Live Nation trades at $158.88 and has moved in lockstep with the market. Its shares have returned 18% over the last six months while the S&P 500 has gained 18.4%.

Is now a good time to buy LYV? Find out in our full research report, it’s free.

Why Does LYV Stock Spark Debate?

Owner of Ticketmaster and operator of music festival EDC, Live Nation (NYSE: LYV) is a company specializing in live event promotion, venue management, and ticketing services for concerts and shows.

Two Positive Attributes:

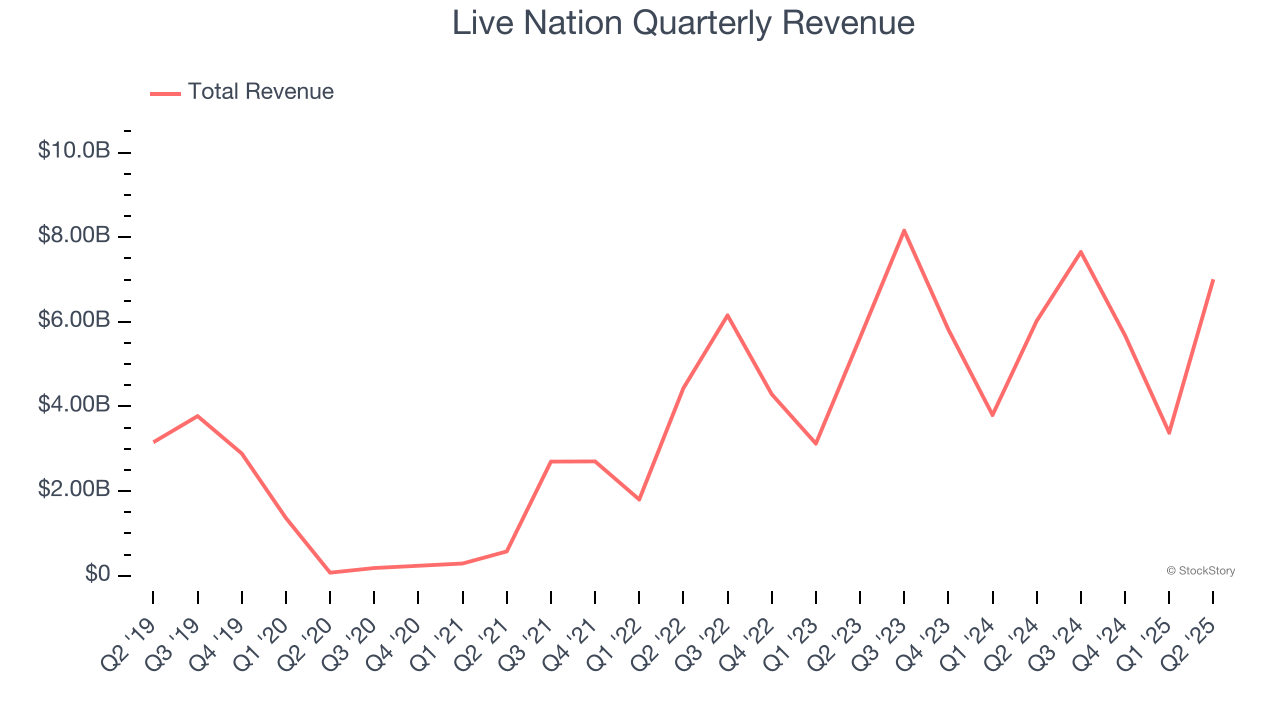

1. Skyrocketing Revenue Shows Strong Momentum

Reviewing a company’s long-term sales performance reveals insights into its quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Thankfully, Live Nation’s 24% annualized revenue growth over the last five years was impressive. Its growth surpassed the average consumer discretionary company and shows its offerings resonate with customers.

2. New Investments Bear Fruit as ROIC Jumps

A company’s ROIC, or return on invested capital, shows how much operating profit it makes compared to the money it has raised (debt and equity).

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Over the last few years, Live Nation’s ROIC has increased. This is a great sign when paired with its already strong returns, but we also recognize its lack of profitable growth during the COVID era was the primary reason for the change.

One Reason to be Careful:

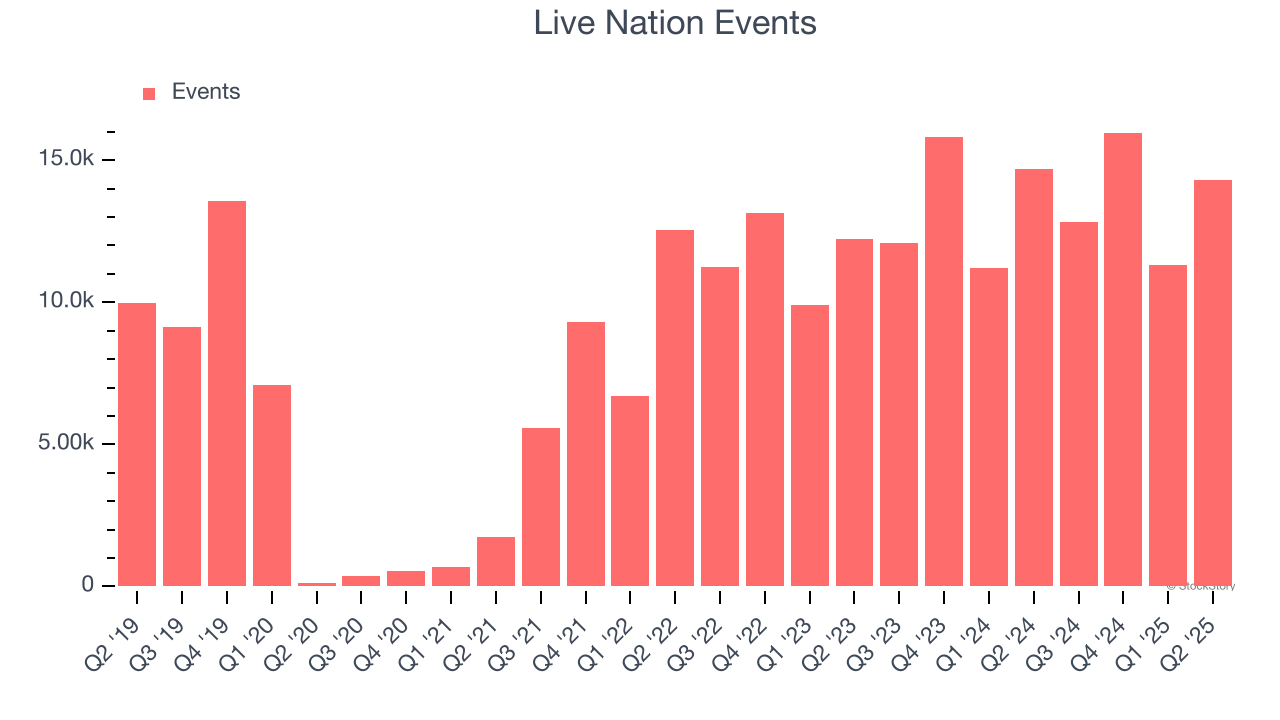

Weak Growth in Events Points to Soft Demand

Revenue growth can be broken down into changes in price and volume (for companies like Live Nation, our preferred volume metric is events). While both are important, the latter is the most critical to analyze because prices have a ceiling.

Live Nation’s events came in at 14,292 in the latest quarter, and over the last two years, averaged 8.3% year-on-year growth. This performance was underwhelming and suggests it might have to lower prices or invest in product improvements to accelerate growth, factors that can hinder near-term profitability.

Final Judgment

Live Nation’s merits more than compensate for its flaws, but at $158.88 per share (or 48.3× forward P/E), is now the time to initiate a position? See for yourself in our in-depth research report, it’s free.

High-Quality Stocks for All Market Conditions

When Trump unveiled his aggressive tariff plan in April 2025, markets tanked as investors feared a full-blown trade war. But those who panicked and sold missed the subsequent rebound that’s already erased most losses.

Don’t let fear keep you from great opportunities and take a look at Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-small-cap company Comfort Systems (+782% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.