BOULDER, Colo., January 26, 2023 (Newswire.com) - The NFT market turmoil is palpable. Rampant speculation, a slew of bad actors, and technical knowledge barriers form a perfect storm of confusion. But at the eye of this storm is the question: Are NFTs the latest Ponzi scheme or a new asset?

Skry believes NFTs represent the latter: a new form of digital-native asset. While confusion and skepticism exist, the idea of a digital collectible will be commonplace. Skry looks to examples like the Reddit CryptoSnoos NFT launch as indicators of where NFTs are heading. A series of NFTs termed "digital collectibles" took off among a decidedly anti-crypto audience. When you peel back misinformation and layers of techno-babble, it's obvious there is demand for natively digital asset ownership.

As with any asset class, a lack of quality standards creates ambiguity. Skry contends this is the central issue affecting NFTs today. Getting scammed is easy if there are no objective criteria for what you are buying. Apart from intentional scams, creators need more technical know-how to launch an NFT with staying power. We need people-friendly metrics to gauge quality before NFTs become accessible.

"We need to work together to aggregate strategies, analyses, and best practices from collectors, creators, and developers to build standards around NFTs or we'll continue running into problems," said Mike Roth, co-founder and CEO of Skry.

Skry understands this is easier said than done. NFTs are multifaceted, but Skry believes the way forward is to focus on specific use cases and their existing examples.

Roth continued, "Framing NFTs specifically as digital collectibles helps create standards by looking at what already exists, for example, trading card grading and secondary markets like StockX. For each of these, a major factor is the social context. While hard to quantify, we know community is an obvious component of a collectible's value. Apart from that, there are technical components like any other asset. With a baseball card, you want to know if it is torn or damaged. With NFTs, the most NFT-native technical factors are how decentralized the collection is and what the mint mechanics were."

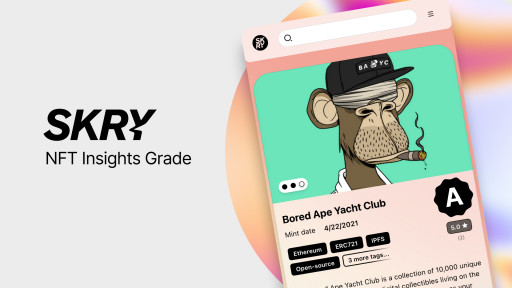

Skry aggregates community engagement, code quality, and market performance, then outputs those factors as an "insights grade." The grade rates collections from A (high quality) to D (low quality) with the goal of A-rated collections being less volatile over the long run. The platform presents insights as bite-sized chunks anyone can quickly parse without hours of Discord surfing or becoming a smart-contract developer.

Skry understands that creating standards takes years of proven data and market endurance to decide what "quality" looks like. Because of this, the Skry Insights Grade improves as the market evolves through the use of machine learning. Skry recently launched a dashboard to visualize this evolution of its rating system over time. To view the new dashboard and learn more about Skry, visit skry.xyz/about.

Contact Information:Mike Roth

CEO

press@skry.xyz

Original Source: Skry Helps You Find NFT Collectibles Worth Collecting