A look at Marketbeat’s list of Most Upgraded Stocks will tell you many things. One of those is that fast food stocks are hot. Most of the top fast food stocks are listed for having the most upgrades because they are growing in 2023, outperforming their consensus estimates, and providing sound guidance. This combination has them trending higher; many are already trading at historic or all-time high levels. The only name not on the list is Wendy’s (NASDAQ: WEN), but it was the most recent to report, so the analysts may not have had time to digest its tasty report.

Chipotle Mexican Grill Is On Fire

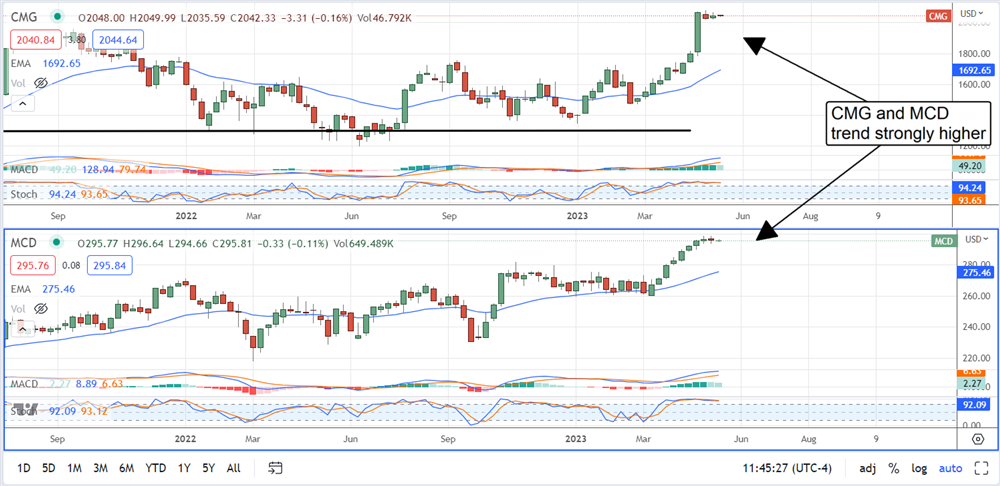

Chipotle Mexican Grill (NYSE: CMG) reported top and bottom-line outperformance with topline growth of 17%. This company is firing on all burners due to CEO Brian Niccol's push toward digital sales. The addition of Chipotlanes is amplifying the company’s already robust growth but enabling deeper penetration at existing stores where they are added and outperformance at new stores where they are included. The takeaway is that 21 of CMG’s 27 analysts updated their commentary following the report, and all but 1 raised their price target. The sole standout reiterated an above-consensus target; most new targets are also above the consensus. The only bad news is that the consensus figure assumes a fair value near $2000, offset by the fact that most new targets are closer to $2200 or another 10% higher.

McDonald’s Is The Industry Leader

McDonald’s (NYSE: MCD) is the industry leader, the world’s largest restaurant franchise, and can still produce growth. The company beat on the top and bottom lines but grew at a slower 4% compared to CMGs 17%, but there are mitigating factors. For 1, McDonald’s is more than twice the size of Chipotle and is working to rationalize business across a global footprint. The takeaway from the report is that growth is on the front burner, with double-digit comps in all regions. The 28 analysts following this stock produced 15 new commentaries because of the news, and this consensus price target is increasing. The $306 consensus figure is about 3.5% above the current action, not much, but boosted by the 2% dividend yield. However, most new targets range from $220 to $240, so new all-time highs are expected.

Restaurant Brands International Has Yield And Value

If you like the blue-chip names, Restaurant Brands International (NYSE: QSR), parent of Burger King and Popeyes, offers a bit of value compared to McDonald’s and pays a higher 3.0% dividend yield. This company produced 10% top-line growth in Q1, beating the consensus estimates on the top and bottom lines, with results underpinned by successful price pass-throughs. The news spurred 10 of the 21 analysts covering the stock into action, resulting in 9 price target increases to make 21 positive comments for the quarter. The consensus price target assumes fair value at current price levels, but again, this target is trending higher. The recent updates have the stock trading in the low-$80s, another 1200 to 1500 bps above the consensus figure, which may trend higher by the end of the year.

Jack In The Box Reports Q1 Results Soon

Jack In The Box (NASDAQ: JACK) is scheduled to report Q1 earnings soon and can be expected to produce solid results on the top and bottom lines. CEO Darrin Harris has been working to rationalize the business, invigorate growth, and is leaning into digital channels, and the results have been good. This quarter, the analysts expect a significant increase in YOY revenue and earnings due to the addition of Del Taco. Still, the sequential downtick underestimates the business and the fast-food industry. Jack In The Box should be able to outpace the $385 million consensus figure easily, which may allow the stock to move higher. As it is, 18 analysts are Holding the stock and see it trading 5% below the current action. However, the price target is trending higher and may continue to do so following the release.