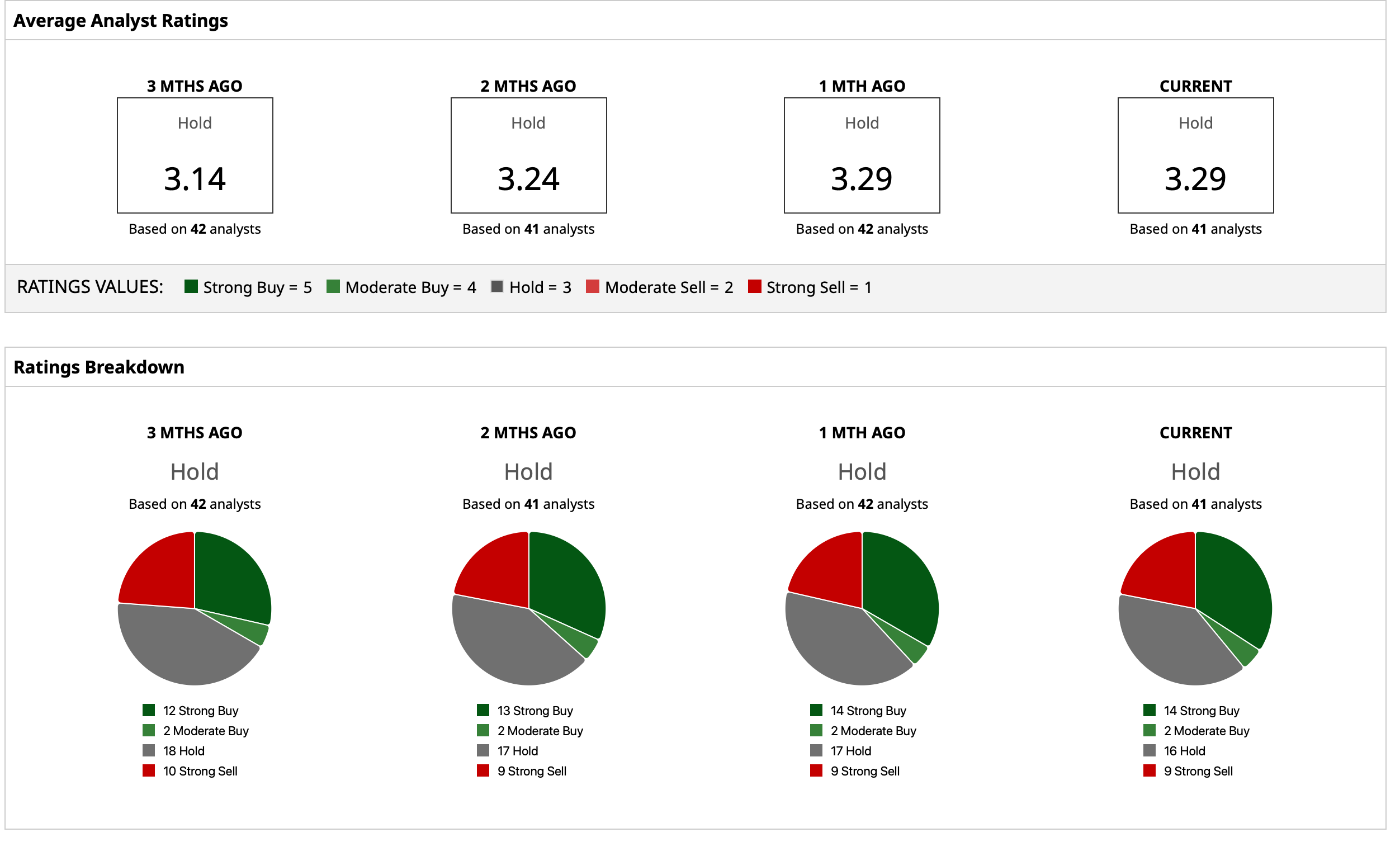

Overall, analysts have attributed a rating of “Hold” for the stock, with a mean target price that has already been surpassed. The high target price of $600 denotes upside potential of roughly 40% from current levels. Out of 41 analysts covering the stock, 14 have a “Strong Buy” rating, two have a “Moderate Buy” rating, 16 have a “Hold” rating, and nine have a “Strong Sell” rating.

On the date of publication, Pathikrit Bose did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- TD Cowen Says This Chip Stock (Not Nvidia) Is the Best Idea for 2026

- Trump Is Doubling Down on Robotics. Does That Make Tesla Stock a Buy Here?

- The $500 Billion Reason Wells Fargo Thinks Oracle Stock Can Gain 40% from Here

- Wall Street Is Cheering Metaverse Spending Cuts at Meta Platforms, But Is META Stock a Buy Here?