Tesla (TSLA) is a leading American electric vehicle and clean energy company that designs and manufactures battery electric cars, energy storage systems, and solar products. Known primarily for its innovative electric cars, the company also has grid-scale and residential batteries and integrated solar solutions.

Founded in 2003, it is headed by Elon Musk, with headquarters in Austin, Texas. The company spans across North America, Europe, and Asia, marketing vehicles and energy solutions to 30+ countries.

About Tesla Stock

Tesla’s 2025 is marked by volatility, with the stock gaining momentum, up 6.4% over the last five days. The one-month performance shows a 1% drop, six-month returns around 61% from lows, and 52-week gains of 13%, with YTD positive.

Tesla significantly outperformed the S&P 500 ($SPX), which returned 13.4% over 52 weeks versus TSLA's 24%, and 6.2% in three months against TSLA's 30%.

Tesla’s Q3 Results

Tesla reported Q3 2025 revenue of $28.1 billion, up from prior quarters and beating analyst estimates of $26.22 billion by 7.17%. GAAP EPS came in at $0.50, missing the consensus forecast of $0.54 by 7.41%, though non-GAAP net income reached $1.8 billion amid record vehicle deliveries of over 497,000 units.

Gross margin declined to 18.0% from 19.8% year-over-year (YoY) due to lower fixed cost absorption, tariffs, and sales mix shifts, partially offset by reduced raw material costs. Cash, equivalents, and investments grew 24% to $41.6 billion, with record free cash flow of nearly $4.0 billion and operating cash flow of $6.2 billion. GAAP operating income was $1.6 billion (5.8% margin), down from 10.8%, while operating expenses rose 50% to $3.43 billion on AI and R&D investments, and energy storage deployments hit a record 12.5 GWh.

Tesla did not provide specific Q4 revenue or EPS guidance but emphasized production capacity targeting 3 million vehicles annually within 24 months, with a focus on AI, autonomy, and energy growth amid ongoing margin pressures.

Tesla Moves Up in Ranking

Tesla, the leading U.S. electric vehicle manufacturer, made significant progress in Consumer Reports' 2026 annual auto brand rankings, rising from 18th place last year to 10th overall among more than 30 automotive brands.

According to Jake Fisher, senior director of auto testing at Consumer Reports, Tesla’s advancement is due to increased vehicle reliability achieved by refining existing models rather than making major redesigns. Its powertrain reliability remains a standout in the EV market, and Tesla utilizes over-the-air updates to improve features remotely.

Despite improvement, Tesla’s older 5- to 10-year-old models rank lowest in reliability. The only Tesla model scoring below average is the new Cybertruck, which features innovative technologies like a 48-volt architecture and steer-by-wire system. Tesla’s rise in ranking reflects growing consumer satisfaction linked to consistency and incremental improvements rather than extensive design changes.

However, the report card focuses on owner satisfaction and reliability scores rather than broader consumer opinion or external controversies surrounding CEO Elon Musk.

Topping the list is Japanese manufacturer Subaru, followed by BMW (BMWKY), Porsche (POAHY), Honda (HMC), and Toyota (TM) in the top five. Meanwhile, names like Jeep, Range Rover, GMC, Dodge, and Alfa Romeo make up the tailenders.

Should You Bet on TSLA?

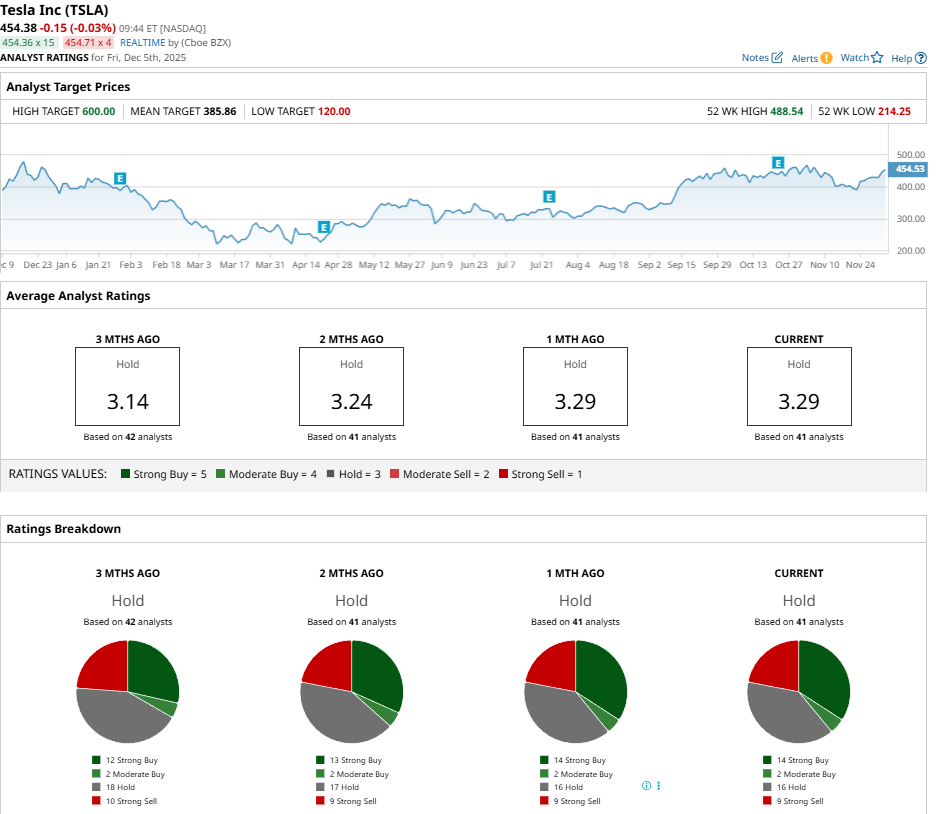

Now, despite TSLA stock’s outperformance in the second half of 2025, it has a consensus “Hold” rating from analysts with a mean price target of $385.86, reflecting a major downside of 16% from the market rate.

The stock has been rated by 41 analysts, receiving 14 “Strong Buy” ratings, two “Moderate Buy” ratings, 16 “Hold” ratings, and nine “Strong Sell” ratings.

On the date of publication, Ruchi Gupta did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Salesforce Generates Strong Free Cash Flow - CRM Could Be 23% Too Cheap

- AMD Is Getting Ready to Launch Helios. Wall Street Thinks You Should Buy AMD Stock First.

- Meta Platforms Has Lost $73 Billion on Reality labs. Are Its Spending Cuts Enough for META Stock?

- UBS Analysts Think This Former Meme Stock Has Become a Disruptor -- And That It Can Gain 20% from Here