Even though Travelers (currently trading at $295 per share) has gained 7.8% over the last six months, it has lagged the S&P 500’s 15.6% return during that period. This might have investors contemplating their next move.

Does this present a buying opportunity for TRV? Or does the price properly account for its business quality and fundamentals?

Why Does TRV Stock Spark Debate?

Tracing its roots back to 1853 when it insured travelers against accidents on steamboats and railroads, Travelers (NYSE: TRV) provides a wide range of commercial and personal property and casualty insurance products to businesses, government units, associations, and individuals.

Two Things to Like:

1. Net Premiums Earned Drive Additional Growth Opportunities

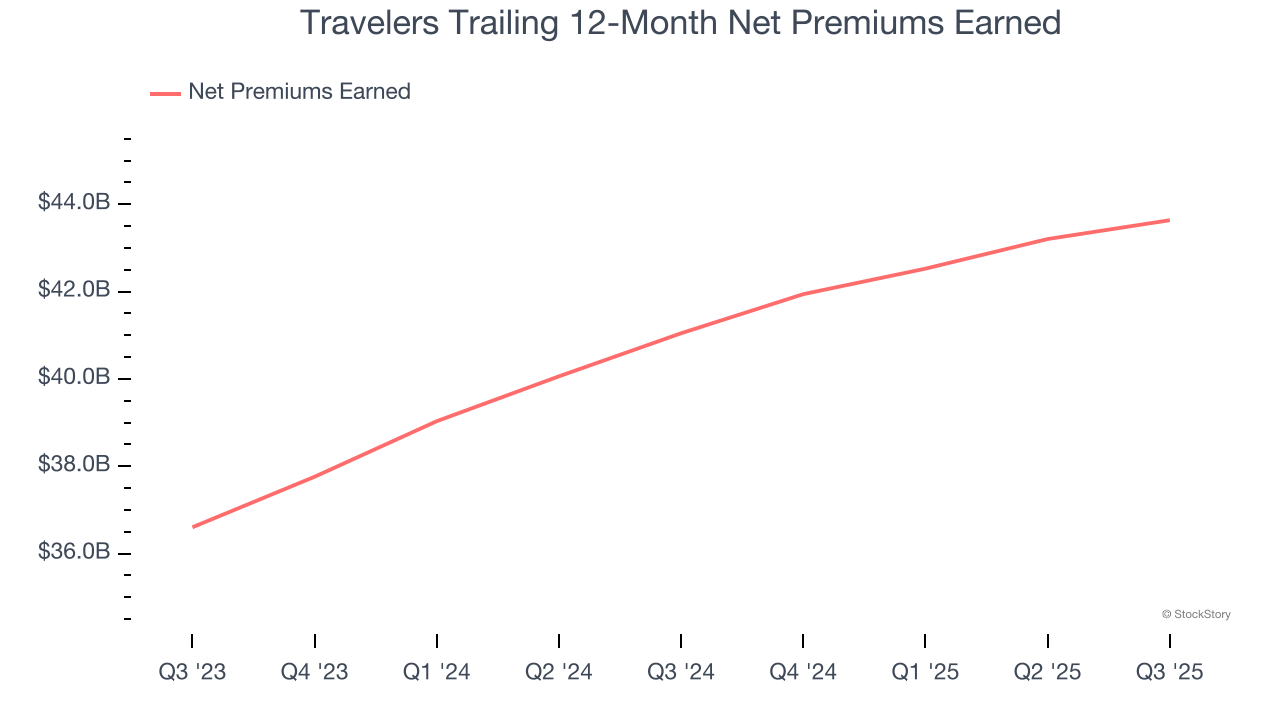

When insurers sell policies, they protect themselves from extremely large losses or an outsized accumulation of losses with reinsurance (insurance for insurance companies). Net premiums earned are therefore net of what’s ceded to reinsurers as a risk mitigation and transfer strategy.

Travelers’s net premiums earned has grown at a 9.2% annualized rate over the last two years, a step above the broader insurance industry and in line with its total revenue.

2. Growing BVPS Reflects Strong Asset Base

Book value per share (BVPS) serves as a key indicator of an insurer’s financial stability, reflecting a company’s ability to maintain adequate capital levels and meet its long-term obligations to policyholders.

Although Travelers’s BVPS increased by a meager 5.2% annually over the last five years, the good news is that its growth has recently accelerated as BVPS grew at an incredible 27.3% annual clip over the past two years (from $87.47 to $141.74 per share).

One Reason to be Careful:

Projected Revenue Growth Is Slim

Forecasted revenues by Wall Street analysts signal a company’s potential. Predictions may not always be accurate, but accelerating growth typically boosts valuation multiples and stock prices while slowing growth does the opposite.

Over the next 12 months, sell-side analysts expect Travelers’s revenue to rise by 3.4%, a deceleration versus its 9.9% annualized growth for the past two years. This projection doesn't excite us and indicates its products and services will see some demand headwinds. At least the company is tracking well in other measures of financial health.

Final Judgment

Travelers’s merits more than compensate for its flaws. With its shares underperforming the market lately, the stock trades at 2× forward P/B (or $295 per share). Is now a good time to initiate a position? See for yourself in our in-depth research report, it’s free for active Edge members.

High-Quality Stocks for All Market Conditions

If your portfolio success hinges on just 4 stocks, your wealth is built on fragile ground. You have a small window to secure high-quality assets before the market widens and these prices disappear.

Don’t wait for the next volatility shock. Check out our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-small-cap company Exlservice (+354% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.