Shares of AeroVironment Inc. (NASDAQ: AVAV) rose by as much as 5.9% in the after-market hours of Tuesday evening. The price action stems from the company releasing its fourth quarter 2023 earnings results. After posting record-breaking figures across critical drivers in the business, alongside management pushing for an even more bullish 2024 outlook, markets perceive it as a sure winner in the coming months. After trading within a price channel from the second half of 2022 to today, the stock may finally find some directional winds to carry it into its following range. Fortunately for investors, it is likely upward.

AeroVironment stock has also outperformed close competitors in the space; Kratos Defense and Security Solutions Inc. (NASDAQ: KTOS) has underperformed the former by as much as 7.9% during the past 12 months. Subsequently, valuation multiples for the next 12 months, relative between AeroVironment and Kratos, can give investors yet another hint as to where broader markets perceive the future of these two stocks. AeroVironment analyst ratings are looking at the stock similarly, as there is a consensus for a 26.2% upside scenario from today's prices.

The Results

In its press release, management did not shy away from announcing record quarterly revenue of $186 million (up 40% from the same quarter a year prior). These figures can be taken as a lagging indicator, however, as the $186 million represents previous achievements in the business, so investors may now be asking whether the momentum will keep going. Driving the future optimism for the company's prospects is a similar record-breaking funded backlog level of $424.1 million, the keyword "funded," as these backlog levels will significantly accrue to the company's future results.

The recent results laid the foundation for management to build its case for the prospects of the business, and the record level of backlogs was the final brick needed to construct the formal announcement. Management points to a total revenue range of $630 million to $660 million, translating into a 16% to 22% increase from the previous annual $540 million. Furthermore, net income should fall between $50 million and $58 million, presenting a significant advance from today's net losses. Analyst expectations all agree that 2024 will be a fully profitable year for the business, allowing for some exciting valuation implications.

After outperforming competitors like Kratos, broader markets still vote for further potential advances in the stock. Since AeroVironment has no past twelve months' earnings, valuations must be made using the forward P/E ratio. This metric relies on the next 12 months' earnings expectations for a sensible valuation. Carrying a 44.2x forward P/E ratio, AeroVironment enters the top five stocks in the aerospace and defense sector.

Some may argue that this only makes AeroVironment stock the more "expensive" alternative investment. However, this may signify the willingness of broader markets to overpay for each dollar of current and future earnings.

Directional Winds

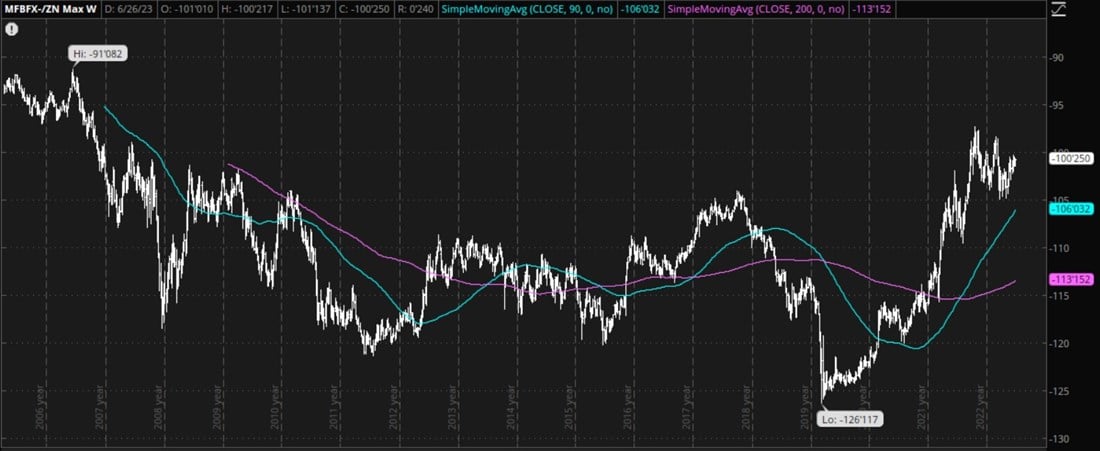

The initial stock price reaction in the face of the earnings announcement and the valuation multiples commanded by the company's prospects may be the beginning of a more significant development. A reliable indicator used by traders and investors is found in the money markets, where operators look at the levels of credit spreads between corporate bond yields and the United States 10-year bond yields.

Considering the historically high level of these spreads, markets are perceiving little risk in corporate fundamentals.

Analysts agree that future macro prospects point to further upside by placing double-digit upside potential targets. The business's record-breaking funded backlog is yet another vote of confidence from AeroVironment's customers.