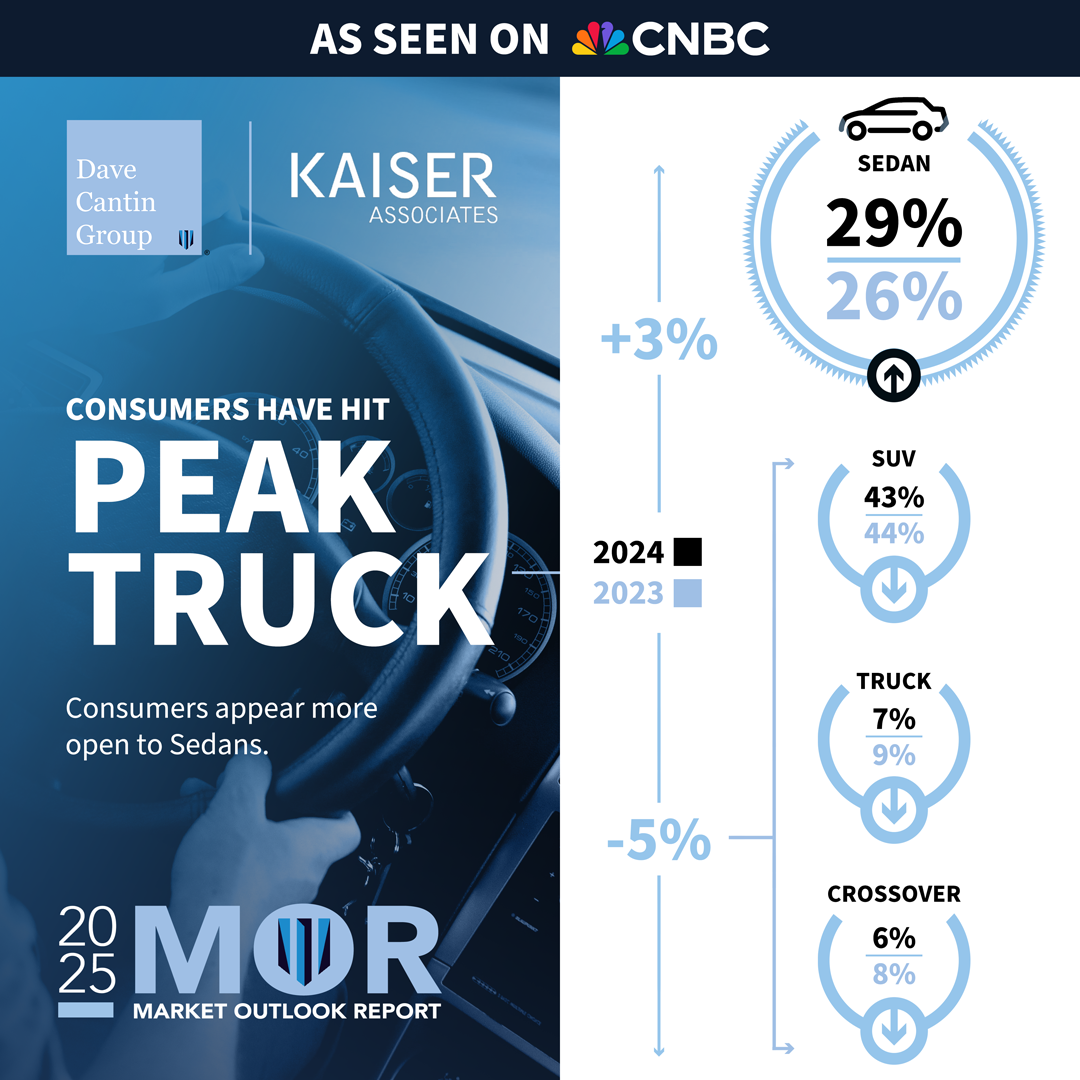

- Survey of U.S. Consumers Shows 3% Year-over-year Decrease in Intent to Buy Trucks, SUVs

- U.S. Consumers Indicate 3% Increase in Intent to Buy Cars

- Main Reason Consumers Indicate Changing Purchase Intent is Affordability

- Inflation at 7-month High Adds to American Consumer Affordability Issues

- “Peak Truck” One of Several 2025 Trends to Watch as Identified in Dave Cantin Group’s 2025 Market Outlook Report

NEW YORK, Feb. 13, 2025 (GLOBE NEWSWIRE) -- Evidence is mounting that “peak truck” is a U.S. economic trend to watch in 2025 as American consumers struggle with vehicle affordability, according to the Dave Cantin Group Market Outlook Report.

Dave Cantin Group (DCG), a leading mergers and acquisitions advisory company to retail automotive groups and their owners, identified “peak truck” as one of its key trends to watch in its 2025 Market Outlook Report issued this month. Rather than reflecting a lack of interest in trucks and SUVs among American consumers, the DCG report, as discussed on CNBC yesterday, reflects American consumers’ growing struggle to afford a new vehicle. The average purchase price for cars now hovers around $37,400, for SUVs and CUVs is more than $43,600 and for pickups is $54,600.

“This isn’t just an automotive story, it’s an American consumer story,” Dave Cantin Group President and CEO Dave Cantin said. “It’s not a declining interest in trucks. We’re not saying that segment is going away. But the consumer survey we conducted as part of our Market Outlook Report finds that the American consumer is feeling the cost pressure of rising prices.”

“In response, we see a decline in the number of people who believe their next purchase will be a truck or SUV and an equivalent increase in the number who intend to purchase a car. Add to that the report that inflation hit a 7-month high in January, and we’re seeing even more evidence that peak truck is a real trend to watch.”

Peak Truck Indicators:

- A Shift in Consumer Spending: Consumers' intent, not necessarily interest, is shifting toward cars because of rising average prices and the need for more affordable monthly payments.

- Affordability Drives the Shift: Data from the DCG Market Outlook Report, conducted by Kaiser Associates, captured the perspectives of roughly 1,100 consumers and reveals that consumer intent to purchase cars increased by 3%, reaching 29%, in 2024, while intent to buy trucks has decreased by 2%. While SUVs remain the most popular body type, consumer intent to buy dropped 1% for SUVs from 2023.

- Changing Demographics and Preferences: The report highlights a pronounced shift among older consumers, with the 35–54 and 75+ age groups increasingly favoring sedans. Additionally, tighter budgets — especially among buyers earning between $75,000 and $100,000 — are prompting a move from SUVs to more affordable car options.

- Marketwide Impact: The “peak truck” phenomenon is just one manifestation of broader affordability issues. With prolonged high interest rates pushing consumers to closely scrutinize their monthly expenses, the record average age of vehicles on the road (12.6 years overall and 14 years for passenger cars, according to S&P Global Mobility) further illustrates the reluctance to invest in new, higher-priced vehicles.

- Inflation’s Role: Compounding these trends, U.S. inflation unexpectedly rose to 3 percent in January, a 7-month high. This inflationary spike confirms that consumers continue to face cost pressures, reinforcing their focus on affordability and likely accelerating the shift away from higher-priced trucks and SUVs toward sedans and lighter-trim models that offer lower monthly payments.

- Broader Industry Implications: Manufacturers are responding to these market signals by shipping vehicles with fewer bells and whistles to dealers, an approach designed to help reduce costs for buyers. Additionally, value-driven brands such as Hyundai and Kia are seeing increased interest as consumers search for quality vehicles that align with their tightened budgets.

"The automotive industry has always been an early economic barometer, and what we're seeing now – that Americans may have hit max capacity for the largest, most expensive vehicles, at least for now – is a clear indicator of the cost-of-living pressures facing the American consumer and the overall economy,” DCG Chief Business and Strategy Officer Brian Gordon said. “This is a trend that will continue to play out and has the potential to fundamentally reshape manufacturer strategies and what ends up on dealer lots. It’s a trend we see continuing to define the market into 2025."

For additional details, please refer to the Dave Cantin Group Market Outlook Report here.

About Dave Cantin Group

The Dave Cantin Group is a leading automotive M&A advisory company specializing in acquisitions, divestitures, intelligence, and other advisory services. The company is the M&A services provider of choice for North America’s top automotive dealership groups, advising on approximately 40 transactions annually. DCG is differentiated by its advisory approach, long-term lens on client relationships, and commitment to market intelligence tools that inform DCG and client strategies. In 2023, DCG became the only retail automotive M&A company with a significant strategic investor, welcoming Kaltroco to the DCG family.

Through its M&A intelligence division, DCG produces automotive content and delivers relevant, timely marketing intelligence, including the automotive industry Market Outlook Report (MOR). Together with CBT News, DCG produces the Inside M&A studio show and podcast to share stories, news and trends impacting the retail automotive industry. DCG’s proprietary AI-enabled software, Jump IQ, anchors its advisory services that support retail automotive dealers in developing informed M&A strategies and making smarter M&A decisions.

The company’s nonprofit initiative, DCG Giving, funds child and adolescent cancer research and treatment in communities nationwide and other worthy charitable initiatives. DCG team members regularly feature on the industry speaking circuit and are regularly cited by top national and global news outlets. For more information, please visit davecantingroup.com.

Media Contact:

Katie Merx

katiemerx@gmail.com

313.510.5090

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/0f489265-1e2d-43b6-9891-d702f7cdb352