“Wait a minute Rob, isn’t the Fed thinking of lowering rates this week? And if they don’t do it now, won’t they lower rates in an upcoming meeting?”

If President Donald Trump and his administration have their way, the Federal Reserve will lower rates as close to near-zero levels as possible.

However, this week should serve as a reminder to traders and investors about one of the most frequently misunderstood aspects of modern investing. It has to do with what the Fed really does when they change interest rates.

The fact is, the Fed only controls very short-term interest rates. The shortest, actually. Its purview is the rate at which banks borrow from the central bank, as well as from each other. Translation: Rate-setting beyond the next day’s figures is not the Fed’s mandate. That’s the job of the bond market to determine.

Now, with all that said, the Fed’s actions are notorious for shaking up the rest of the yield curve. In fact, there are many things that impact interest rates, most of which the Fed has no control over.

Why the Bond Market Is the Key Indicator This Week

In particular, there’s been some movement in the yield and price of long-term U.S. Treasury bonds in recent weeks. That has the potential to reach a crescendo later this week. The issue is not what the Fed will do on Wednesday. That’s a blip on the radar compared to what investors have to grapple with.

You see, the U.S. debt buildup at the federal level has moved from “one day this will be a problem” to “it’s a problem.” As they say, it happens slowly, then all at once. Tariffs are hung up in courts, adding to the problem, and Japan’s rates are approaching a dangerously high 2% level that threatens to reverse the so-called “Carry Trade.” That’s the long-tenured strategy whereby big investors borrow in low-yield Japanese yen, and invest in the U.S.. The interest rate gap is narrowing, and that could prompt a lot of traditional buyers of U.S. Treasuries to either pull back activity, or demand higher rates.

To the rest of us, that situation is six of one, half a dozen of the other, in that if long-term rates are going up, we don’t really care why. It’s the impact on our wealth that matters.

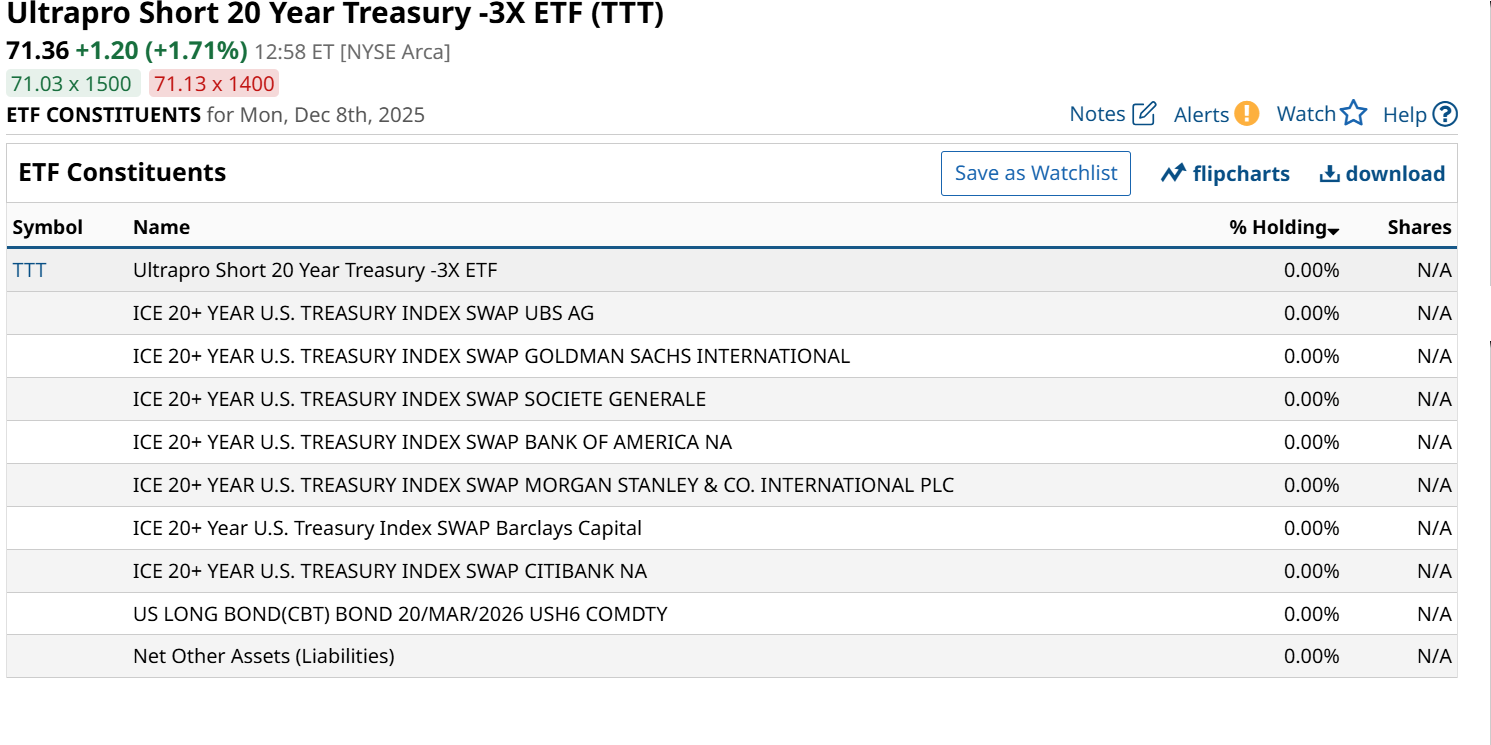

That’s why of all the ETFs I’ve used over the years to try to profit from rising long-term rates, regardless of this week’s Fed event, the one I’m most focused on currently is the easiest ticker symbol to remember. It’s the first letter of “Treasuries,” 3 times in a row: The Ultrapro Short 20 Year Treasury -3X ETF (TTT). And while it is not for everyone, given its high leverage, if used responsibly, it can be akin to a put option surrogate.

In other words, rather than owning put options on a popular bond ETF like the 20+ Year Treasury Bond Ishares ETF (TLT), TTT covers a lot of ground in ETF form. And has no expiration date.

Telling The Truth about TTT

First, let’s remember that this is a -3x leveraged ETF. That means it is geared to replicate the reverse of what happens to the price (NOT the yield) of 20-30 year U.S. Treasury bonds. That’s the most volatile part of the yield curve. Times 3.

The appeal of TTT is that by essentially acting as a leveraged short position on the bonds’ price, when bond prices fall, yields rise. Translation: TTT is a rising yield profit machine, as long as that upward run in yields is of some magnitude. With a Fed decision looming, that might get interesting.

TTT is also quite small for an ETF. $20 million in assets, and now in its 14th year. TLT is a $48 billion ETF. TTT also doesn’t trade in high volume. Only about 3,500 shares a day.

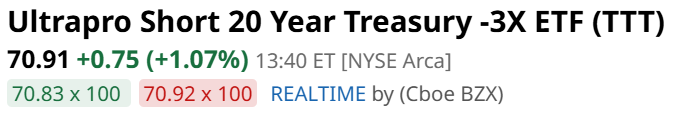

However, ETF investing is more about the ability for a fund’s traders to maintain a tight bid-offer spread, regardless of how frequently that ETF is traded. At least at the moment of time I wrote this, the spread below ($70.83 by $70.92, so about $0.09 a share), is plenty tight enough for me.

Below is the main reason for my intrigue here. I’m a chartist to the core, and this is a very high-octane chart to me. That is, while there’s always risk, if I keep my position size small to start, I get a shot at a big return. From what, to many, would be an unlikely source. Also note that another fund, the Short 20+ Year Treasury -1X ETF (TBF), is similar to TTT, but without the leverage. It still moves up when long-term Treasury rates do, but only at a -1:1 ratio on a daily basis. So essentially TBF aims to be the mirror image of TLT.

Finally, perhaps a “cleaner” way to track TTT and TBF’s potential is to follow the 30-year T-bond rate, shown below. Again, rates up, inverse bond ETFs up.

This is what I call “taking big shots with small amounts of capital.” To me, the current market cries out for more of that, and less big-money risk-taking. Because if rates do pop at the long end, it will likely not be limited to the bond market. The stock market will feel it soon too. So I’m on guard, as we risk managers tend to be.

Rob Isbitts, founder of Sungarden Investment Publishing, is a semi-retired chief investment officer, whose current research is found here at Barchart, and at his ETF Yourself subscription service on Substack. To copy-trade Rob’s portfolios, check out the new Pi Trade app.

On the date of publication, Rob Isbitts did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- This ETF Thrives on Rising Long-Term Rates. Why It’s 1 of the Best Ways to Profit Before Wednesday’s Fed Meeting.

- S&P Futures Muted Ahead of FOMC Meeting and U.S. JOLTs Report

- This Popular Wall Street Strategist Says It’s a ‘High-Risk Bull Market.’ He’s Right, with the Fed in Focus.

- Is a Global Margin Call Coming? How a Bank of Japan Rate Hike Could Trigger the Next Market Shock