The Newport Beach, California-based Chipotle Mexican Grill, Inc. (CMG) is a fast-casual restaurant chain operating over 3,800 company-owned locations globally. With a market capitalization brushing $53 billion, the company serves burritos, bowls, tacos, salads, kids' meals, chips, drinks, and offers app/website delivery.

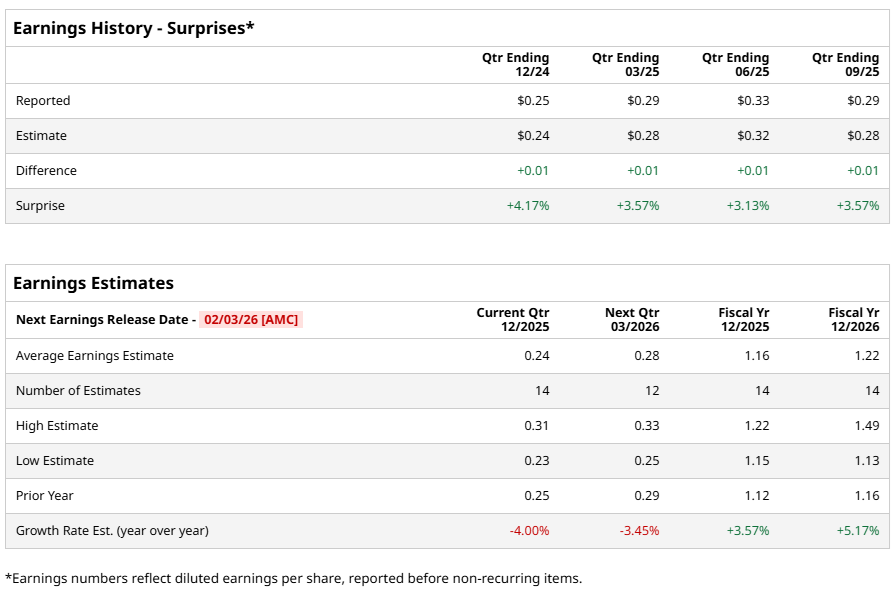

Chipotle is now approaching its fiscal 2025 fourth-quarter earnings release, scheduled for Tuesday, Feb. 3, after market close. Analysts expect diluted EPS of $0.24, a 4% year-over-year decline from $0.25 a year earlier. Even so, the company has beaten EPS expectations in each of the past four quarters, underscoring operational consistency.

Beyond near-term pressure, Wall Street sees earnings momentum resuming. Analysts forecast fiscal 2025 diluted EPS of $1.16, implying 3.6% annual growth. Earnings could strengthen further in fiscal 2026, with the bottom line projected at $1.22, a 5.2% increase from the previous year.

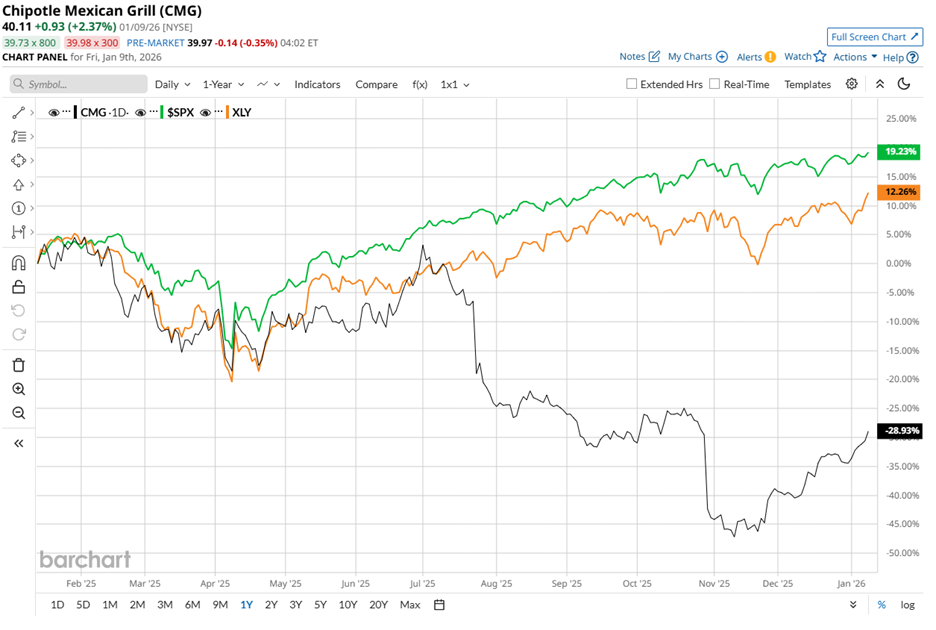

Share performance, however, tells a tougher tale. CMG stock has fallen 30.8% over the past 52 weeks, though it rebounded 8.4% year-to-date (YTD). By contrast, the S&P 500 Index ($SPX) has gained 17.7% over the last 52 weeks and is up 1.8% YTD, widening Chipotle’s relative underperformance gap.

The same divergence appears versus sector peers. The State Street Consumer Discretionary Select Sector SPDR ETF (XLY) climbed 11.6% over the past year and 4.2% YTD, again outpacing CMG stock.

On Dec. 12, 2025, Chipotle’s shares rose 3.6% intraday as Chipotle marked a major milestone with the opening of its 4,000th restaurant in Manhattan, Kansas, known as the “Little Apple.”

With more than 100 locations now outside the United States, the brand has launched its first non–North America Chipotlane in Kuwait and lined up entries into Mexico, South Korea, and Singapore, underscoring a measured, globally scalable expansion strategy.

As Chipotle’s global expansion gains momentum and the next earnings report nears, analysts have assigned CMG stock an overall rating of “Moderate Buy,” which has remained unchanged for the past two months. Of the 35 analysts covering the stock, 22 rate CMG a “Strong Buy,” three recommend “Moderate Buy,” and 10 suggest “Hold.”

Analysts peg CMG’s mean price target at $44.91, representing potential upside of 12%. Meanwhile, the Street-high target of $70 suggests a gain of 74.5% from current levels.

On the date of publication, Aanchal Sugandh did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart