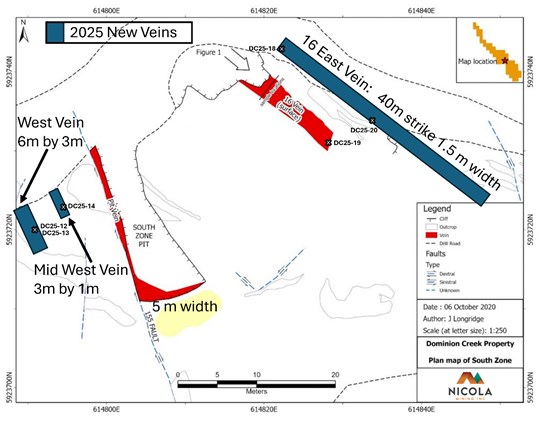

Vancouver, British Columbia--(Newsfile Corp. - November 10, 2025) - Nicola Mining Inc. (TSXV: NIM) (FSE: HLIA) (OTCQB: HUSIF) (the "Company" or "Nicola") is pleased to announce that it received final assays from the Dominion Gold Project ("Dominion Gold"). The Company provided an update on its 2025 work on November 4, 2025. Chip samples were taken from all five veins, three of which are newly discovered, to measure exposed vein grades prior to commencing extraction, Figure 1.

A sampling program targeting the exposures of the new veins discovered during development work for the bulk sampling of the pit and 16 veins to determine if the new veins carried high enough gold values to warrant including them in the bulk sample. A total of nine samples, including one sample of waste rock that is not included, were collected by the mine manager, Alan Raven, and his co-manager, Randy Mervyn, on October 6th and 7th.

Samples from the pit vein are similar to the historic high-grade samples. Pit Vein sample spans across the 2.7 metres of the exposed vein with a 1x1 metre panel sample of the vein taken within the pit. The 5-metre exposure was not sampled this trip as it was underwater. The results are representative of the high-grade mineralization in the veins and not of the total volume of material being extracted for the bulk sample.

Table 1: Chip Sampling Across Exposed Veins

| Sample # | g/t Au | Oz / t Au | Location | Sample Area |

| DC25-12 | 0.526 | 0.02 | West Vein | 2m by 3m |

| DC25-13 | 0.104 | 0.00 | West Vein | 3m by 3m |

| DC25-14 | 0.433 | 0.01 | Mid West Vein | 0.8m across exposed vein |

| DC25-15 | 55.17 | 1.77 | Pit Vein | 1.5m |

| DC25-16 | 29.25 | 0.94 | Pit Vein | 1.2m |

| DC25-17 | 113.51 | 3.65 | Pit Vein | 1.0m |

| DC25-19 | 37.2 | 1.20 | 16 Vein | 1.4m |

| DC25-20 | 9.4 | 0.30 | 16 East Vein | 1.6m |

Note: See Figure 2 on next page for map

Key Takeaways include the following:

- All veins remain open in all directions.

- The West Vein, Mid West Vein and 16 East Vein were all previously unknown.

- Previously unknown 16 East Vein has been followed for 40 metres at surface but remains open in all directions.

- Pit Vein sample spans across the five metres of the exposed vein.

- Under terms of the agreement, Nicola holds a 75% economic interest, after which it owns 100% of the Dominion Gold.

The samples were collected from a typical area of each new exposure to help determine the average grade of the veins sampled. Sampling was done using a hammer and rock chisel, samples were placed in a poly bag, labeled on the outside with a sample number with a corresponding number written on survey flagging and placed inside the sample bag, and secured with a zip tie. Samples averaged 2 to 3.5 kilograms each. The samples were then transported by the mine manager, Alan Raven, to his residence, stored in locked facilities until they were transported and delivered on October 30 to Paragon Geochemical laboratory in Surrey BC, an independent ISO 17025:2017 accredited geochemical testing laboratory. Samples were crushed and pulverized (lab code PREP) then analyzed for gold using 2-cycle PhotonAssayTM (lab code (PA-AU02 Au). The analytical results that the present exposures of the West vein and the Mid-west vein indicate that they are not of a high enough grade to be included in the bulk sample.

Figure 2. Current Map of Dominion Gold Project (modified from 2020 to include new veins and sample locations; note that DC-25-18 was waste pile sample)

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/4873/273763_6529c675f4d4091c_001full.jpg

Mr. Peter Espig, CEO of Nicola Mining Inc., commented, "We had expected the grades to be high and assay results clearly confirm what we had hoped for. However, the scale and new vein discoveries were, unanticipated exciting revelations of Dominion's long-term potential. During 2026 we will focus on both bulk sample extraction and better understanding of project scale."

Nicola also announces that it has provided Talisker Resources Inc., 60 days' notice after which it the Company will no longer accept ore for processing at its Merritt facility.

Qualified Person

The scientific and technical disclosures included in this news release have been reviewed and approved by Will Whitty, P.Geo., who is the Qualified Person as defined by NI 43-101. Mr. Whitty is Vice President of Exploration for the Company.

DOMINION CREEK PROPERTY HISTORY

The Dominion Creek Property consists of 9 mineral claims (55 units) totaling approximately 1,058 hectares. The property was acquired from the prospector N. Kencayd by Noranda Exploration Company Ltd. in 1986. Noranda subsequently conducted geological, geochemical, and geophysical surveys which culminated in an increase in their land position. Between 1987 and 1990, Noranda's exploration program included a small (20 samples) geochemical silt sample survey. Encouraged by those results, a larger soil geochemical survey (3,399 samples) was conducted. Noranda drilled a total of 53 shallow diamond drill holes, totaling 3,483.86 meters (average depth of approximately 65.7 meters). Trenching of several coincident Pb, Zn, Cu, Ag and Au soil geochemistry anomalies resulted in the discovery of several mineralized quartz veins.

A Technical Report1 on the Dominion Creek Project was completed by Geospectrum Engineering on August 22, 2003.

About Nicola Mining

Nicola Mining Inc. is a junior mining company listed on the Exchange and Frankfurt Exchange that maintains a 100% owned mill and tailings facility, located near Merritt, British Columbia. It has signed Mining and Milling Profit Share Agreements with high grade gold projects. Nicola's fully permitted mill can process both gold and silver mill feed via gravity and flotation processes.

The Company owns 100% of the New Craigmont Project, a high-grade copper property, which covers an area of over 10,800 hectares along the southern end of the Guichon Batholith and is adjacent to Highland Valley Copper, Canada's largest copper mine. The Company also owns 100% of the Treasure Mountain Property, which includes 30 mineral claims and a mineral lease, spanning an area exceeding 2,200 hectares.

On behalf of the Board of Directors

"Peter Espig"

Peter Espig

CEO & Director

For additional information

Contact: Peter Espig

Phone: (778) 385-1213

Email: info@nicolamining.com

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

1 Makepeace, D. K., 2003. Dominion Creek Project Technical Report for XMP Mining Ltd. Geospectrum Engineering, August 22.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/273763