Cloud security platform Zscaler (NASDAQ: ZS) beat Wall Street’s revenue expectations in Q3 CY2025, with sales up 25.5% year on year to $788.1 million. The company expects next quarter’s revenue to be around $798 million, close to analysts’ estimates. Its non-GAAP profit of $0.96 per share was 11.4% above analysts’ consensus estimates.

Is now the time to buy Zscaler? Find out by accessing our full research report, it’s free for active Edge members.

Zscaler (ZS) Q3 CY2025 Highlights:

- Revenue: $788.1 million vs analyst estimates of $773.6 million (25.5% year-on-year growth, 1.9% beat)

- Adjusted EPS: $0.96 vs analyst estimates of $0.86 (11.4% beat)

- Adjusted Operating Income: $171.9 million vs analyst estimates of $167.9 million (21.8% margin, 2.4% beat)

- The company slightly lifted its revenue guidance for the full year to $3.29 billion at the midpoint from $3.27 billion

- Management raised its full-year Adjusted EPS guidance to $3.80 at the midpoint, a 3.8% increase

- Operating Margin: -4.6%, in line with the same quarter last year

- Free Cash Flow Margin: 52.4%, up from 23.9% in the previous quarter

- Billings: $597 million at quarter end, up 15.5% year on year

- Market Capitalization: $44.38 billion

“Our outstanding Q1 results demonstrate the strong demand we are experiencing for our Zero Trust and AI Security platform. With over $3.2B in Annual Recurring Revenue, growing over 25% year-over-year, and Rule-of-78 performance, I'm very pleased to share that an increasing number of customers are relying on our platform for better security, lower operational costs and reduced IT complexity,” said Jay Chaudhry, Chairman and CEO of Zscaler.

Company Overview

Pioneering the "zero trust" approach that has fundamentally changed enterprise network security, Zscaler (NASDAQ: ZS) provides a cloud-based security platform that connects users, devices, and applications securely without traditional network-based security hardware.

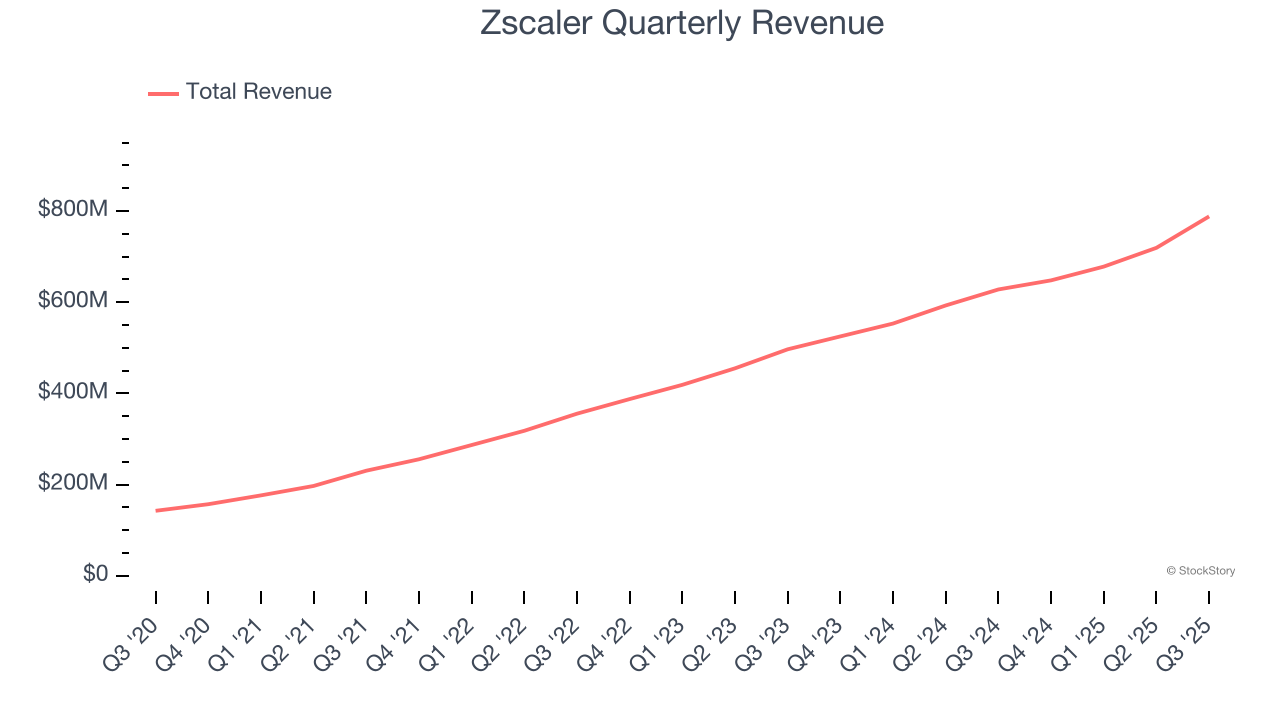

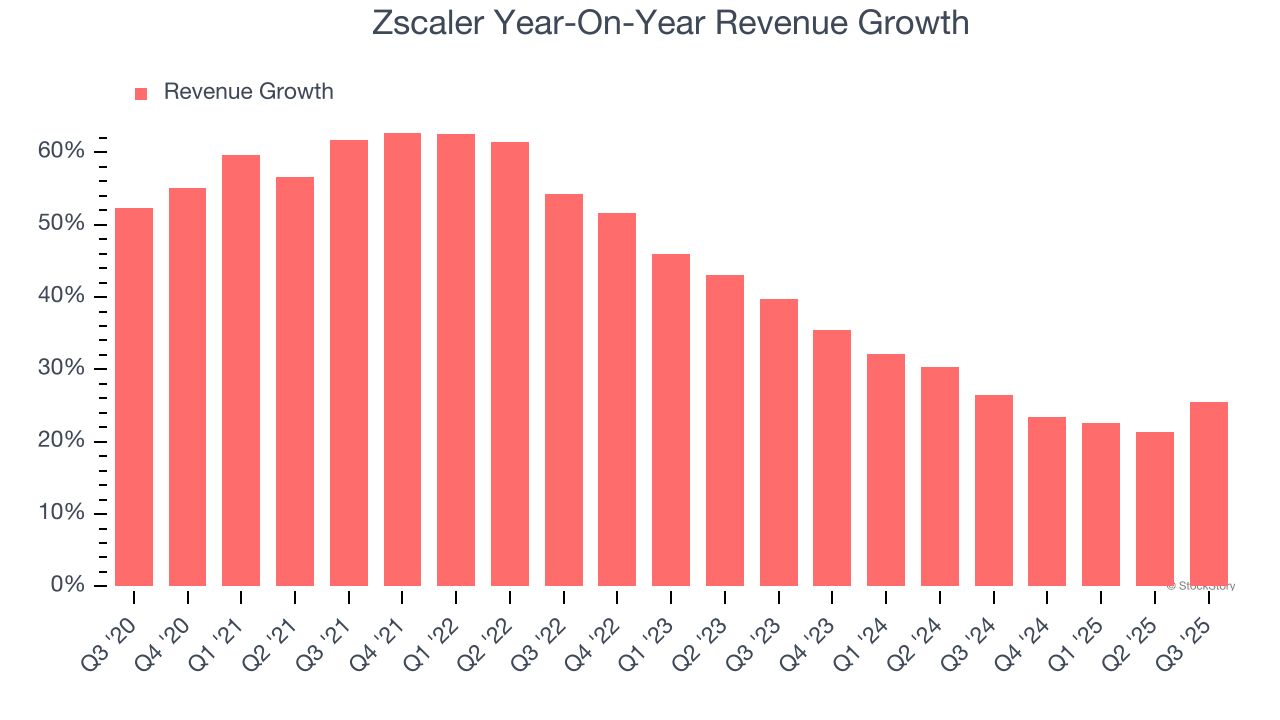

Revenue Growth

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years. Over the last five years, Zscaler grew its sales at an incredible 42.6% compounded annual growth rate. Its growth surpassed the average software company and shows its offerings resonate with customers, a great starting point for our analysis.

Long-term growth is the most important, but within software, a half-decade historical view may miss new innovations or demand cycles. Zscaler’s annualized revenue growth of 26.9% over the last two years is below its five-year trend, but we still think the results suggest healthy demand.

This quarter, Zscaler reported robust year-on-year revenue growth of 25.5%, and its $788.1 million of revenue topped Wall Street estimates by 1.9%. Company management is currently guiding for a 23.2% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 21.1% over the next 12 months, a deceleration versus the last two years. Despite the slowdown, this projection is commendable and implies the market is baking in success for its products and services.

Software is eating the world and there is virtually no industry left that has been untouched by it. That drives increasing demand for tools helping software developers do their jobs, whether it be monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming. Click here to access a free report on our 3 favorite stocks to play this generational megatrend.

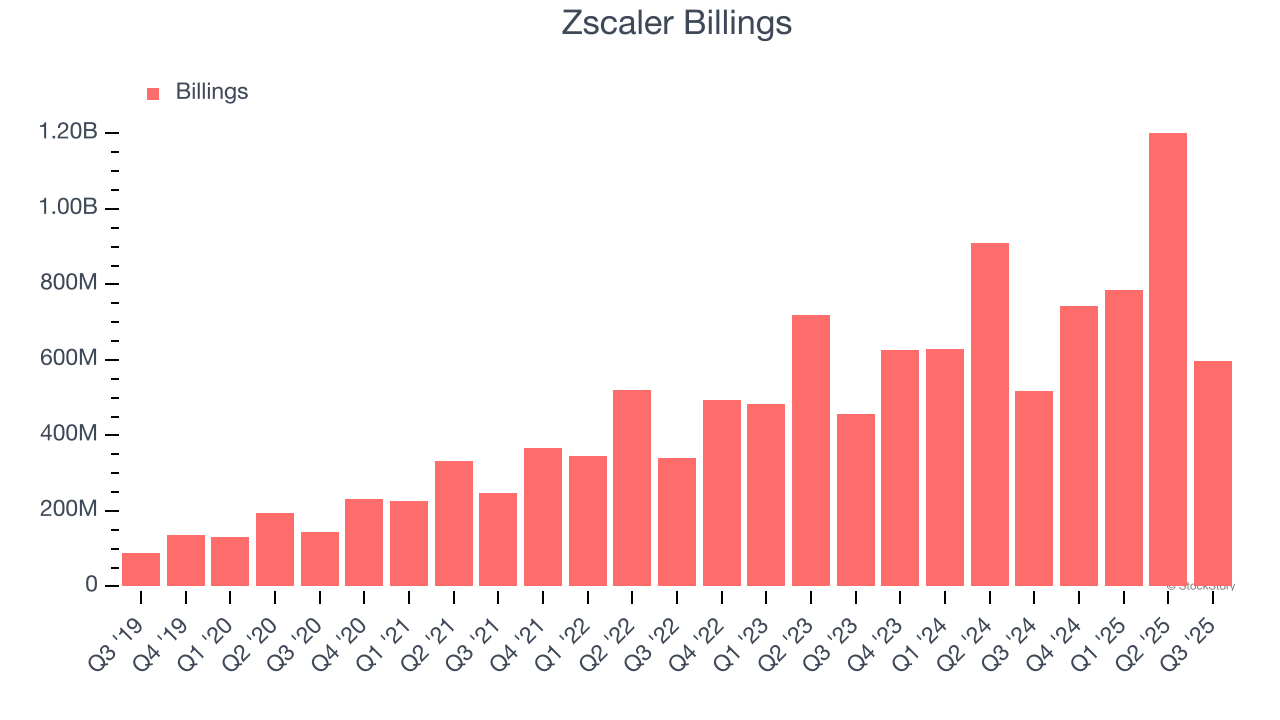

Billings

Billings is a non-GAAP metric that is often called “cash revenue” because it shows how much money the company has collected from customers in a certain period. This is different from revenue, which must be recognized in pieces over the length of a contract.

Zscaler’s billings punched in at $597 million in Q3, and over the last four quarters, its growth was impressive as it averaged 22.7% year-on-year increases. This performance aligned with its total sales growth, indicating robust customer demand. The high level of cash collected from customers also enhances liquidity and provides a solid foundation for future investments and growth.

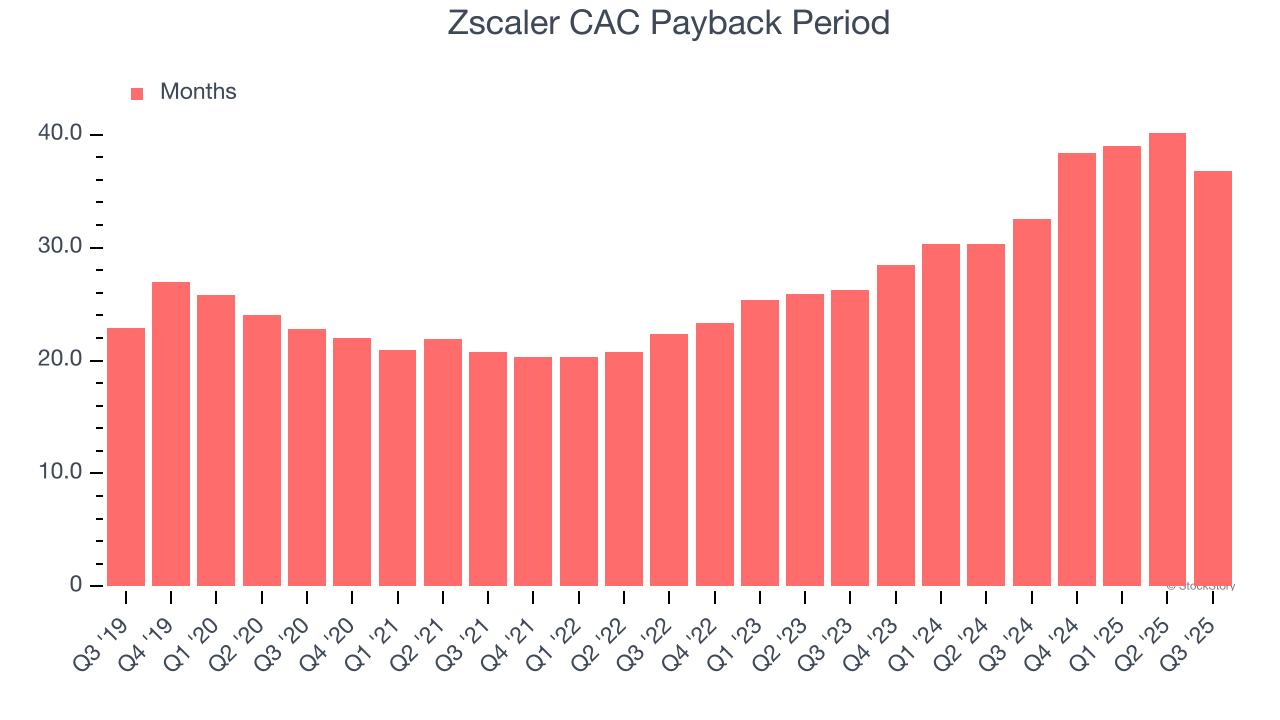

Customer Acquisition Efficiency

The customer acquisition cost (CAC) payback period measures the months a company needs to recoup the money spent on acquiring a new customer. This metric helps assess how quickly a business can break even on its sales and marketing investments.

Zscaler is efficient at acquiring new customers, and its CAC payback period checked in at 36.8 months this quarter. The company’s relatively fast recovery of its customer acquisition costs gives it the option to accelerate growth by increasing its sales and marketing investments.

Key Takeaways from Zscaler’s Q3 Results

We were impressed by Zscaler’s optimistic full-year EPS guidance, which blew past analysts’ expectations. We were also happy its revenue outperformed Wall Street’s estimates. On the other hand, its billings missed. Zooming out, we think this was a mixed quarter. The market seemed to be hoping for more, and the stock traded down 10.9% to $260.72 immediately after reporting.

Is Zscaler an attractive investment opportunity right now? When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free for active Edge members.