Two industrial giants, General Electric (NYSE: GE) and Eaton Corporation (NYSE: ETN), are showing everyone how it's done this year by consistently outperforming the overall market and their competing companies in the sector. The extent of their outperformance might come as a surprise, but both GE and ETN have been growing steadily, and their stock charts are pointing upward, suggesting more positive trends ahead.

In a year where the Industrial Select Sector SPDR Fund (NYSE: XLI) has gone up around 8%, and the overall market represented by the SPDR S&P 500 ETF Trust (NYSE: SPY) is up almost 15%, these two companies are standing out even more.

Having these industrial champs in your investment portfolio comes with some great perks. They offer stability and the chance for dividends, and their success is closely tied to economic growth. Keeping an eye on these two outperformers could be wise as they defy expectations and show why industrial stocks are worth a look.

General Electric (NYSE: GE)

Until now, General Electric's shares have shown remarkable performance, surging by 35.4% year-to-date and by nearly 50% over the past year. While the stock's dividend yield is a modest 0.28%, its impressive share price growth more than compensates for this. Despite the gains achieved this year, the stock remains an appealing option for value investors.

It boasts a price-to-earnings ratio (P/E) of 13.46, and its current relative strength index (RSI) stands at 54.03. This indicates that the stock trades at a reasonable value and is not excessively bought in the short term.

On July 25th, 2023, General Electric released its latest earnings report. The company exceeded analysts' expectations with earnings per share of $0.68 for the quarter, surpassing estimates by $0.22. Additionally, the company's revenue for the quarter was $15.85 billion, outperforming the projected $14.76 billion.

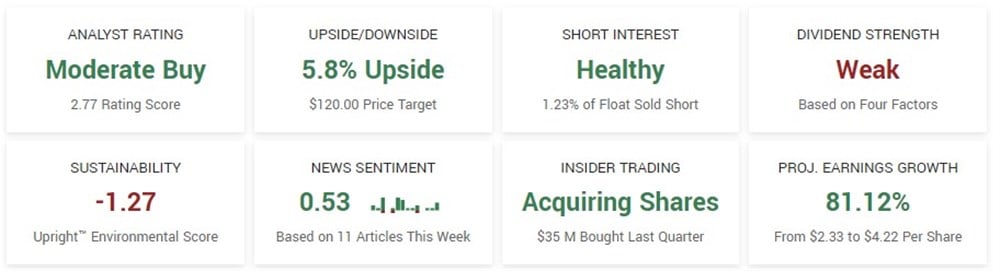

This resulted in a substantial 18.6% increase in quarterly revenue compared to the previous year. Analysts see a 5.75% upside for GE, based on the $120 consensus analyst price target, and have a consensus rating of Moderate Buy.

Throughout the year, General Electric's shares have maintained a consistent upward trend, with the 50-day Simple Moving Average (SMA) serving as crucial support. The stock tested this support level recently and successfully reclaimed its position within the upward trend.

For the momentum to persist, shares must reclaim the short-term resistance level of approximately $115. Successfully achieving this indicates the potential for increasing momentum, driving the stock towards reaching new all-time highs.

Eaton Corporation (NYSE: ETN)

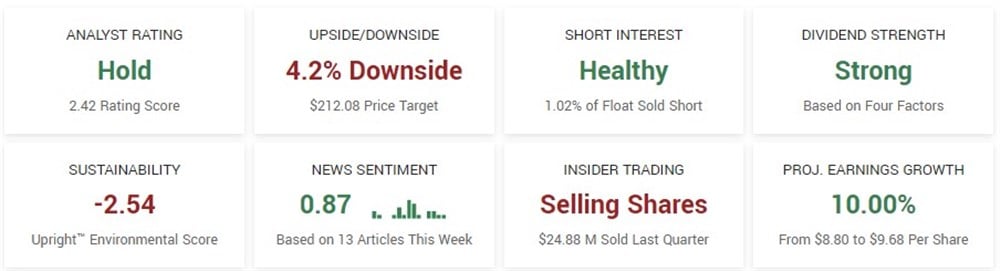

ETN emerges as a standout performer among large-cap industrial stocks this year, having surged by 41% year-to-date and over 52% in the past year. In contrast to GE, ETN offers a moderate dividend yield of 1.55%. However, the company's price-to-earnings ratio (P/E) is more than double that of GE, sitting at 32.69.

This renders ETN's shares notably more expensive for investors considering the P/E ratio in their decisions. It's worth noting that the Relative Strength Index (RSI) for ETN is at 66.02, suggesting that the shares are not yet overbought in the short term.

Eaton announced its latest quarterly earnings on August 1, 2023. The company exceeded expectations by reporting earnings per share (EPS) of $2.21 for the quarter, surpassing analysts' average forecast of $2.11 by $0.10.

Additionally, Eaton generated $5.87 billion in revenue during the quarter, outperforming the estimated $5.76 billion. This marked a notable 12.5% increase in revenue compared to the same quarter in the previous year.

Considering technical analysis, the current indications suggest continued upward momentum for ETN. The stock is presently trading above all significant moving averages and consistently supporting and basing above its steady uptrend.

As things stand, ETN's upward momentum will likely persist unless the stock's value drops below the supporting upward trend line near $215.