Royal Caribbean has been treading water for the past six months, recording a small return of 3.4% while holding steady at $257.76. The stock also fell short of the S&P 500’s 11.3% gain during that period.

Is now the time to buy RCL? Or does the price properly account for its business quality and fundamentals? Find out in our full research report, it’s free for active Edge members.

Why Does RCL Stock Spark Debate?

Established in 1968, Royal Caribbean Cruises (NYSE: RCL) is a global cruise vacation company renowned for its innovative and exciting cruise experiences.

Two Things to Like:

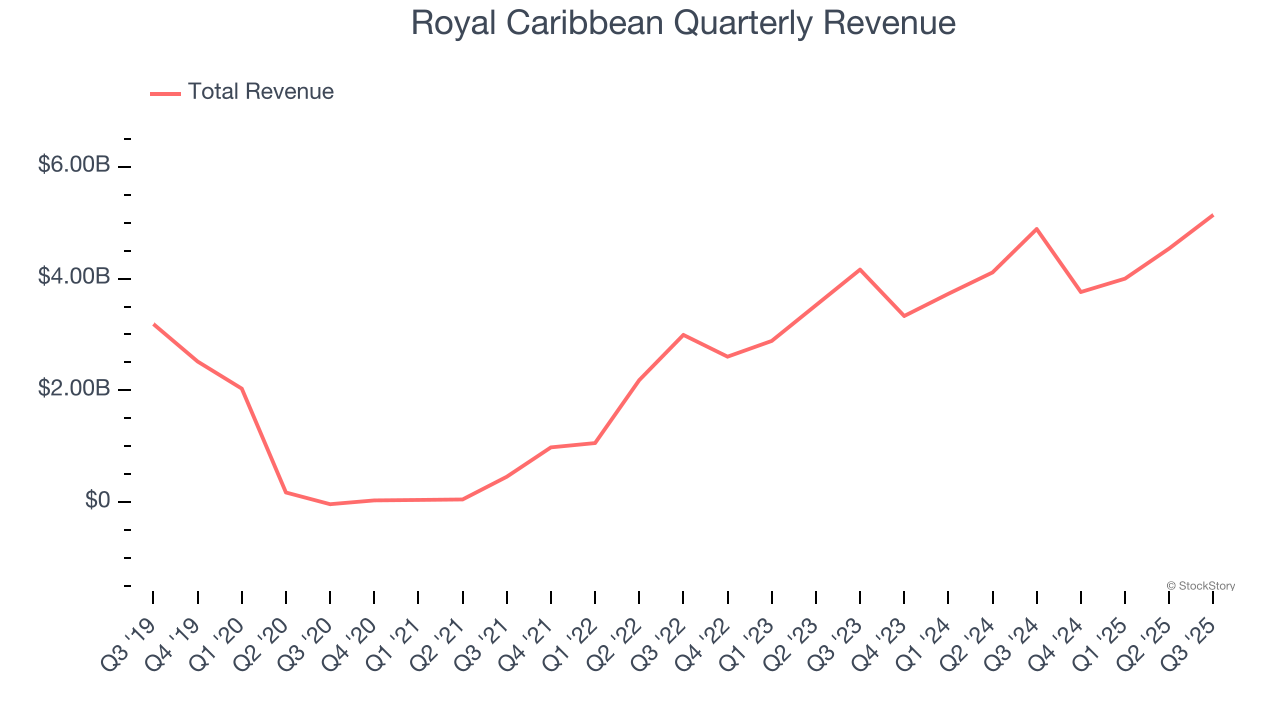

1. Skyrocketing Revenue Shows Strong Momentum

Examining a company’s long-term performance can provide clues about its quality. Any business can have short-term success, but a top-tier one grows for years. Over the last five years, Royal Caribbean grew its sales at an incredible 30% compounded annual growth rate. Its growth beat the average consumer discretionary company and shows its offerings resonate with customers.

2. New Investments Bear Fruit as ROIC Jumps

ROIC, or return on invested capital, is a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Over the last few years, Royal Caribbean’s ROIC has increased. This is a good sign, but we recognize its lack of profitable growth during the COVID era was the primary reason for the change.

One Reason to be Careful:

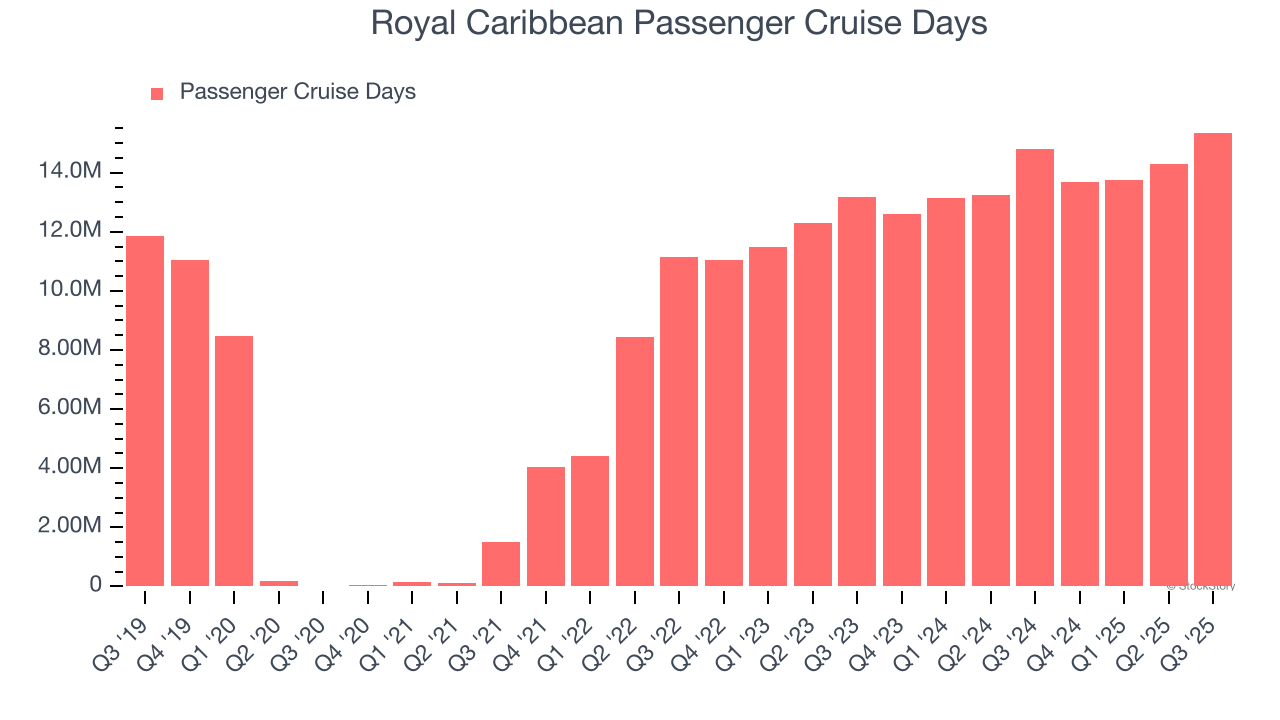

Weak Growth in Passenger Cruise Days Points to Soft Demand

Revenue growth can be broken down into changes in price and volume (for companies like Royal Caribbean, our preferred volume metric is passenger cruise days). While both are important, the latter is the most critical to analyze because prices have a ceiling.

Royal Caribbean’s passenger cruise days came in at 15.36 million in the latest quarter, and over the last two years, averaged 9.2% year-on-year growth. This performance was underwhelming and suggests it might have to lower prices or invest in product improvements to accelerate growth, factors that can hinder near-term profitability.

Final Judgment

Royal Caribbean has huge potential even though it has some open questions. With its shares underperforming the market lately, the stock trades at 14.5× forward P/E (or $257.76 per share). Is now a good time to initiate a position? See for yourself in our full research report, it’s free for active Edge members.

High-Quality Stocks for All Market Conditions

The market’s up big this year - but there’s a catch. Just 4 stocks account for half the S&P 500’s entire gain. That kind of concentration makes investors nervous, and for good reason. While everyone piles into the same crowded names, smart investors are hunting quality where no one’s looking - and paying a fraction of the price. Check out the high-quality names we’ve flagged in our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-small-cap company Comfort Systems (+782% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.