The end of the earnings season is always a good time to take a step back and see who shined (and who not so much). Let’s take a look at how renewable energy stocks fared in Q3, starting with NuScale (NYSE: SMR).

Renewable energy companies are buoyed by the secular trend of green energy that is upending traditional power generation. Those who innovate and evolve with this dynamic market can win share while those who continue to rely on legacy technologies can see diminishing demand, which includes headwinds from increasing regulation against “dirty” energy. Additionally, these companies are at the whim of economic cycles, as interest rates can impact the willingness to invest in renewable energy projects.

The 18 renewable energy stocks we track reported a slower Q3. As a group, revenues missed analysts’ consensus estimates by 7.5% while next quarter’s revenue guidance was 7.2% below.

While some renewable energy stocks have fared somewhat better than others, they have collectively declined. On average, share prices are down 1.2% since the latest earnings results.

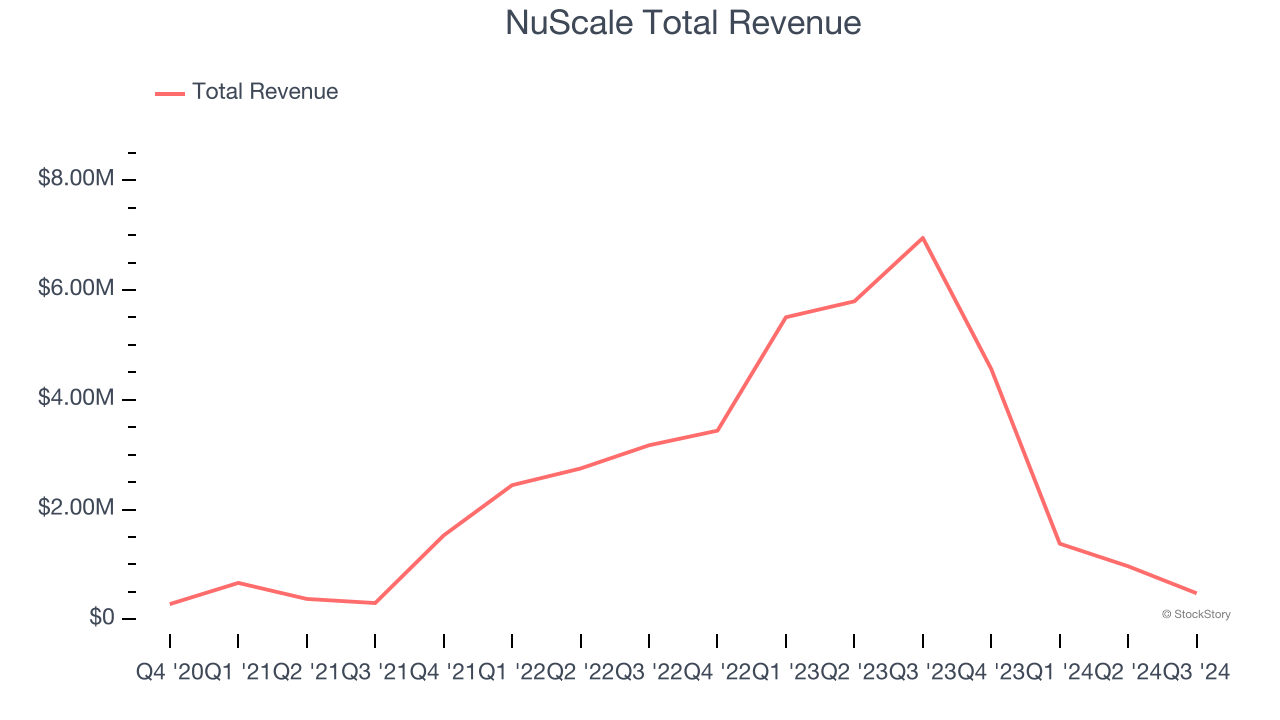

NuScale (NYSE: SMR)

Founded by a team of nuclear scientists, NuScale (NYSE: SMR) specializes in small modular reactor technology, providing scalable nuclear power solutions.

NuScale reported revenues of $475,000, down 93.2% year on year. This print fell short of analysts’ expectations by 95.6%. Overall, it was a disappointing quarter for the company with a significant miss of analysts’ EPS estimates.

“As energy demand grows, the world’s largest technology companies are urgently seeking sources of secure, clean, reliable nuclear power, and NuScale is uniquely positioned to serve their needs for uninterrupted energy,” said John Hopkins, President and Chief Executive Officer of NuScale Power.

NuScale delivered the weakest performance against analyst estimates and slowest revenue growth of the whole group. Unsurprisingly, the stock is down 2.9% since reporting and currently trades at $21.01.

Read our full report on NuScale here, it’s free.

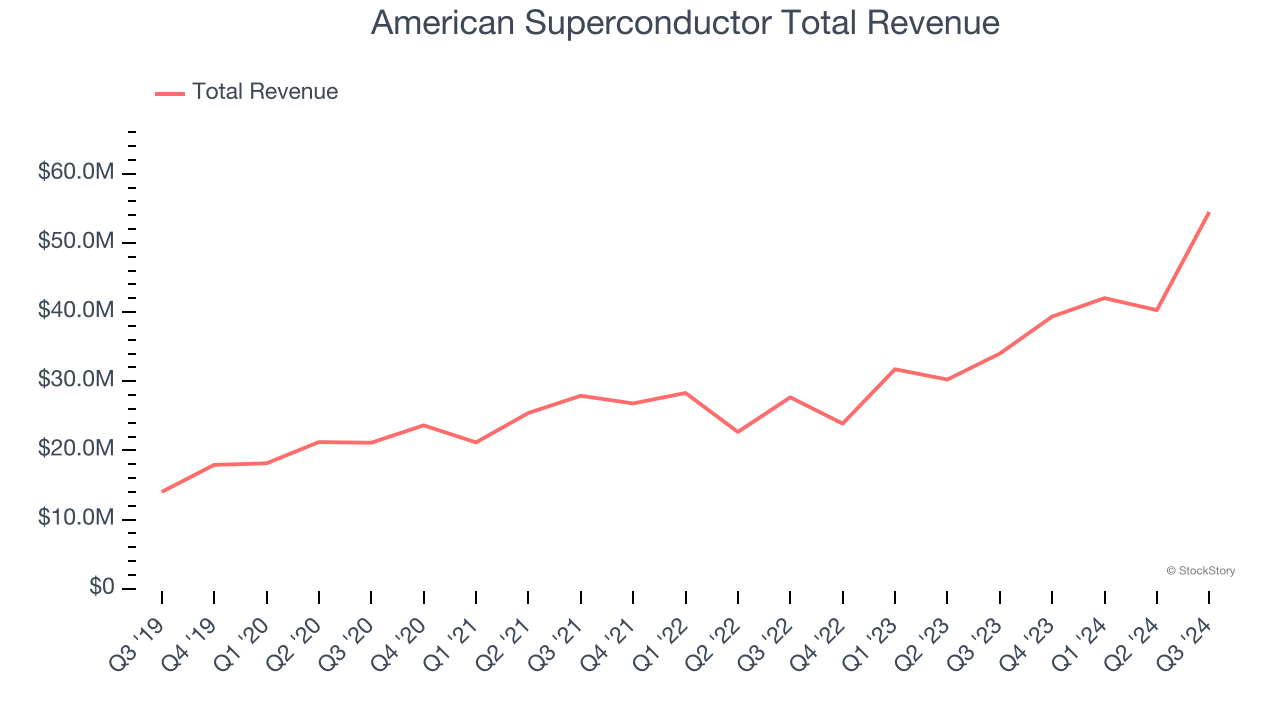

Best Q3: American Superconductor (NASDAQ: AMSC)

Founded in 1987, American Superconductor (NASDAQ: AMSC) has shifted from superconductor research to developing power systems, adapting to changing energy grid needs and naval technology requirements.

American Superconductor reported revenues of $54.47 million, up 60.2% year on year, outperforming analysts’ expectations by 6.1%. The business had an exceptional quarter with a solid beat of analysts’ EPS estimates and an impressive beat of analysts’ EBITDA estimates.

The market seems happy with the results as the stock is up 5.7% since reporting. It currently trades at $24.85.

Is now the time to buy American Superconductor? Access our full analysis of the earnings results here, it’s free.

SolarEdge (NASDAQ: SEDG)

Established in 2006, SolarEdge (NASDAQ: SEDG) creates advanced systems to improve the efficiency of solar panels.

SolarEdge reported revenues of $260.9 million, down 64% year on year, falling short of analysts’ expectations by 3.7%. It was a disappointing quarter as it posted revenue guidance for next quarter missing analysts’ expectations.

The stock is flat since the results and currently trades at $14.75.

Read our full analysis of SolarEdge’s results here.

TPI Composites (NASDAQ: TPIC)

Founded in 1968, TPI Composites (NASDAQ: TPIC) manufactures composite wind turbine blades and provides related precision molding and assembly systems.

TPI Composites reported revenues of $380.8 million, up 2.1% year on year. This result surpassed analysts’ expectations by 5.9%. Zooming out, it was a mixed quarter as it also produced a solid beat of analysts’ billings estimates but a significant miss of analysts’ adjusted operating income estimates.

The stock is down 33.3% since reporting and currently trades at $1.86.

Read our full, actionable report on TPI Composites here, it’s free.

Blink Charging (NASDAQ: BLNK)

One of the first EV charging companies to go public, Blink Charging (NASDAQ: BLNK) is a manufacturer, owner, operator, and provider of electric vehicle charging equipment and networked EV charging services.

Blink Charging reported revenues of $25.19 million, down 41.9% year on year. This number lagged analysts' expectations by 28.1%. Overall, it was a disappointing quarter as it also logged full-year revenue guidance missing analysts’ expectations.

Blink Charging had the weakest full-year guidance update among its peers. The stock is down 24.4% since reporting and currently trades at $1.52.

Read our full, actionable report on Blink Charging here, it’s free.

Market Update

Thanks to the Fed's series of rate hikes in 2022 and 2023, inflation has cooled significantly from its post-pandemic highs, drawing closer to the 2% goal. This disinflation has occurred without severely impacting economic growth, suggesting the success of a soft landing. The stock market has thrived in 2024, spurred by recent rate cuts (0.5% in September and 0.25% each in November and December), and a notable surge followed Donald Trump's presidential election win in November, propelling indices to historic highs. Nonetheless, the outlook for 2025 remains clouded by the pace and magnitude of future rate cuts as well as potential changes in trade policy and corporate taxes once the Trump administration takes over. The path forward is marked by uncertainty.

Want to invest in winners with rock-solid fundamentals? Check out our Top 6 Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.