Clinical research company Fortrea Holdings (NASDAQ: FTRE) announced better-than-expected revenue in Q3 CY2025, with sales up 3.9% year on year to $701.3 million. The company’s full-year revenue guidance of $2.73 billion at the midpoint came in 3.1% above analysts’ estimates. Its non-GAAP profit of $0.12 per share was 25.7% below analysts’ consensus estimates.

Is now the time to buy Fortrea? Find out by accessing our full research report, it’s free for active Edge members.

Fortrea (FTRE) Q3 CY2025 Highlights:

- Revenue: $701.3 million vs analyst estimates of $648.3 million (3.9% year-on-year growth, 8.2% beat)

- Adjusted EPS: $0.12 vs analyst expectations of $0.16 (25.7% miss)

- Adjusted EBITDA: $50.7 million vs analyst estimates of $49.49 million (7.2% margin, 2.5% beat)

- The company lifted its revenue guidance for the full year to $2.73 billion at the midpoint from $2.65 billion, a 2.8% increase

- EBITDA guidance for the full year is $185 million at the midpoint, in line with analyst expectations

- Operating Margin: -1.2%, up from -2.7% in the same quarter last year

- Free Cash Flow was $79.5 million, up from -$10.6 million in the same quarter last year

- Market Capitalization: $880.8 million

“Fortrea delivered a solid performance that met expectations in the third quarter by partnering with our clients and advancing the development of potentially life-changing treatments for patients,” said Anshul Thakral, CEO of Fortrea.

Company Overview

Spun off from Labcorp in 2023 to focus exclusively on clinical research services, Fortrea (NASDAQ: FTRE) is a contract research organization that helps pharmaceutical, biotech, and medical device companies develop and bring their products to market through clinical trials and support services.

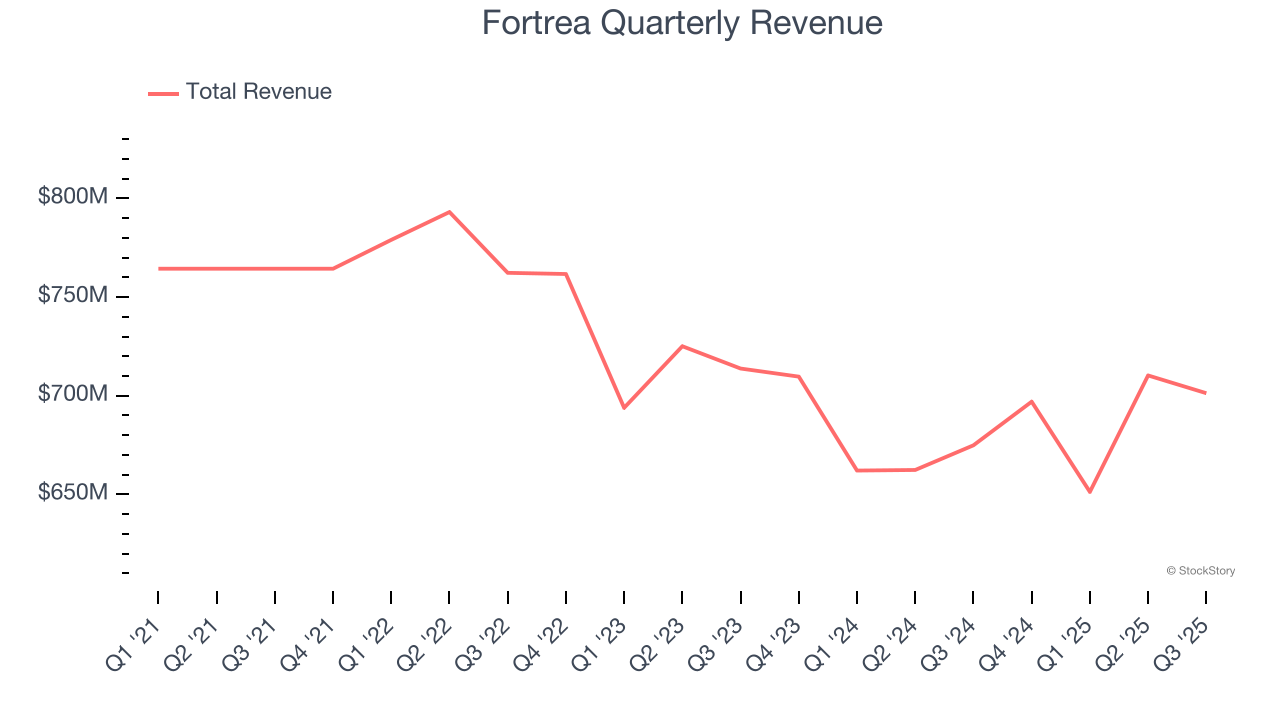

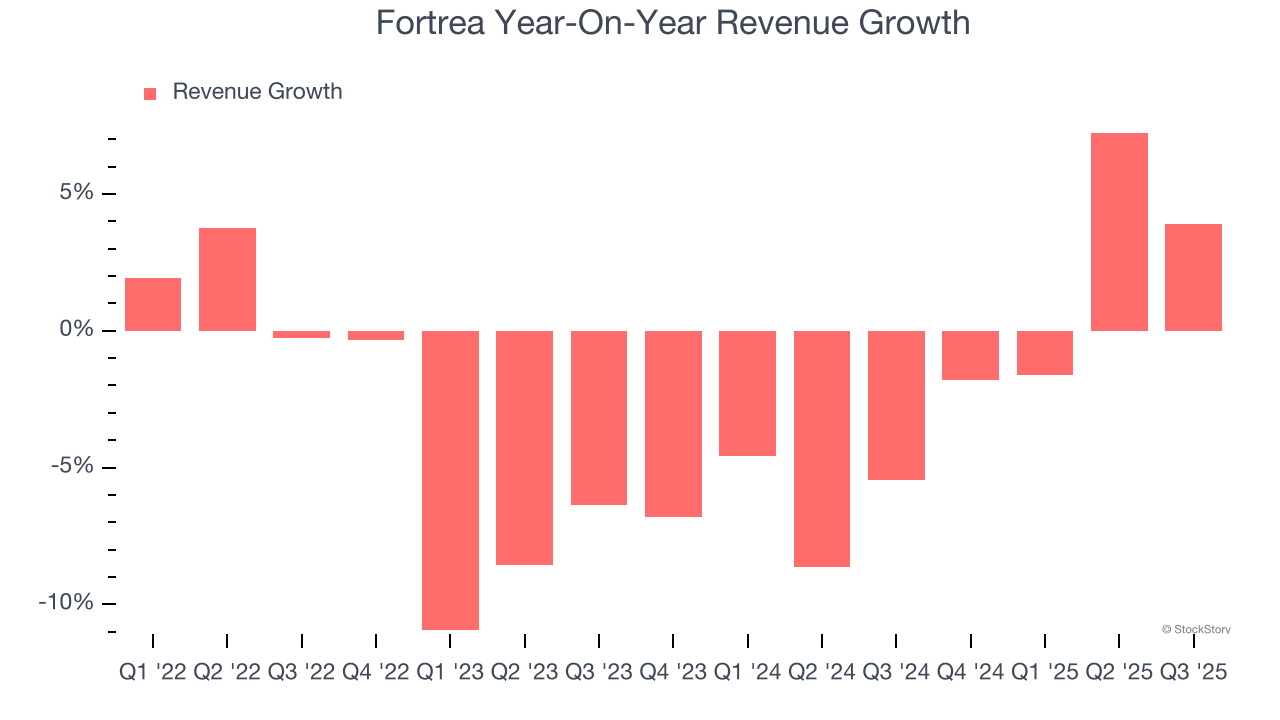

Revenue Growth

A company’s long-term sales performance can indicate its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Fortrea struggled to consistently generate demand over the last four years as its sales dropped at a 2.6% annual rate. This was below our standards and suggests it’s a low quality business.

We at StockStory place the most emphasis on long-term growth, but within healthcare, a stretched historical view may miss recent innovations or disruptive industry trends. Fortrea’s annualized revenue declines of 2.4% over the last two years align with its four-year trend, suggesting its demand has consistently shrunk.

This quarter, Fortrea reported modest year-on-year revenue growth of 3.9% but beat Wall Street’s estimates by 8.2%.

Looking ahead, sell-side analysts expect revenue to decline by 6.2% over the next 12 months, a deceleration versus the last two years. This projection is underwhelming and indicates its products and services will see some demand headwinds.

While Wall Street chases Nvidia at all-time highs, an under-the-radar semiconductor supplier is dominating a critical AI component these giants can’t build without. Click here to access our free report one of our favorites growth stories.

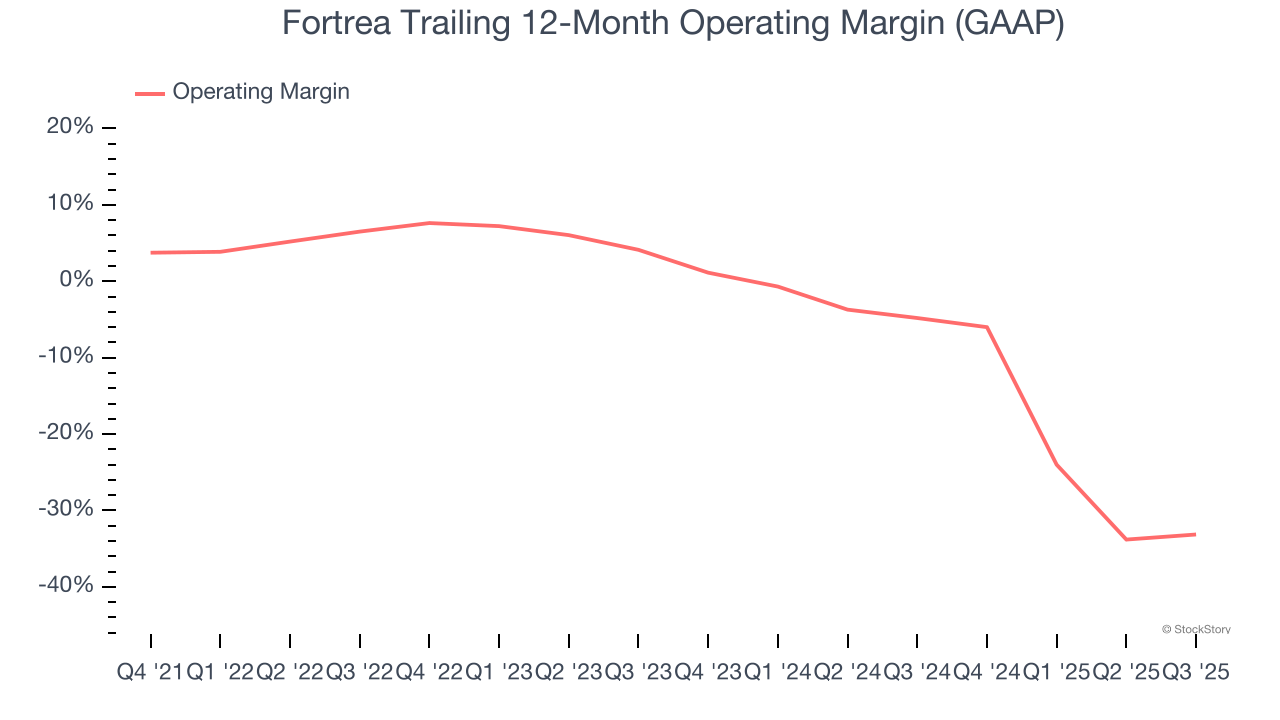

Operating Margin

Fortrea’s high expenses have contributed to an average operating margin of negative 4.6% over the last five years. Unprofitable healthcare companies require extra attention because they could get caught swimming naked when the tide goes out. It’s hard to trust that the business can endure a full cycle.

Looking at the trend in its profitability, Fortrea’s operating margin decreased by 45.4 percentage points over the last five years. The company’s two-year trajectory also shows it failed to get its profitability back to the peak as its margin fell by 37.3 percentage points. This performance was poor no matter how you look at it - it shows its expenses were rising and it couldn’t pass those costs onto its customers.

Fortrea’s operating margin was negative 1.2% this quarter. The company's consistent lack of profits raise a flag.

Earnings Per Share

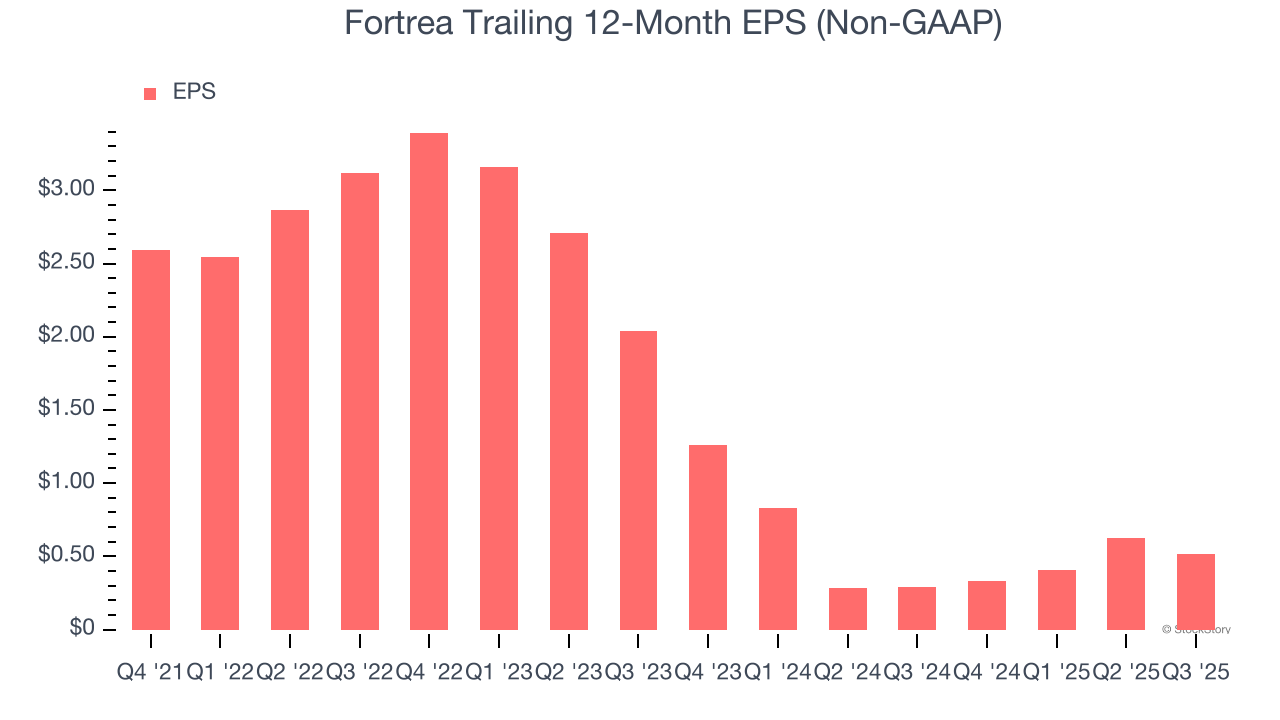

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Sadly for Fortrea, its EPS declined by 35.6% annually over the last four years, more than its revenue. This tells us the company struggled because its fixed cost base made it difficult to adjust to shrinking demand.

In Q3, Fortrea reported adjusted EPS of $0.12, down from $0.23 in the same quarter last year. This print missed analysts’ estimates. Over the next 12 months, Wall Street expects Fortrea’s full-year EPS of $0.52 to grow 29.2%.

Key Takeaways from Fortrea’s Q3 Results

We were impressed by how significantly Fortrea blew past analysts’ revenue expectations this quarter. We were also glad its full-year revenue guidance trumped Wall Street’s estimates. On the other hand, its EPS missed. Overall, we think this was a decent quarter with some key metrics above expectations. The stock remained flat at $9.70 immediately after reporting.

Should you buy the stock or not? What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here, it’s free for active Edge members.