Richmond, VA, and Oklahoma City, OK, were ranked as the top-performing small-bay and big-box industrial markets, respectively, according to CoStar, the leading global provider of online real estate marketplaces, information, and analytics in the property markets.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20251218357382/en/

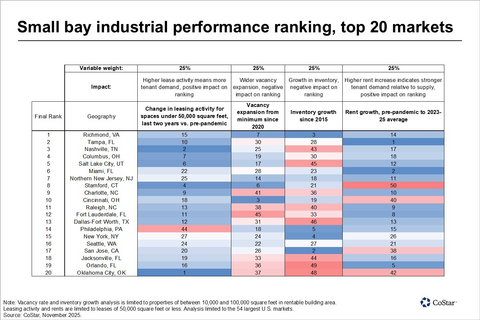

Small bay industrial performance ranking, top 20 markets

Based on a Z-score analysis of the largest 54 markets in the U.S., Richmond ranked at the top of the small-bay sector due to its more limited inventory growth over the last 10 years and its minimal vacancy expansion.

“Richmond has continued to experience strong demand for industrial space over the last few years,” said Juan Arias, national director of industrial analytics at CoStar Group. “The market has retained one of the lowest vacancy rates among all major markets with more than 100 million square feet of inventory. It has also seen a significant amount of demolition of small bay space, which has offset the impact of new supply.”

Other standout markets in the small-bay sector include Tampa, which has generated the largest rent gains for small-bay space among the top 54 markets, and Nashville, which has experienced some of the strongest gains in leasing activity in the last two years relative to pre-pandemic levels.

Using the same Z-score analysis, Oklahoma City’s top spot among the big-box sector was due to healthy leasing activity for larger occupiers and retention of a relatively low availability rate among newer properties.

“Among the big-box industrial markets, Oklahoma City is dominated by owner-users who occupy nearly half of the overall stock,” said Arias. “This unique building-ownership dynamic helps to keep space availability in the market’s big-box sector relatively tight, even after major construction waves.”

Other high-performing markets reflect healthy demand in the industrial big box sector. While Nashville has seen significant new supply, it has been met by healthy tenant demand from large occupiers, which has dampened the impact of new construction on the area’s vacancy expansion. In contrast, Richmond’s more limited supply growth has helped drive a relatively low availability rate in newer properties.

Small-bay analysis

The four variables analyzed were: leasing activity for sub-50,000-square-foot spaces in the last two years, compared to the pre-pandemic average since 2015, to assess tenant demand performance; Vacancy rate expansion for industrial properties between 10,000 to 100,000 square feet, to quantify how tight the small bay market has remained over the last few years; Inventory growth since 2015 of properties measuring 100,000 square feet or smaller, to assess the ease of building new small bay supply; and rent increases for small bay spaces from pre-pandemic average levels, to average levels seen since 2023, to assess asking rental gains.

The full small-bay analysis can be found here.

Big-box analysis

The three variables analyzed were: leasing activity for logistics spaces of 50,000 square feet or more in the last two years versus the pre-pandemic average since 2015, to assess tenant demand performance; vacancy rate expansion for logistics properties of over 100,000 square feet, to quantify how tight the big box market has remained over the last few years; and the availability rate of newer properties built since 2021, to assess the amount of space available in newer competitive properties.

The full big-box analysis can be found here.

For more information about the company and its products and services, please visit costargroup.com.

About CoStar Group

CoStar Group (NASDAQ: CSGP) is a global leader in commercial real estate information, analytics, online marketplaces, and 3D digital twin technology. Founded in 1986, CoStar Group is dedicated to digitizing the world’s real estate, empowering all people to discover properties, insights, and connections that improve their businesses and lives.

CoStar Group’s major brands include CoStar, a leading global provider of commercial real estate data, analytics, and news; LoopNet, the most trafficked commercial real estate marketplace; Apartments.com, the leading platform for apartment rentals; Homes.com, the fastest-growing residential real estate marketplace; and Domain, one of Australia’s leading property marketplaces. CoStar Group’s industry-leading brands also include Matterport, a leading spatial data company whose platform turns buildings into data to make every space more valuable and accessible; STR, a global leader in hospitality data and benchmarking; Ten-X, an online platform for commercial real estate auctions and negotiated bids; and OnTheMarket, a leading residential property portal in the United Kingdom.

CoStar Group’s websites attracted over 143 million average monthly unique visitors in the third quarter of 2025, serving clients around the world. Headquartered in Arlington, Virginia, CoStar Group is committed to transforming the real estate industry through innovative technology and comprehensive market intelligence. From time to time, we plan to utilize our corporate website as a channel of distribution for material company information. For more information, visit CoStarGroup.com.

View source version on businesswire.com: https://www.businesswire.com/news/home/20251218357382/en/

Contacts

News Media Contacts

Haley Luther

Senior Communications Manager

(216) 278-0627

hluther@costar.com