Intel (INTC) shares have been in a sharp uptrend over the past five months, but a senior KeyBanc analyst believes “significant progress” in the foundry business could push them up further in 2026.

On Tuesday, John Vinh raised his rating on the semiconductor firm to “Overweight” and announced a $60 price objective indicating potential upside of another 30% from here.

Vinh’s bullish call is significant given it suggests the investment firm believes Intel stock, despite a meteoric 150% gain since last August, hasn’t fully priced in the positives yet.

What May Drive Intel Stock Higher in 2026

According to the KeyBanc analyst, Intel has onboarded Apple (AAPL) as an 18A-P customer. The company will use that advanced node to make chips for its low-end Macs and iPads.

In his research note, John Vinh dubbed the partnership INTC’s “first big whale design win,” adding the titan may eventually use its upcoming 14A process to make low-end chips that power its iPhone as well.

Last week, Intel launched its first chips built on the 18A process, claiming they outperform predecessors by 60% in multithreaded workloads and 77% in gaming.

The subsequent rally confirmed a break-out as INTC stock pushed decisively above its 20-day moving average (MA), indicating bulls will likely remain in control in the near term.

AI Remains a Material Tailwind for INTC Shares

John Vinh recommends sticking with Intel shares also because the artificial intelligence (AI) buildout is driving unprecedented demand for its CPUs.

In fact, the Nasdaq-listed firm is “almost sold out for the year” currently, he told clients.

In its latest report, KeyBanc also cited “billions of dollars’ worth of investments” from SoftBank (SFTBY), Nvidia (NVDA), and even President Donald Trump as a testament to INTC’s strategic importance.

Earlier this week, Trump said the U.S. government is “proud to be a shareholder of Intel” and endorsed its “very successful” chief executive Lip-Bu Tan.

Note the value of that stake has doubled in the last five months.

What’s the Consensus Rating on Intel?

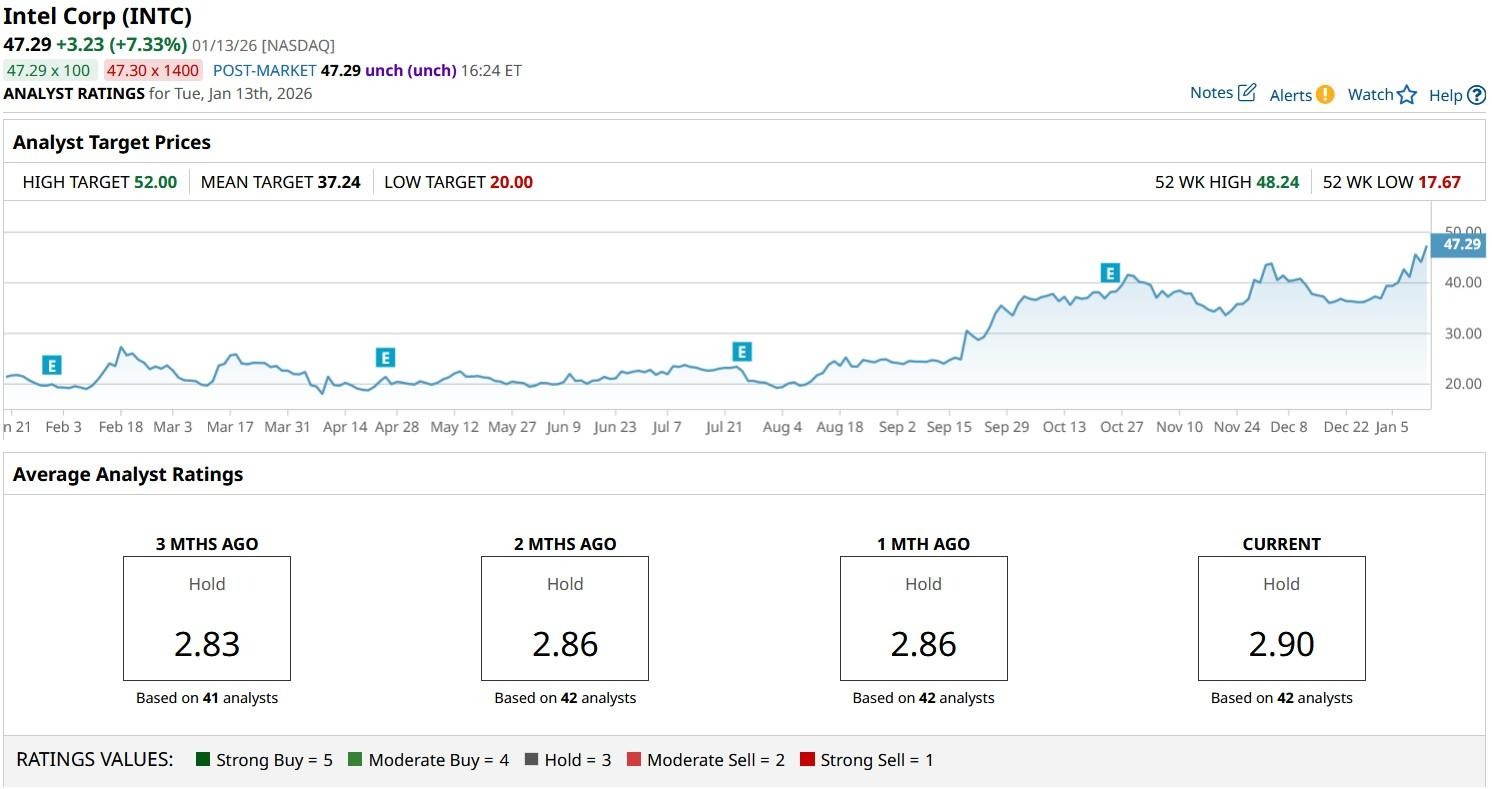

Despite significant positives, however, other Wall Street firms seem to disagree with KeyBanc on INTC shares.

The consensus rating on Intel stock currently sits at “Hold” only, with the mean target of about $37 indicating potential downside of more than 20% from here.

On the date of publication, Wajeeh Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Trump Just Juiced the Bull Case for Lockheed Martin to $1.5 Trillion. Does That Make LMT Stock a Buy Here?

- A $2.65 Billion Reason to Buy Bloom Energy Stock in January 2026

- This 1 Greenland Stock Has Surged in the Past Month. Should You Chase the Rally Here?

- This Memory Stock Is Up 745% in the Past 6 Months. Is It Unstoppable?