Valued at a market cap of $75.8 billion, Dell Technologies Inc. (DELL) is a prominent multinational technology company headquartered in Round Rock, Texas. It is one of the world’s largest and most diversified technology providers, serving consumers, enterprise customers, governments, and educational institutions globally.

Shares of the tech giant have returned 8.6% over the past 52 weeks, trailing the broader S&P 500 Index’s ($SPX) 14.3% rally. Moreover, in 2026, DELL is down 14.3%, compared to SPX’s 1.4% rise.

Looking closer, the stock has lagged behind the State Street Technology Select Sector SPDR Fund’s (XLK) increase of 23.9% over the past 52 weeks and a marginal dip in 2026.

Shares of Dell rose 2.9% on Jan. 21 after Donald Trump eased trade war concerns by suspending planned tariffs on European allies. The move followed talks in Davos with Mark Rutte, where a framework for cooperation on Arctic and Greenland issues was discussed, alongside a commitment to avoid military action.

For the fiscal year that ended in January 2026, analysts expect DELL’s EPS to grow 21.9% year over year to $9.12. The company’s earnings surprise history is mixed. It beat the consensus estimates in three of the last four quarters while missing on one other occasion.

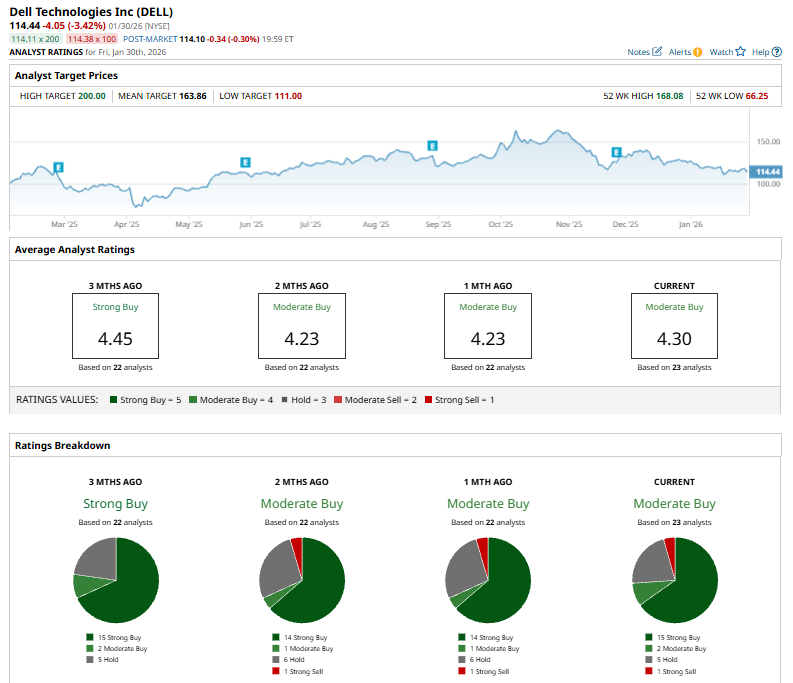

Meanwhile, among the 23 analysts covering the stock, the consensus rating is a “Moderate Buy.” The current rating is based on 15 “Strong Buys,” two “Moderate Buy” ratings, five “Holds,” and one “Strong Sell.”

This overall consensus is bearish than three months ago when the stock was rated a “Strong Buy.”

On Jan. 15, Barclays upgraded Dell Technologies to “Overweight”, citing its strong leadership in AI server infrastructure and best-in-class operational discipline. Analyst Tim Long reaffirmed a $148 price target, highlighting Dell’s ability to scale AI revenue while protecting margins.

DELL’s mean price target of $163.86 indicates a 43.2% premium from the current price levels. Meanwhile, the Street-high price target of $200 implies a robust potential upside of 74.8% from the current price levels.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart