Everest Group, Ltd. (EG) rebranded from Everest Re in 2023 to signal its evolution beyond pure reinsurance into a broader underwriting platform. The company underwrites property, casualty, and specialty reinsurance and insurance products, reinforcing a diversified risk engine that supports resilience across cycles.

Headquartered in Hamilton, Bermuda, Everest Group commands an estimated market capitalization of nearly $14 billion, firmly classifying it as a “large-cap” enterprise. This scale enables operations across more than 100 countries on six continents, allowing the company to diversify exposures and access global premium pools.

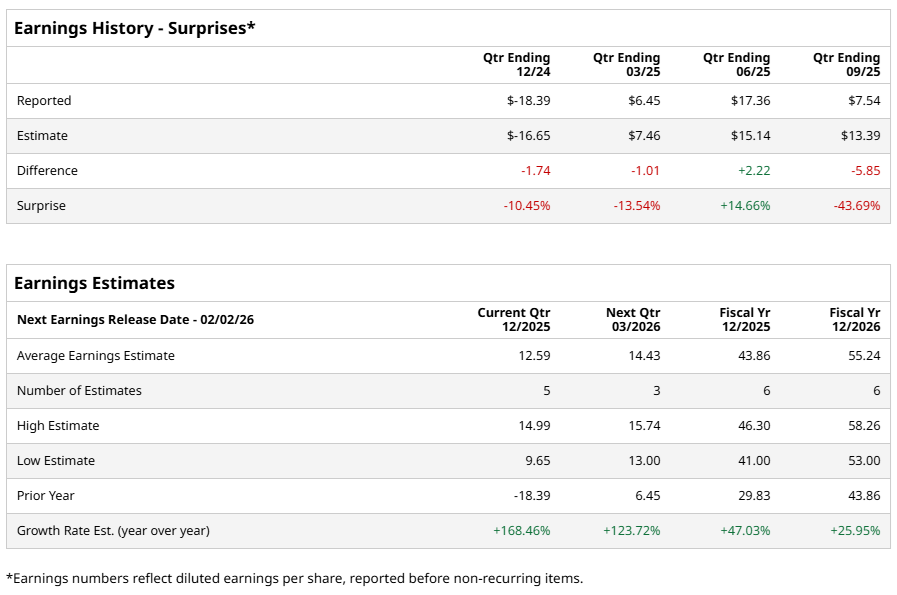

Investor focus now centers on Everest Group’s Q4 fiscal 2025 earnings release, scheduled for Monday, Feb. 2. Analysts project diluted EPS of $12.59, up 168.5% and a sharp turnaround from the $18.39 loss per share reported a year earlier. That said, consistency remains a concern, as Everest surpassed EPS expectations in only one of the past four quarters.

The stock’s fragility surfaced on Oct. 28, 2025, when shares dropped 11.4%, a day after the company posted weaker-than-expected Q3 2025 results. Revenue marginally increased year over year to $4.32 billion, missing Street expectations of $4.45 billion. Profitability disappointed more sharply as adjusted EPS declined 48.4% year over year to $7.54 per share, far below analyst estimates of $13.39.

Underwriting proved the primary drag, as the combined ratio deteriorated to 103%. A ratio above 100% signals underwriting losses, meaning claims and expenses exceeded premium income. The outcome directly pressured profitability and emphasized the critical need for tighter risk selection and pricing discipline.

Net premiums earned, a core revenue driver, declined 1.6% year over year to $3.86 billion, also undershooting analyst forecasts. However, investment performance offered partial relief, with net investment income rising to $540 million from $496 million in the prior year quarter, supported by asset growth and strong alternative returns.

Looking ahead, analysts expect a meaningful rebound. Consensus forecasts call for fiscal 2025 diluted EPS of $43.86, representing 47% year-over-year growth. For fiscal 2026, projections anticipate a further 26% increase to $55.24.

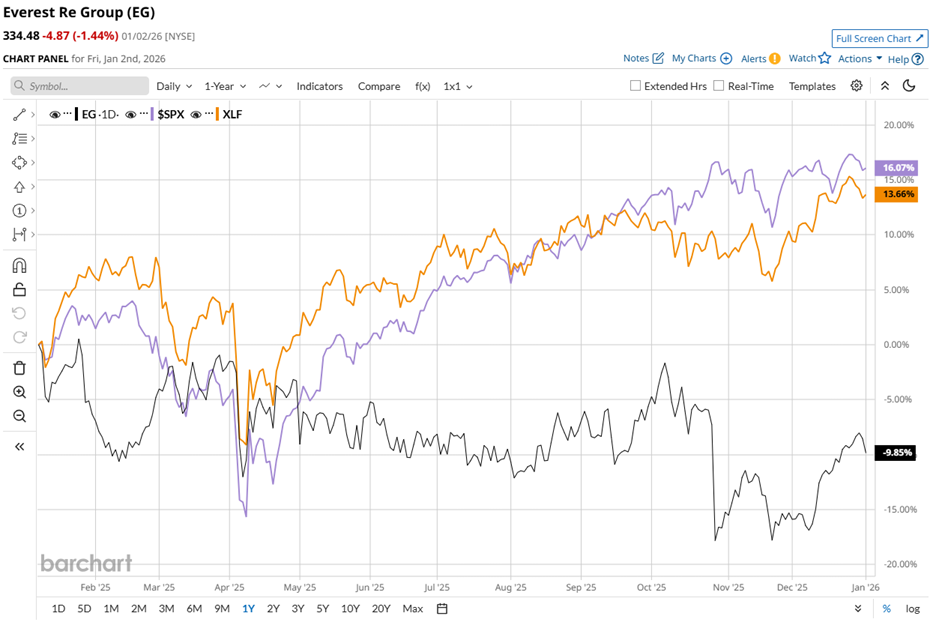

Over the past 52 weeks, Everest Group shares declined 7.9%. Still, the stock remains 1.4% higher on a year-to-date (YTD) basis, signaling tentative stabilization. In contrast, the S&P 500 Index ($SPX) advanced 16.9% over the same period with only marginal YTD gains.

Meanwhile, the State Street Financial Select Sector SPDR ETF (XLF) rose 13.9% annually, also posting modest YTD performance.

Strategic leadership changes added a positive catalyst. On Dec. 18, 2025, Everest Group appointed Paul Trueman as Head of International and Mark Shaw as Global Head of Commercial within its Global Wholesale & Specialty unit. Their proven underwriting expertise and broker alignment bolstered strategic execution, propelling the stock up 1.2%.

Wall Street maintains a balanced stance. EG stock holds a consensus “Moderate Buy” rating, unchanged for three months. Among 19 analysts, five rate the stock “Strong Buy,” two suggest “Moderate Buy,” 10 recommend “Hold,” and two issue “Strong Sell.”

Analyst expectations suggest room for a steadier run ahead. The mean price target of $362.38 implies potential upside of 8.3%, while the Street-High target of $446 represents approximately 33.3% gain from current levels.

On the date of publication, Aanchal Sugandh did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart