- Vodafone (VOD) is trading at a new 3-year high and has strong technical momentum.

- Shares are up nearly 61% over the past 52 weeks.

- VOD maintains a 100% “Buy” technical rating from Barchart.

- Some analysts warn that after its runup, Vodafone is now overvalued. Be cautious chasing this rally.

Today’s Featured Stock

Valued at $31.70 billion, Vodafone (VOD) is the world’s largest international mobile communications firm. Its primary operation is in digital and analog cellular telephone networks.

What I’m Watching

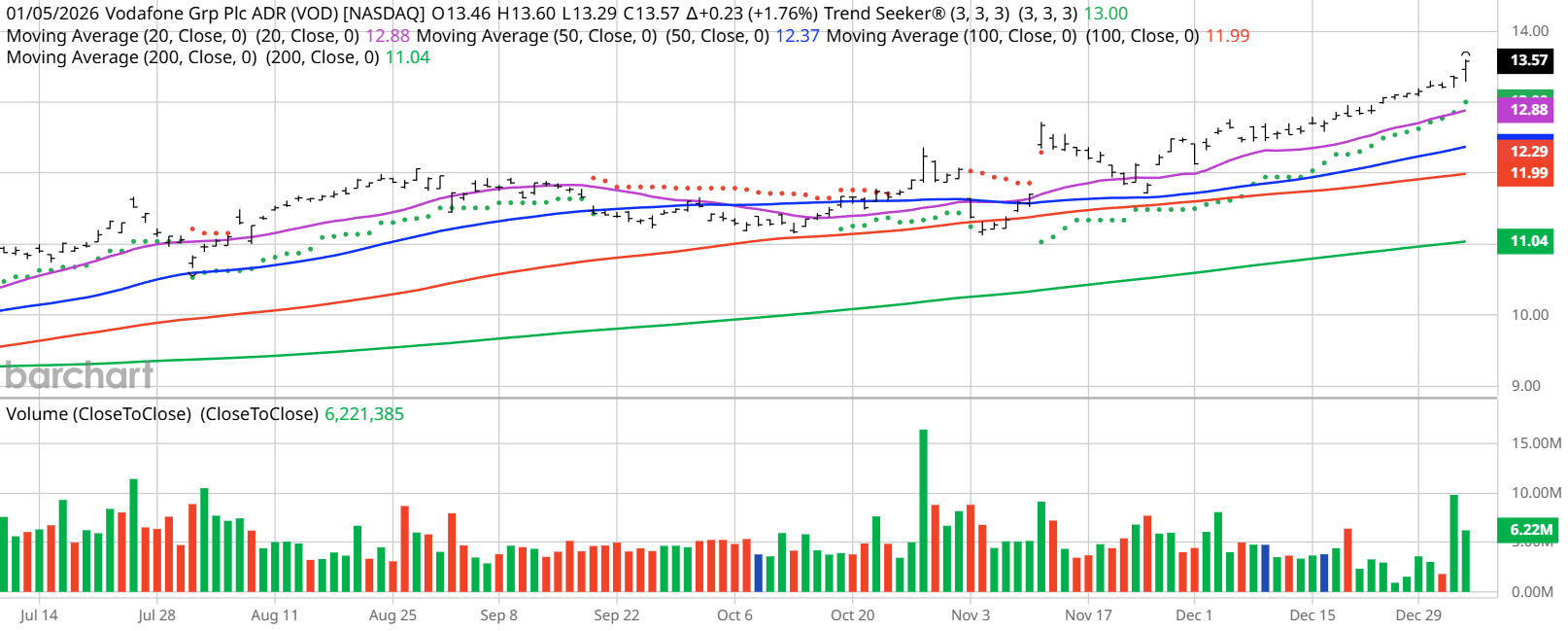

I found today’s Chart of the Day by using Barchart’s powerful screening functions to sort for stocks with the highest technical buy signals; superior current momentum in both strength and direction; and a Trend Seeker “buy” signal. I then used Barchart’s Flipcharts feature to review the charts for consistent price appreciation. VOD checks those boxes. Since the Trend Seeker signaled a new “Buy” on Nov. 12, the stock has gained 9.7%.

Barchart Technical Indicators for Vodafone

Editor’s Note: The technical indicators below are updated live during the session every 20 minutes and can therefore change each day as the market fluctuates. The indicator numbers shown below therefore may not match what you see live on the Barchart.com website when you read this report. These technical indicators form the Barchart Opinion on a particular stock.

Vodafone scored a new 3-year high of $13.74 on Jan. 6.

- VOD has a Weighted Alpha of +68.37.

- Vodafone has a 100% “Buy” opinion from Barchart.

- The stock gained 60.57% over the past year.

- VOD has its Trend Seeker “Buy” signal intact.

- The stock recently traded at $13.57 with a 50-day moving average of $12.41.

- Vodafone made 15 new highs and gained 9.06% in the last month.

- Relative Strength Index (RSI) is at 78.19.

- There’s a technical support level around $13.37.

Don’t Forget the Fundamentals

- $31.7 billion market capitalization.

- 3.78% dividend yield.

- Revenue is expected to grow 8.34% this year and another 3.03% next year.

- Earnings are estimated to decrease 34.83% this year but recover again by 55.36% next year.

Analyst and Investor Sentiment on Vodafone

- Wall Street analysts tracked by Barchart have given 4 “Strong Buy,” 3 “Hold,” and 5 “Strong Sell” opinions on the stock with price targets between $8 and $13.20.

- Value Line ranks the stock “Average” but has a price target of $12 for a 15% loss.

- CFRA’s MarketScope Advisor rates the stock as “Buy.”

- Morningstar thinks with the stock’s recent runup, it’s 21% overvalued with a Fair Value of $11.00.

- 2,705 investors following the stock on Motley Fool think it will beat the market, while 212 think it won’t.

- 50,020 investors are monitoring the stock on Seeking Alpha, which rates the stock a “Hold.”

The Bottom Line on Vodafone

Wall Street is split on this stock, but individual investors overwhelmingly like it.

Additional disclosure: The Barchart Chart of the Day highlights stocks that are experiencing exceptional current price appreciation. They are not intended to be buy recommendations as these stocks are extremely volatile and speculative. Should you decide to add one of these stocks to your investment portfolio it is highly suggested you follow a predetermined diversification and moving stop loss discipline that is consistent with your personal investment risk tolerance.

On the date of publication, Jim Van Meerten did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart