Valued at a market cap of $72.5 billion, Miami, Florida-based Royal Caribbean Cruises Ltd. (RCL) is a global cruise company. It operates 67 ships across its Royal Caribbean International, Celebrity Cruises, and Silversea Cruises brands.

Companies valued at $10 billion or more are generally considered "large-cap" stocks, and Royal Caribbean Cruises fits this criterion perfectly. The company offers a wide range of itineraries, serving travelers around the world.

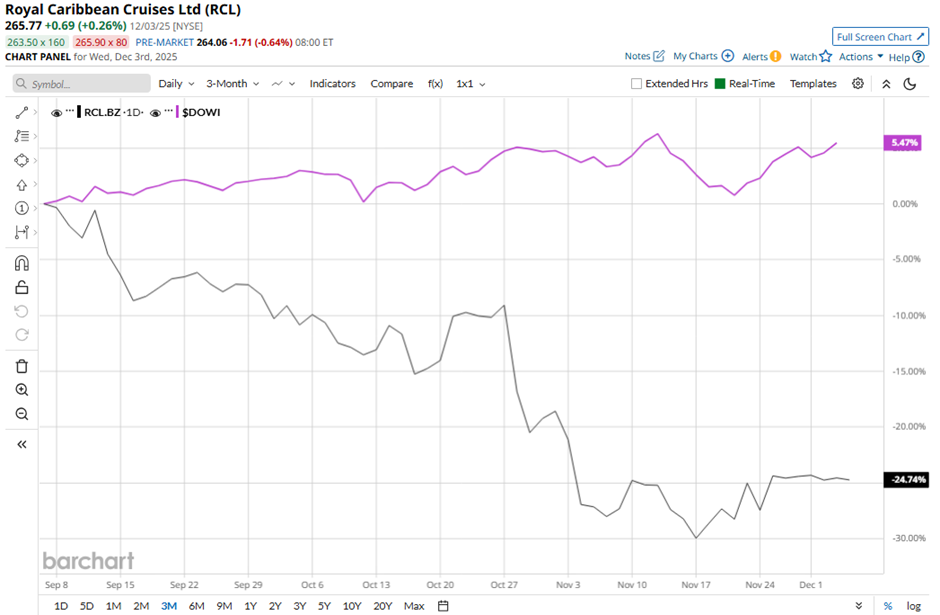

Shares of Royal Caribbean Cruises have declined 27.9% from its 52-week high of $366.50. Over the past three months, its shares have decreased 25.1%, underperforming the broader Dow Jones Industrials Average's ($DOWI) 5.8% rise during the same period.

Longer term, RCL stock is up 15.2% on a YTD basis, outpacing DOWI's 12.6% gain. Moreover, shares of the cruise operator have returned 8.1% over the past 52 weeks, compared to DOWI’s 7.1% increase over the same time frame.

However, the stock has been trading below its 50-day moving average since mid-September.

Despite reporting better-than-expected Q3 2025 adjusted EPS of $5.75, shares of RCL tumbled 8.5% on Oct. 28 because revenue of $5.14 billion missed forecasts. Investors also reacted to rising costs, with NCC ex-fuel up 4.8% and Gross Cruise Costs per APCD up 2.7%, alongside pressures from adverse weather and the extended closure of Labadee, which weighed on expectations for Q4. Additionally, the company issued softer Q4 guidance of $2.74 to $2.79 in adjusted EPS.

In comparison, rival Airbnb, Inc. (ABNB) has performed weaker than RCL stock. ABNB stock has dipped 8.6% YTD and 12.6% over the past 52 weeks.

Despite the stock’s outperformance relative to the Dow over the past year, analysts remain cautiously optimistic about its prospects. RCL stock has a consensus rating of “Moderate Buy” from 25 analysts in coverage, and the mean price target of $335.92 is a premium of 26.4% to current levels.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart