Tesla (TSLA) stock has experienced significant volatility in 2025. A combination of factors, including slower electric vehicle (EV) demand, rising competition, and growing skepticism around Elon Musk’s high-profile political commentary and its impact on Tesla’s brand, has weighed on TSLA stock. On the other hand, the future-focused narrative Musk is selling has kept investor excitement alive, fueling dramatic price moves throughout the year.

Even with the turbulence, Tesla’s valuation has remained notably high. Over the past three months alone, the stock has climbed more than 33%. That momentum has less to do with current financial performance and more to do with the belief that Tesla is building the next generation of transformative technologies. Investors are buying into the long-term story, ignoring the short-term numbers.

Full Self-Driving (FSD) software, artificial intelligence (AI) development, humanoid robots like Optimus, and a robotaxi network represent entirely new business frontiers. If these big-picture innovations deliver, Tesla could strengthen its position as a dominant player across multiple future industries, from mobility to robotics to autonomous services.

However, there is a flip side to Tesla’s ambitious roadmap. These projects remain largely unproven, and pouring resources into robotaxis and humanoid robots risks diverting focus from the core business, including the profitable production and sale of EVs. With EV demand softening and rivals rapidly catching up, there’s a significant disconnect between Tesla’s fundamentals and its stock performance.

All of this comes with a valuation that is already priced for exceptional success. Tesla currently trades at 375.7 times forward earnings, a staggering premium, even with analysts forecasting robust 64.9% earnings growth in 2026. The stock reflects high expectations, and any delay in delivering on Tesla’s bold promises could add significant volatility to its stock price.

Tesla’s Push Into Autonomous Ride-Hailing

Tesla is laying the groundwork for future growth. In June, Tesla officially launched its long-anticipated robotaxi service, marking an entry into the self-driving transportation market. This strategy has the potential to dramatically boost Tesla’s revenue model, reducing dependence on vehicle sales and creating a stream of recurring, high-margin income from mobility services.

The company is preparing for substantial fleet expansion, beginning with a plan to double its robotaxi presence in Austin by December 2025. It also expects to introduce the service to additional U.S. cities.

However, the rollout is far from guaranteed. Tesla continues to navigate regulatory hurdles in multiple states and faces stiff competition from Waymo, Alphabet’s self-driving subsidiary, which currently leads across several major markets.

Tesla’s Humanoid Robots and the Future of Automation

Alongside its push toward autonomous mobility, Tesla is developing what could become one of its most disruptive technologies, the Optimus humanoid robot. The company expects to begin supplying the robots to commercial customers in the second half of 2026, opening a new frontier in labor-automation solutions.

Investor interest has surged following the release of newly released footage showing Optimus moving fluidly in a lab environment. Tesla has a dedicated production line in Fremont to manufacture one million units by the end of next year while keeping the cost at $20,000 per robot. If successful, this could unlock massive adoption across industries ranging from manufacturing to logistics.

Should You Buy Tesla Stock Now? Analyst Views and Risks.

The company’s future ventures beyond EVs won’t deliver immediate financial impact, but they reflect Tesla’s commitment to building businesses with wide economic moats. Tesla’s evolution into a mobility and robotics powerhouse remains a central reason many are still optimistic about Tesla stock.

However, Tesla stock continues to trade at a premium valuation, and its transformative opportunities also carry high execution risk. Elevated expectations and uncertain timelines make the stock vulnerable.

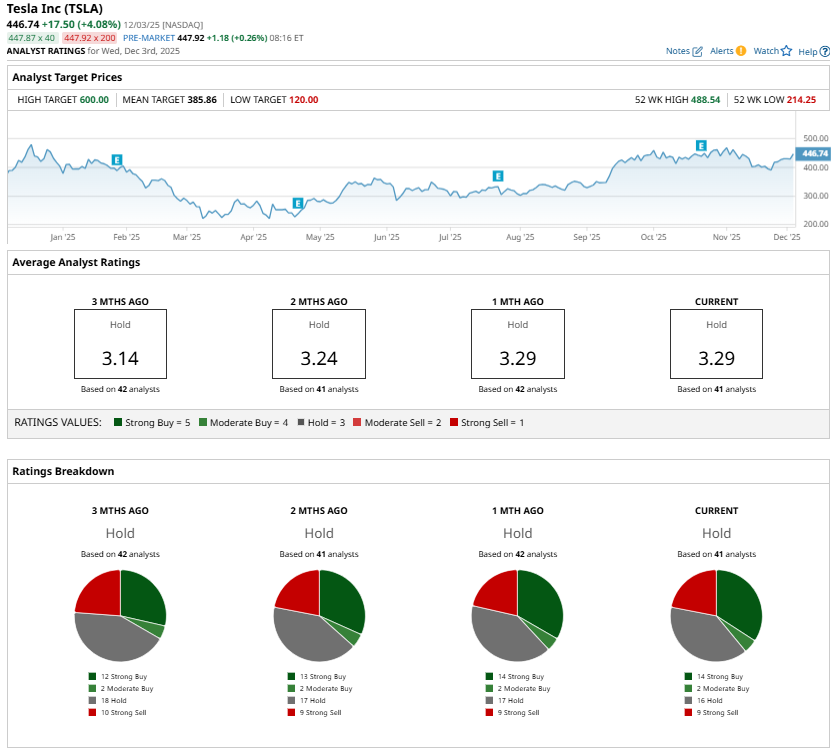

The majority of Wall Street analysts covering TSLA currently maintain a “Hold” rating, suggesting the market has priced in Tesla’s future growth.

On the date of publication, Amit Singh did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart