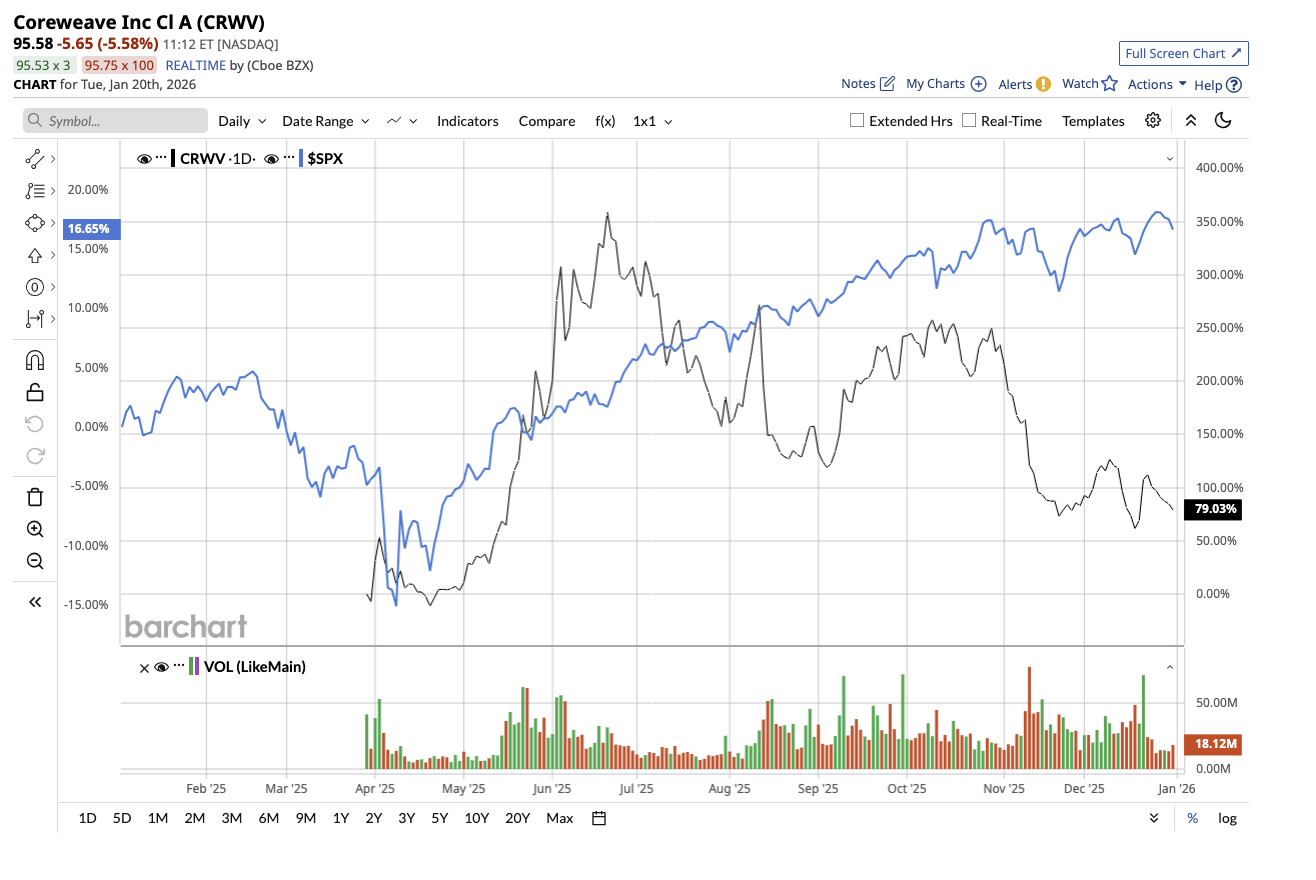

Valued at $39.1 billion, CoreWeave (CRWV) is a cloud infrastructure company that provides high-performance computing capacity designed for artificial intelligence (AI) workloads. Ever since its IPO in March, CoreWeave's stock has surged, closing last year with a 79% gain, reflecting just how quickly global demand for AI infrastructure is accelerating. The stock is already up over 25% so far this year following explosive revenue growth in Q3 driven by AI demand and a large multi-year revenue backlog, signaling ongoing strong customer commitments.

Could AI tailwinds propel the stock further to touch $200 this year?

CoreWeave’s Growth Seems Unstoppable

Unlike conventional cloud providers like Amazon's (AMZN) AWS and Microsoft's (MSFT) Azure, CoreWeave's platform is designed specifically for AI workloads such as large-scale training, inference, and other GPU-intensive tasks. In the third quarter, the company generated $1.4 billion in revenue, a 134% increase year-over-year (YoY). What was more impressive was that the company gained more than $25 billion in new backlog, bringing the total revenue backlog to $55.6 billion by the end of the quarter. Remaining performance obligations (or RPO) stood at $50 billion, which reflects future revenue.

Adjusted EBITDA more than doubled YoY to $838 million, reflecting a 61% margin. While the corporation reported a GAAP net loss of $110 million, this marked a significant improvement over the previous year's loss of $360 million. Management stated that demand remained high across various generations of GPUs, not just the most recent platforms. Furthermore, customers are renewing major deployments at prices near to the initial contract levels, indicating satisfaction and long-term value.

Positioning as the Essential Cloud for AI

CoreWeave is also taking precautions not to rely heavily on a single customer. As of Q3, no single customer accounted for more than 35% of the revenue backlog, a significant decrease from earlier in the year, and more than 60% of the backlog is related to investment-grade customers. During Q3, it signed large-scale compute contracts with Meta Platforms (META) and OpenAI, and management forecasted substantial growth among hyperscalers, enterprises, and AI-native companies. Notably, nine of the company's top ten customers have now signed multiple agreements.

In fact, chip giant Nvidia (NVDA) is a strategic partner and major stakeholder, further connecting CoreWeave with the AI ecosystem.

CoreWeave also increased its active power footprint to around 590 megawatts and contracted power capacity to 2.9 gigawatts. The company expects over 1 gigawatt of contracted capacity to come online over the next 12 to 24 months. In the third quarter, the company opened eight new data centers in the U.S. and continued its European expansion, including a substantial project in Scotland developed in collaboration with the British government.

Beyond infrastructure, CoreWeave is expanding its full-stack AI capabilities with the launch of AI Object Storage, a completely managed storage service that eliminates data movement friction with no egress or transaction fees. Additionally, storage-related services generated more than $100 million in annual recurring revenue in Q3.

CoreWeave ended the quarter with $3 billion in liquidity and no major debt maturities until 2028. For full-year 2025, CoreWeave now expects revenue of $5.05 billion to $5.15 billion, in line with the consensus estimates. Revenue is expected to further rise by 134.9% to $12 billion in 2026.

What Is Wall Street Saying About CRWV Stock?

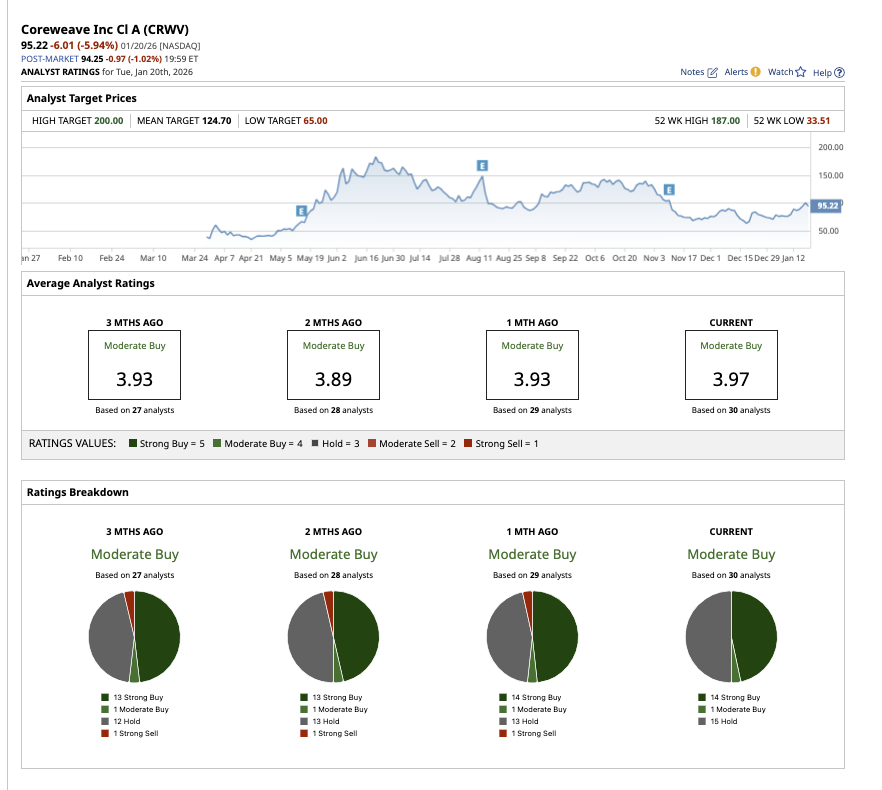

Currently, CRWV stock is trading at $95.58. The stock has an average target price of $124.70, indicating a 30.5% expected upside from current levels. Plus, its high target price of $200 implies the stock could rally 109.2% over the next 12 months.

Overall, analysts have rated CRWV stock a “Moderate Buy.” Out of 30 analysts covering the stock, 14 have a “Strong Buy” rating, one suggests a “Moderate Buy,” and 15 rate it a “Hold.”

With rapid capacity expansion, a diversifying customer base, and growing software and services capabilities, the company is entering its next phase of growth with strong momentum. While CoreWeave is not profitable now, this momentum could push the company towards profitability soon and the stock towards the high target price.

Investors willing to bear the short-term risks might find this AI stock a valuable buy in the long run.

On the date of publication, Sushree Mohanty did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Wall Street Is Betting Against These 3 Popular AI Stocks. Should You?

- This AI Company Was the Most Shorted Tech Stock in December. Does That Mean a Short Squeeze Is Coming in 2026?

- Stifel Is Pounding the Table on Micron Stock for 2026. Here’s Why.

- Why Analysts Think Analog Devices Stock Can Hit $375 in 2026