Fleet Management Market size worth over $45 Bn by 2027

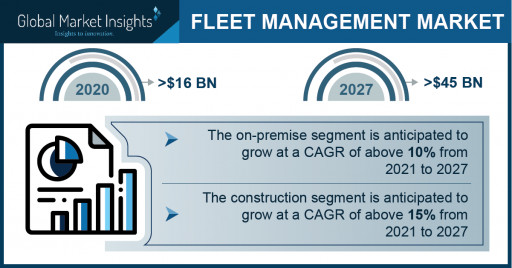

Fleet Management Market size is set to surpass USD 45 billion by 2027, according to a new research report by Global Market Insights, Inc.

Global Market Insights Inc. has recently added a new report on the fleet management market, which estimates the market valuation for fleet management will cross US $55 billion by 2027. The growing automobile industry, enterprise-wide demand for location-aware technologies, and shifting consumer demand toward more efficient smart vehicles will augment the industry demand. The increasing adoption of fleet management solutions improves operational efficiency, along with effective supply chain processes across the e-commerce industry, and is another major factor driving the market growth.

The fleet management market growth is attributed to the growing automobile industry, enterprise-wide demand for location-aware technologies, and shifting consumer demand toward more efficient smart vehicles. The increasing adoption of fleet management solutions improves operational efficiency, along with effective supply chain processes across the e-commerce industry, which is another major factor driving the market growth.

Request for a sample of this research report at https://www.gminsights.com/request-sample/detail/3598

The on-premise segment is anticipated to grow at a CAGR of above 10% from 2021 to 2027. On-premise deployment helps fleet operators with enhanced control and management capabilities for fleet operations. In addition, network outages will not affect fleet management applications due to the absence of connection to cloud infrastructure. This creates more opportunities for enterprises to offer more personalized services and reduce security concerns.

The operation management segment captured around 25% of the fleet management market share in 2020 due to the increasing need to manage end-to-end logistics functions including customer order management and suitable fleet selection. The emergence of smartphone technology has made operation management more accessible to fleet operators and affordable to logistics enterprises. This is anticipated to support the market growth over the forecast period.

The construction segment is anticipated to observe a 15% CAGR from 2021 to 2027 on account of increasing dependency on mixed equipment and vehicles such as bulldozers, cranes, excavators, expensive loaders, trenchers, and trucks. These expensive assets require monitoring in real-time, followed by a collection of asset-related data.

The passenger vehicle segment held over 35% of the fleet management market share in 2020, impelled by the growing opportunities in car leasing and renting businesses followed by the flourishing production of passenger vehicles. The use of fleet management components including software, hardware, and technology can benefit car rental enterprises in improving their business efficiency.

Europe is projected to grow significantly in the fleet management market with a significant CAGR during the forecast period. Growth is attributed to the extensive proliferation of commercial vehicles, extensive digitization, and launch of automotive leasing services. In addition, the presence of several automobile manufacturers and their growing brand value and sales are anticipated to support the market growth over the forecast period.

Several automotive companies in the region are partnering with enterprises in the market to support commercial vehicle & fleet growth. For instance, in July 2020, FORD and ALD Automotive signed a partnership agreement to launch fleet management solutions across Europe. Through this partnership, both the companies will provide new integrated fleet leasing and management solutions under Ford Fleet Management. This partnership will help both the companies to expand their businesses in Europe and support commercial vehicle & fleet growth.

The companies operating in the market are focused on developing innovative solutions. In June 2020, Samsara Networks Inc. launched an integration tool for Ford Commercial services. The launched integrated solution is developed by combining Ford Data Services and Samsara's platform. The launched integrated solution enables Ford's commercial vehicle owners to access advanced vehicle telematics data over Samsara's fleet management platform.

Some major findings of the fleet management market report include:

- The growing adoption of various telematics solutions to monitor driving patterns across the transportation and logistics sector is supporting the fleet management market growth.

- Europe is anticipated to hold a significant market share in fleet management due to enterprise-wide demand for location-aware technologies.

- Major players operating in the fleet management market are ARI Fleet Management Company, Astrata Europe BV, Automile Inc, Azuga, Inc, Bestmile SA, ClearpathGPS, Inc., and Donlen Corporation.

- Companies operating in the market are focusing on the integration of new technologies and portfolio expansion to cater to diverse customer requirements.

Request for customization of this research report at https://www.gminsights.com/roc/3598

Partial chapters of report table of contents (TOC):

Chapter 3 Fleet Management Industry Insights

3.1 Introduction

3.2 Industry segmentation

3.3 Impact of COVID-19 outbreak

3.3.1 Global outlook

3.3.2 Regional outlook

3.3.2.1 North America

3.3.2.2 Europe

3.3.2.3 Asia Pacific

3.3.2.4 Latin America

3.3.2.5 Middle East & Africa

3.3.3 Industry value chain

3.3.3.1 Fleet management providers

3.3.3.2 Marketing & distribution channel

3.3.4 Competitive landscape

3.3.4.1 Strategy

3.3.4.2 Distribution network

3.3.4.3 Business growth

3.4 Fleet management industry ecosystem analysis

3.4.1 Telematics component provider

3.4.2 Fleet management software providers

3.4.3 Cloud service providers

3.4.4 Distribution channel

3.4.5 End users

3.5 Technology & innovation landscape

3.5.1 GPS and On-Board Diagnostics (OBD)

3.5.2 Commercialization of 5G networks

3.6 Investment portfolio

3.7 Regulatory landscape

3.7.1 China VI Emission Standards

3.7.2 CSA 2010 (Compliance and Enforcement Program), U

3.7.3 Electronic Logging Devices (ELD) Rule 2017 (U

3.7.4 Federal Motor Carrier Safety Administration (FMCSA)

3.7.5 OBD-II Standards

3.7.6 The California Air Resources Board (CARB) guidelines

3.7.7 The European OBD Standards

3.7.8 The Society of Indian Automobile Manufacturers (SIAM)

3.7.9 The U Environmental Protection Agency (EPA) Heavy Duty Engine Standards

3.8 Industry impact forces

3.8.1 Growth drivers

3.8.1.1 Growing emphasis by fleet operators on operational efficiency

3.8.1.2 Extensive penetration of cloud computing and big data analytics solutions

3.8.1.3 Emergence of AI technology in fleet management systems

3.8.1.4 Growing adoption of IoT and proliferation of commercial vehicles

3.8.2 Industry pitfalls & challenges

3.8.2.1 Increasing cyberthreats and data breach incidents

3.8.2.2 Lack of awareness among smaller fleet owners

3.9 Growth potential analysis

3.10 Porter's analysis

3.11 PESTEL analysis

About Global Market Insights

Global Market Insights, Inc., headquartered in Delaware, U.S., is a global market research and consulting service provider; offering syndicated and custom research reports along with growth consulting services. Our business intelligence and industry research reports offer clients with penetrative insights and actionable market data specially designed and presented to aid strategic decision making. These exhaustive reports are designed via a proprietary research methodology and are available for key industries such as chemicals, advanced materials, technology, renewable energy and biotechnology.

Contact Us:

Arun Hegde

Corporate Sales, USA

Global Market Insights, Inc.

Phone: 1-302-846-7766

Toll Free: 1-888-689-0688

Email: sales@gminsights.com

Press Release Service by Newswire.com

Original Source: Fleet Management Market to Hit US $55B by 2026; Global Market Insights, Inc.