Ace Hardware Ranks Highest in Customer Satisfaction for 14th Time in 15 Years

Think everyone was staying home, doing all their shopping online and avoiding human contact at all costs during the past year? Think again. According to the J.D. Power 2021 U.S. Home Improvement Retailer Satisfaction Study,℠ released today, home improvement is one retail category that maintained a consistent level of in-store shopping.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20210601005041/en/

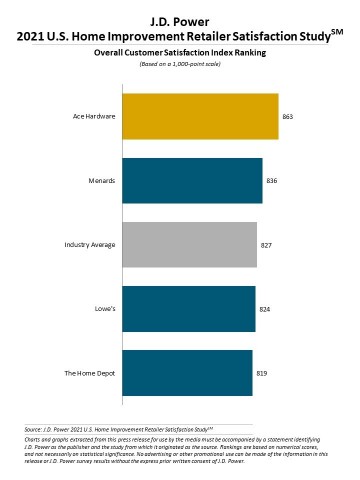

J.D. Power 2021 U.S. Home Improvement Retailer Satisfaction Study (Graphic: Business Wire)

“The home improvement category is booming right now as part of the pandemic-related silver lining from people being home more and finally getting the time to tackle those home projects,” said Christina Cooley, director of the home intelligence practice at J.D. Power. “What’s interesting is that unlike many other retail categories, when it comes to home improvement, customers are heading out to the stores to touch and feel products before buying—and wanting to engage with store staff along the way.”

Following are some key findings of the 2021 study:

- Yes, it’s true, home improvement projects are popular: Nearly one-third (30%) of U.S. consumers say they are either planning or actively working on a home improvement project.

- Vast majority of customers shop in-store, feel safe and comfortable doing so: Just 13% of home improvement retailer customers say they purchased products via a retailer’s website, while 87% shopped in a brick-and-mortar location. Of the 87% who shopped in a store, 98% say they felt safe and comfortable while shopping during the height of the pandemic.

- Make it easy: Customers don’t want to have to spend more than five minutes finding an item or aisle. Fortunately, 66% of customers say their home improvement retailer met this threshold. One differentiator is customers’ ability to receive assistance without having to search or ask for it. More than half (55%) of customers give their primary retailer credit for doing so, but there is a definite range in performance, from the best-in-class retailer achieving this criteria 72% of the time to the lowest average of 49%.

- Younger customers have highest levels of satisfaction: Overall satisfaction among Gen Y1 and Gen Z customers averages 842 (on a 1,000-point scale) while overall satisfaction among Gen X and Boomers averages 824. These younger generations have increased their home improvement activity during the past year with 42% planning for, or in the process of, doing a project in the next three months compared with 27% among older generations.

Study Ranking

Ace Hardware ranks highest in customer satisfaction among home improvement retailers for the 14th time in 15 years, with a score of 863. Menards (836) ranks second.

The 2021 U.S. Home Improvement Retailer Satisfaction Study measures customer satisfaction with home improvement retailers by examining five factors (in alphabetical order): in-store experience; merchandise; online experience; price; and staff and service. The study is based on responses from 2,172 customers who purchased home improvement-related products from a home improvement retailer within the previous 12 months. The study was fielded in January-February 2021.

For more information about the U.S. Home Improvement Retailer Satisfaction Study, visit https://www.jdpower.com/business/resource/us-home-improvement-retailer-satisfaction-study.

To view the online press release, please visit http://www.jdpower.com/pr-id/2021060.

About J.D. Power

J.D. Power is a global leader in consumer insights, advisory services and data and analytics. A pioneer in the use of big data, artificial intelligence (AI) and algorithmic modeling capabilities to understand consumer behavior, J.D. Power has been delivering incisive industry intelligence on customer interactions with brands and products for more than 50 years. The world's leading businesses across major industries rely on J.D. Power to guide their customer-facing strategies.

J.D. Power is headquartered in Troy, Mich., and has offices in North America, Europe and Asia Pacific. To learn more about the company’s business offerings, visit JDPower.com/business. The J.D. Power auto shopping tool can be found at JDPower.com.

About J.D. Power and Advertising/Promotional Rules: www.jdpower.com/business/about-us/press-release-info

1 J.D. Power defines generational groups as Pre-Boomers (born before 1946); Boomers (1946-1964); Gen X (1965-1976); Gen Y (1977-1994); and Gen Z (1995-2004). Millennials (1982-1994) are a subset of Gen Y.

View source version on businesswire.com: https://www.businesswire.com/news/home/20210601005041/en/

Contacts

Media Relations Contacts

Geno Effler, J.D. Power; West Coast; 714-621-6224; media.relations@jdpa.com

John Roderick; East Coast; 631-584-2200; john@jroderick.com