Monster Beverage’s (NASDAQ: MNST) stock received an unwelcome short report that has produced a headwind for the share price.

[content-module:CompanyOverview|NASDAQ: MNST]Spruce Point alleged issues with increased competition, increased regulatory hurdles, and unsustainable international growth among other causes for concern.

However, the report reads more like a reason not to invest than a compelling argument for sharply or rapidly deteriorating stock prices, and other market forces disagree.

Those include the analysts, who are raising their price targets in Q2, and the institutions, who are buying.

They are doing so because the company continues to gain traction in critical categories and regions, makes money, and buys back shares.

Analysts and Institutional Trends Offset Short-Sellers: Higher Share Prices Indicated

The analysts' trends, specifically the six revisions tracked by MarketBeat since Spruce Point issued its report, contradict it. Those include six price target revisions from analysts that rate the stock as a firm Hold with bullish bias. The bias is bullish because more than 50% of the ratings are a Moderate Buy or better, and the price targets suggest a move to the high-end range relative to the trend.

The range of fresh targets runs from $50 to $71, lifting the high-end and the consensus with consensus up 500 bps month-to-month in early May. Throwing out the outliers, the trimmed data set puts this market at $63.50 compared to the broader consensus, a 5% gain in early May, and a new all-time high when reached

Likewise, institutional trends are bullish for this consumer staples stock. Institutional activity has ramped higher since Q3 2024, including selling, but the buying has offset it the entire time. Institutions own more than 70% of the stock and are buying it at a pace of more than two to one relative to sellers in early Q2. This strong support base and tailwind for the market will help push it to new highs.

The move to new highs is significant for this market because of the technical setup and the short interest. Short interest has been elevated since last year and increased by 10% in April. A move to new highs could trigger short covering, but a short squeeze is unlikely. Even with the elevated nature and 10%, this market is still only 2% short, with little reason for short interest to increase.

Monster Beverage Navigates Headwinds in 2025

Monster Beverage’s Q4 2024 results reflect the impact of headwinds and the company’s strengths and diversification. The alcohol segment is struggling with hard seltzers that are out of favor, and consumers are shopping for cheaper beer brands, but energy brand strengths are resilient. The company reported strength in its international business and regained strength in critical US categories such as convenience stores. The takeaway is that while results were mixed relative to analysts' forecasts, the company grew revenue at a mid-single-digit pace and earnings nearly doubled. The estimates for Q1 2025 are for similar results.

Monster Beverage’s capital returns are monstrous. The company doesn’t pay dividends but aggressively buys back its shares. Buybacks reduced the count by 4.2% in 2024 and are expected to continue in 2025. The company had about $500 million left on its authorization, positive cash flow, and a healthy balance sheet. Highlights at the end of 2024 included a net cash position and long-term debt leverage of less than 0.1x equity.

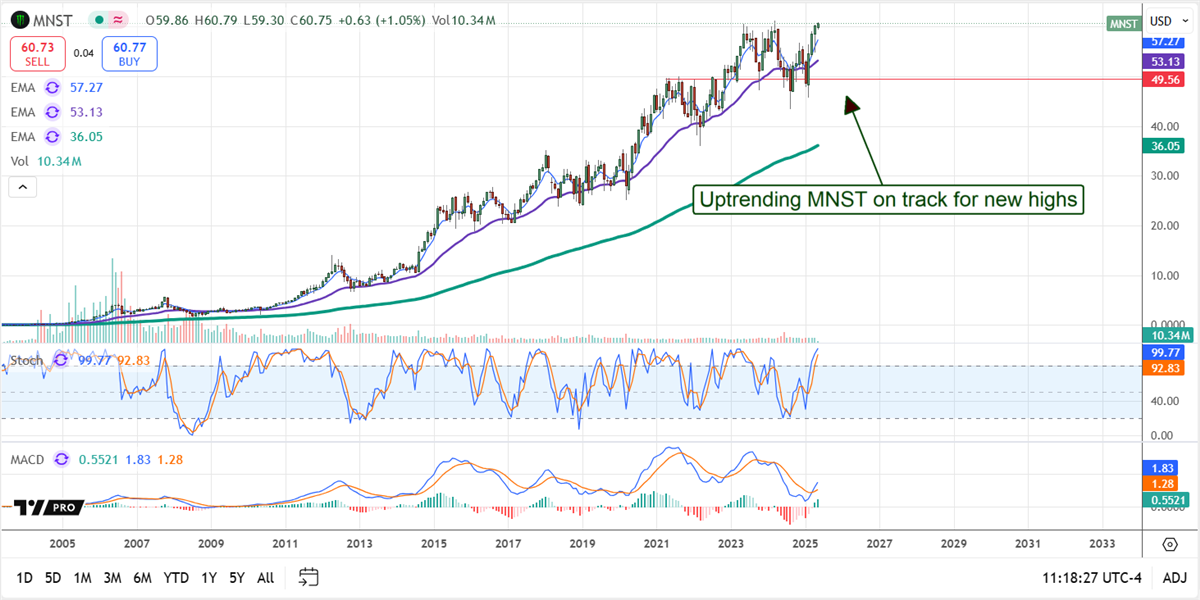

Monster Beverage Is in an Uptrend, Plain and Simple

Monster Beverage’s stock price has been range-bound for the last two years but is otherwise in an uptrend and on track to set new highs. The price action in early May has the market nearing the all-time high, likely reached by mid-year. The risk is the Q1 results and guidance update. If business headwinds intensify, this market could remain range-bound until later in the year.

Where Should You Invest $1,000 Right Now?

Before you make your next trade, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis.

Our team has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and none of the big name stocks were on the list.

They believe these five stocks are the five best companies for investors to buy now...