Capricor Therapeutics Inc. (NASDAQ: CAPR) is a biotechnology firm focused on developing cell and exosome-based treatments for rare diseases like Duchenne muscular dystrophy (DMD). Capricor’s stock surged more than 100% after announcing it will pursue full FDA approval for its primary drug deramiocel (CAP-1002) in this year. The medical sector company plans to file the biologics license application (BLA) in October 2024, seeking full FDA approval to treat all patients with cardiomyopathy associated with DMD.

This rare genetic neuromuscular disorder causes progressive muscle degeneration and weakness. Cardiomyopathy is the leading cause of death among patients with DMD.

Around 30% to 60% of DMD patients suffer from cardiomyopathy. DMD has roughly 300,000 known sufferers worldwide, as 1 in 3,500 boys are born with it. The total addressable market (TAM) size is expected to be around $5.5 billion by 2032.

The company operates in the medical sector, competing with the incumbent leader in DMD treatments, Sarepta Therapeutics Inc. (NASDAQ: SRPT) biotech PepGen Inc. (NASDAQ: PEPG).

DMD Has Many Complications and Symptoms

Duchenne muscular dystrophy causes muscles to degenerate and weaken due to a mutation in the gene that produces a crucial protein that maintains the structural integrity of all muscle cells called dystrophin. DMD complications range from muscle degeneration and weakness resulting in difficulty walking, paralysis and frequent falls to cardiomyopathy, which is a weakening of the heart muscle, which can result in shortness of breath, fatigue, and chest pain, to an increased risk of arrhythmias, lung and heart failure.

Respiratory problems arise from weakening respiratory muscles, resulting in breathing difficulty and ventilator support. Skeletal deformities result in scoliosis, bone fractures and contractures.

While there is no cure as of yet for DMD, the existing treatments focus on treating the symptoms and slowing the progression. DMD gets progressively worse, limiting lifespans into the mid-20s. DMD mostly affects boys and is 100% fatal.

How Capricor’s CAP-1002 Cell Therapy Works

Deramiocel (CAP-1002) is a drug that's focused on treating DMD-associated cardiomyopathy, the weakening of the heart muscle. It's an allogeneic cell therapy that uses cardiosphere-derived cells (CDCs), health donor cells. The CDCs in Deramiocel are administered intravenously. They have regenerative properties, reduce inflammation, and stimulate the formation of new blood vessels through angiogenesis to improve blood flow to heart tissue. Deramiocel reduces fibrosis, which is the thickening of heart tissue, in order to maintain better heart structure and function.

Capricor Is Ready for FDA Approval

Due to the strong results from its Phase 2 HOPE-2 and HOPE-2 Open Label Extension (OLE) trials and positive FDA feedback, Capricor feels they can receive full FDA approval rather than accelerated approval. The FDA had indicated no further trials are required, indicating there is sufficient data for the BLA submission.

Capricor also plans to combine Cohorts A and B of the Phase 3 HOPE-3 clinical trial to support label expansion to treat DMD skeletal muscle myopathy.

Capricor's CEO, Dr. Linda Marbán, stated, "Deramiocel has shown in multiple clinical trials attenuation of the cardiac implications of DMD. Based on the totality of the evidence of the safety and efficacy data deramiocel has shown, we believe this is the best path forward to potential approval, allowing us to bring this novel, first-in-class treatment to patients in need in the most expeditious manner.”

Nippon Shinoki Pays to Be Its European Commercialization Partner

On Sept. 17, 2024, Capricor announced it struck a deal with Japanese pharmaceutical company Nippon Shinyaku for the commercialization and distribution of deramiocel in Europe. Capricor will handle the developing and manufacturing of the drug for approval in the European Union and the United Kingdom. Nippon agreed to buy $15 million of Capricor stock at a 20% premium to its 60-day VWAP, which it did after acquiring 2.79 million shares. Nippon will also provide an upfront payment of $20 million, along with potential milestone payments of up to $715 million and a double-digit share of product revenue.

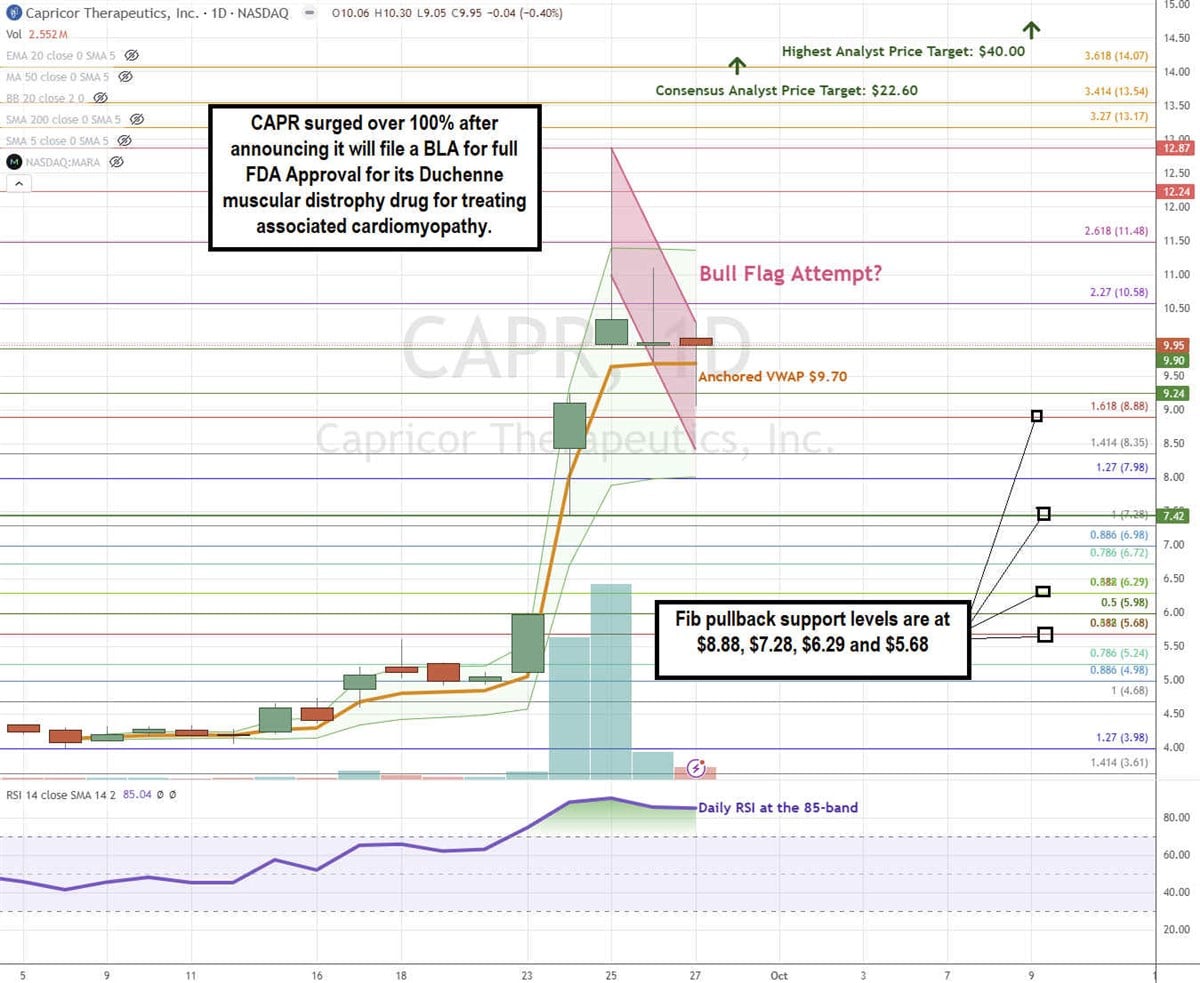

CAPR Stock Forms a Potential Bull Flag

A bull flag pattern forms when the stock surges up through the descending upper trendline resistance after forming the flag, which follows a steep run-up.

CAPR generated 30 and 41 million shares volume on the days following its Sept. 27, 2024, announcement to file the BLA with the FDA. Shares surged up to $12.87 before forming parallel descending upper and lower trendlines. The daily anchored VWAP is flat at $9.70. The daily relative strength index (RSI) surged to the 85-band. Fibonacci (Fib) pullback support levels are at $8.88, $7.28, $6.29, and $5.68.

Capricor’s average consensus price target is $22.80, and its highest analyst price target sits at $40.00. It has 5 analyst Buy ratings.

Actionable Options Strategies: While the 100% run-up from $5 per share seems extreme, a full FDA approval has the potential to surge this stock toward its consensus price target. SRPT is an example of a DMD treatment provider whose shares surged tenfold upon FDA approval.

This is a highly speculative BET or gamble for FDA approval.

Bullish speculators can buy on pullbacks using cash-secured puts to take advantage of the elevated premiums at the fib pullback support levels to buy the dip.

Bullish investors who are convinced of an FDA approval may consider buying out-of-the-money (OTM) directional LEAPS call options in the double-digit price range.