Looking back on terrestrial telecommunication services stocks’ Q2 earnings, we examine this quarter’s best and worst performers, including U.S. Cellular (NYSE: USM) and its peers.

Terrestrial telecommunication companies face an uphill battle, as they mostly sell into a deflationary market, where the price of moving a bit tends to decrease over time with better technology. Without dependable volume growth, revenue growth could be challenged. Unfortunately, broadband penetration in their core US market is quite high already. On the other hand, data consumption from streaming entertainment and 5G expansion could provide a floor on growth for the next number of years. As if that wasn't enough to worry about, competition is intense, with larger telecom providers and hyperscalers expanding their own networks.

The 4 terrestrial telecommunication services stocks we track reported a satisfactory Q2. As a group, revenues were in line with analysts’ consensus estimates.

Luckily, terrestrial telecommunication services stocks have performed well with share prices up 14.3% on average since the latest earnings results.

U.S. Cellular (NYSE: USM)

Operating as a majority-owned subsidiary of Telephone and Data Systems since its founding in 1983, US Cellular (NYSE: USM) is a regional wireless telecommunications provider serving 4.6 million customers across 21 states with mobile phone, internet, and IoT services.

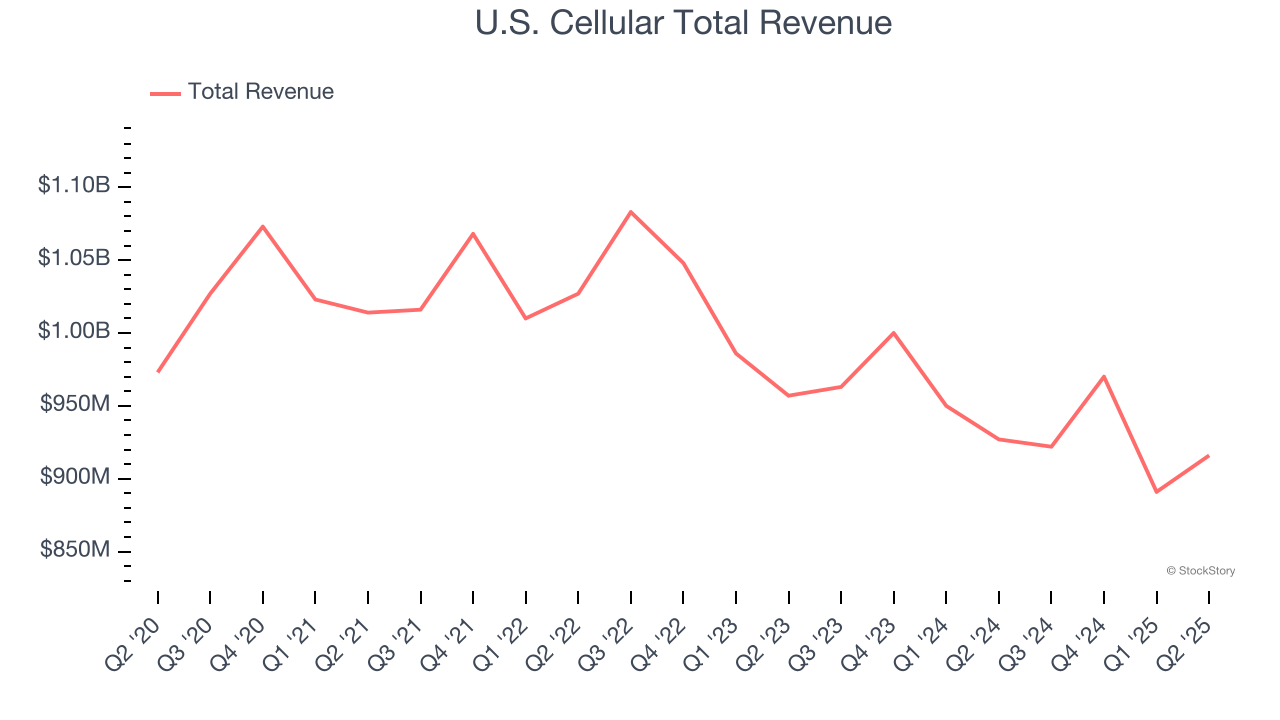

U.S. Cellular reported revenues of $916 million, down 1.2% year on year. This print exceeded analysts’ expectations by 1.5%. Overall, it was a strong quarter for the company with a beat of analysts’ EPS estimates.

"I am pleased that we have successfully closed the T-Mobile deal and have declared a special dividend in connection with the transaction," said Doug Chambers, Array interim President and CEO.

U.S. Cellular scored the biggest analyst estimates beat and fastest revenue growth of the whole group. Unsurprisingly, the stock is up 3.6% since reporting and currently trades at $77.01.

Is now the time to buy U.S. Cellular? Access our full analysis of the earnings results here, it’s free for active Edge members.

Best Q2: Lumen (NYSE: LUMN)

With approximately 350,000 route miles of fiber optic cable spanning North America and the Asia Pacific, Lumen Technologies (NYSE: LUMN) operates a vast fiber optic network that provides communications, cloud connectivity, security, and IT solutions to businesses and consumers.

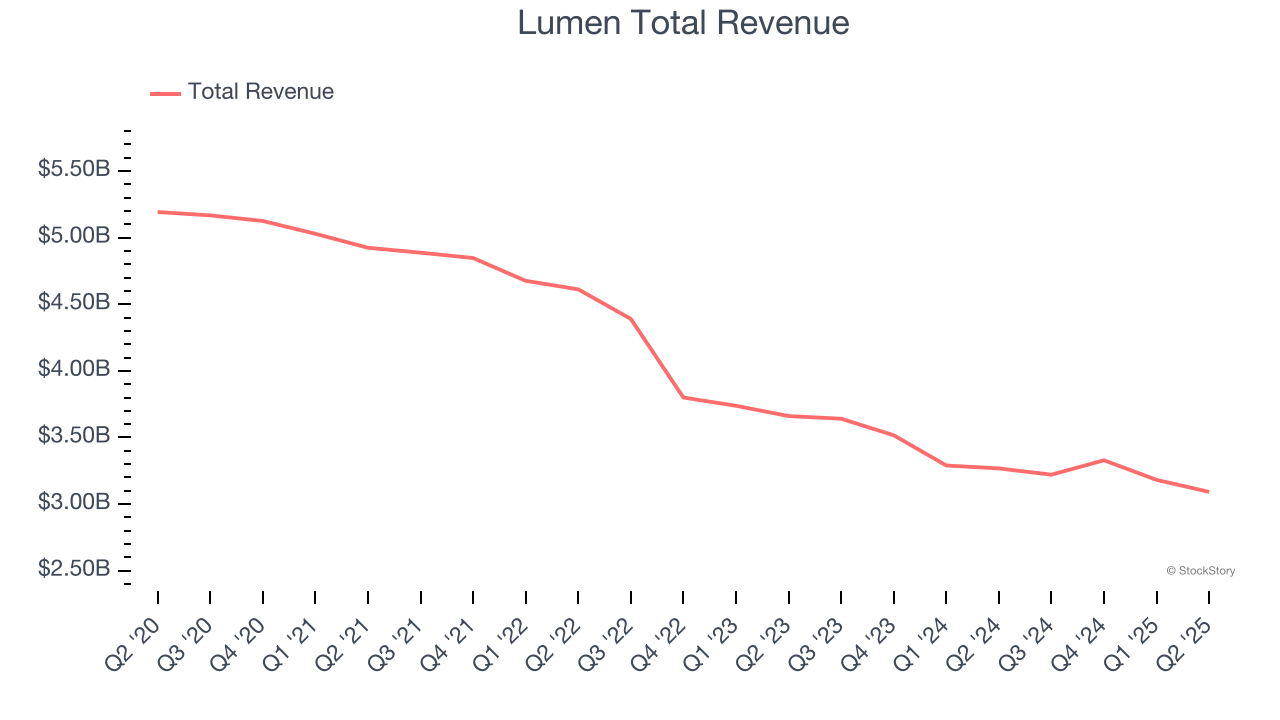

Lumen reported revenues of $3.09 billion, down 5.4% year on year, falling short of analysts’ expectations by 0.7%. However, the business still had a very strong quarter with a beat of analysts’ EPS estimates.

The market seems happy with the results as the stock is up 53.6% since reporting. It currently trades at $6.87.

Is now the time to buy Lumen? Access our full analysis of the earnings results here, it’s free for active Edge members.

Weakest Q2: Telephone and Data Systems (NYSE: TDS)

Operating primarily through its majority-owned subsidiary UScellular and wholly-owned TDS Telecom, Telephone and Data Systems (NYSE: TDS) provides wireless, broadband, video, and voice communications services to 4.6 million wireless and 1.2 million broadband customers across the United States.

Telephone and Data Systems reported revenues of $1.19 billion, down 4.2% year on year, exceeding analysts’ expectations by 1.5%. Still, it was a softer quarter as it posted a significant miss of analysts’ EPS estimates.

The stock is flat since the results and currently trades at $38.66.

Read our full analysis of Telephone and Data Systems’s results here.

Cogent (NASDAQ: CCOI)

Operating a massive network spanning 20,000 miles of fiber optic cable and connecting to over 3,200 buildings worldwide, Cogent Communications (NASDAQ: CCOI) provides high-speed Internet access, private network services, and data center colocation to businesses and bandwidth-intensive organizations across 54 countries.

Cogent reported revenues of $246.2 million, down 5.5% year on year. This number lagged analysts' expectations by 0.7%. More broadly, it was actually a very strong quarter as it produced a beat of analysts’ EPS estimates.

Cogent had the weakest performance against analyst estimates and slowest revenue growth among its peers. The stock is flat since reporting and currently trades at $44.03.

Read our full, actionable report on Cogent here, it’s free for active Edge members.

Market Update

Thanks to the Fed’s series of rate hikes in 2022 and 2023, inflation has cooled significantly from its post-pandemic highs, drawing closer to the 2% goal. This disinflation has occurred without severely impacting economic growth, suggesting the success of a soft landing. The stock market thrived in 2024, spurred by recent rate cuts (0.5% in September and 0.25% in November), and a notable surge followed Donald Trump’s presidential election win in November, propelling indices to historic highs. Nonetheless, the outlook for 2025 remains clouded by potential trade policy changes and corporate tax discussions, which could impact business confidence and growth. The path forward holds both optimism and caution as new policies take shape.

Want to invest in winners with rock-solid fundamentals? Check out our Strong Momentum Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.