Valued at $67.8 billion by market cap, Quanta Services, Inc. (PWR) is a leading infrastructure solutions provider specializing in the design, construction, repair, and maintenance of critical electric power, renewable energy, communications, and pipeline utility systems. Headquartered in Houston, the company operates across North America with a large skilled workforce and plays a key role in supporting power-grid modernization, clean-energy expansion, and utility-infrastructure upgrades.

Companies worth $10 billion or more are generally described as “large-cap stocks,” and PWR perfectly fits that description, with its market cap exceeding this mark, underscoring its size, influence, and dominance within the engineering & construction industry. With diversified capabilities across electric transmission and distribution, renewable energy projects, and underground pipeline services, Quanta is positioned as a major contractor driving the energy-transition and utility infrastructure development.

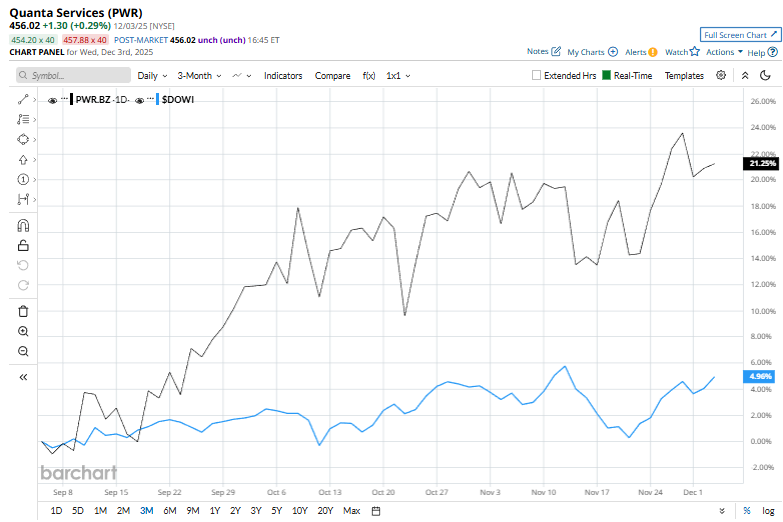

Despite its notable strength, PWR slipped 2.9% from its 52-week high of $469.43, achieved on Jul. 25. Over the past three months, PWR stock gained 21.8% outperforming the Dow Jones Industrial Average’s ($DOWI) 5.8% rise during the same time frame.

In the longer term, shares of PWR rose 44.3% on a YTD basis and climbed 34.2% over the past 52 weeks, outperforming $DOWI’s YTD gains of 12.6% and 7.1% returns over the last year.

To confirm the bullish trend, PWR has been trading above its 200-day moving average since early May. The stock has been trading above its 50-day moving average since mid-September.

Quanta Services’ stock climbed 1.2% on Oct. 30 after the company delivered stronger-than-expected Q3 2025 results. Adjusted EPS came in at $3.33, surpassing analyst forecasts, while revenue surged 17.5% year-over-year to $7.63 billion, also ahead of expectations, reflecting robust momentum in its electric and renewable infrastructure segments. The company also lifted its full-year revenue guidance to $27.8–$28.2 billion and reaffirmed a solid adjusted EPS midpoint of $10.58, underscoring continued confidence in its growth outlook.

In the competitive arena of engineering & construction, Comfort Systems USA, Inc. (FIX) has taken the lead over PWR, showing resilience with a 77.4% uptick on a YTD basis and 137.1% gains over the past 52 weeks.

Wall Street analysts are reasonably bullish on PWR’s prospects. The stock has a consensus “Moderate Buy” rating from the 28 analysts covering it, and the mean price target of $470.75 suggests a potential upside of 3.2% from current price levels.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Grain Market Update: Where are Corn and Soybean Prices Headed?

- This High-Yield Utility Stock Is a Top AI Buy

- Is the Wheel the Best Options Strategy for Income? Here’s How to Trade Options Like Warren Buffett

- Ford Just Reported an Absolute Collapse in Its EV Sales. That Could Be a Key Warning for Tesla Stock.