Business development company Sixth Street Specialty Lending (NYSE: TSLX) reported revenue ahead of Wall Streets expectations in Q3 CY2025, but sales fell by 8.1% year on year to $160.1 million. Its GAAP profit of $0.47 per share was 8.4% below analysts’ consensus estimates.

Is now the time to buy Sixth Street Specialty Lending? Find out by accessing our full research report, it’s free for active Edge members.

Sixth Street Specialty Lending (TSLX) Q3 CY2025 Highlights:

Company Overview

Originally launched as TPG Specialty Lending before rebranding in 2020, Sixth Street Specialty Lending (NYSE: TSLX) is a business development company that provides customized financing solutions to middle-market companies across various industries.

Revenue Growth

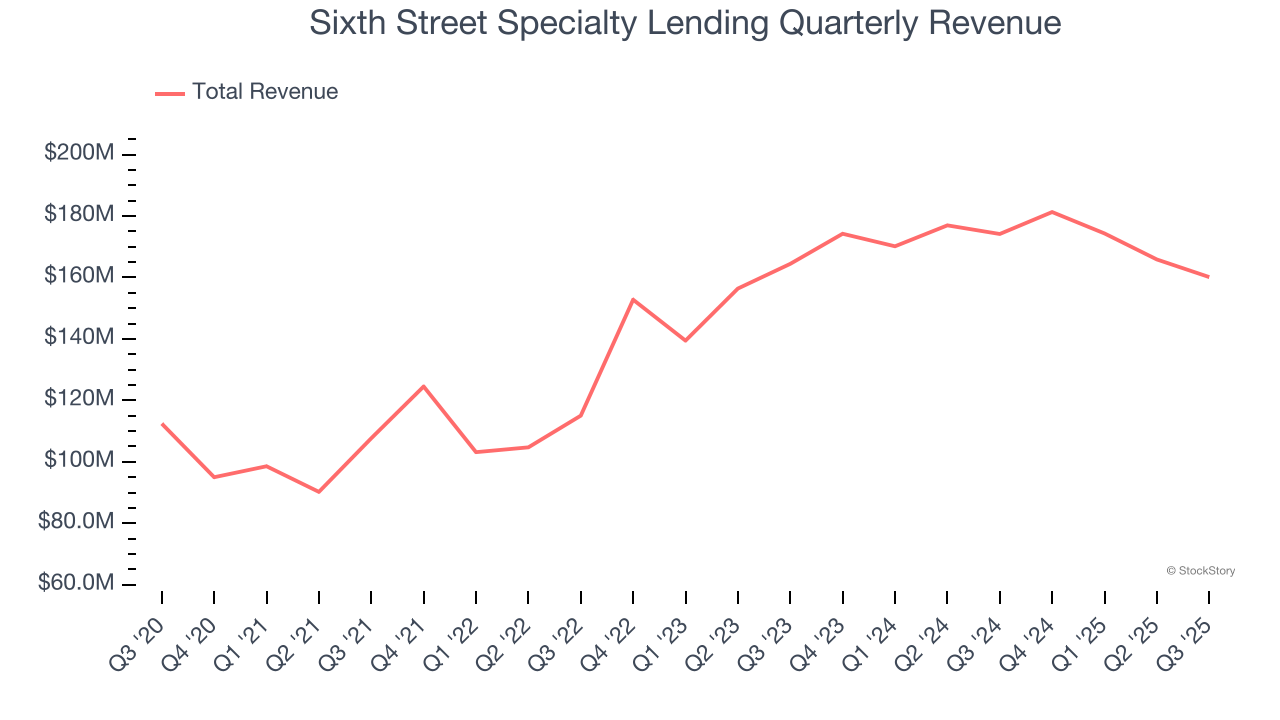

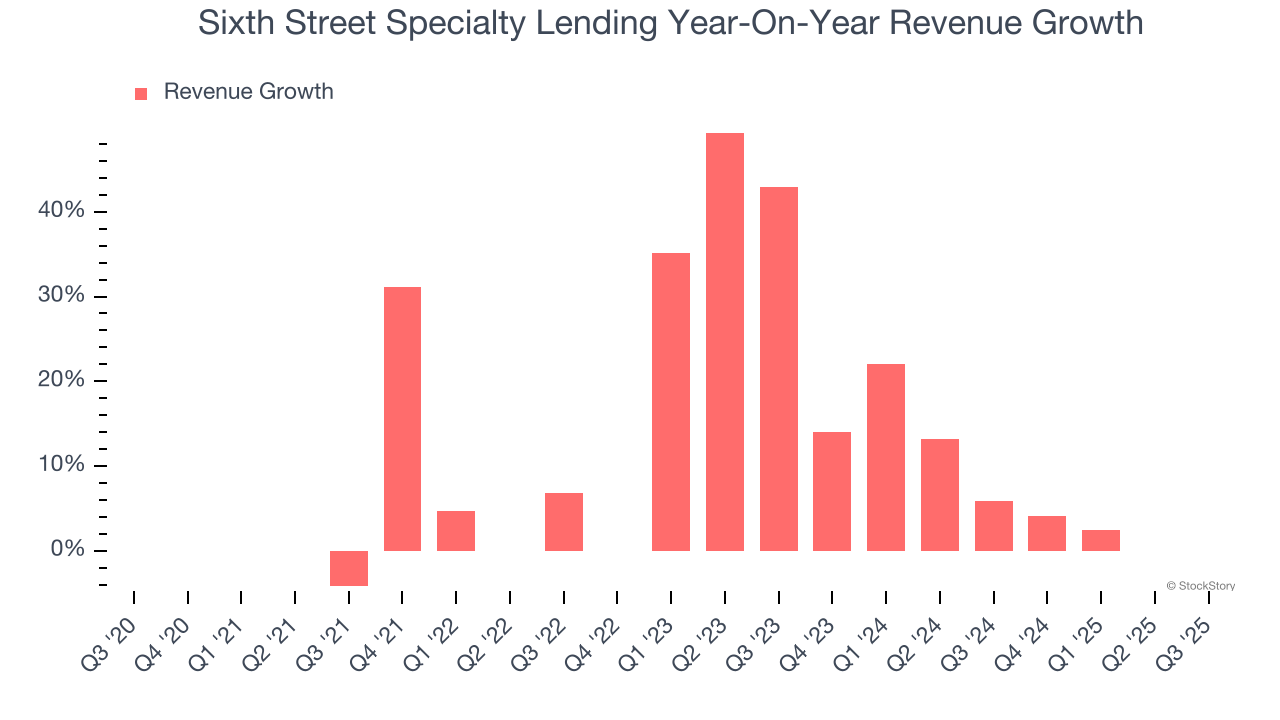

A company’s long-term sales performance is one signal of its overall quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Over the last five years, Sixth Street Specialty Lending grew its revenue at a decent 10% compounded annual growth rate. Its growth was slightly above the average financials company and shows its offerings resonate with customers.

We at StockStory place the most emphasis on long-term growth, but within financials, a half-decade historical view may miss recent interest rate changes, market returns, and industry trends. Sixth Street Specialty Lending’s recent performance shows its demand has slowed as its annualized revenue growth of 5.4% over the last two years was below its five-year trend.  Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

This quarter, Sixth Street Specialty Lending’s revenue fell by 8.1% year on year to $160.1 million but beat Wall Street’s estimates by 1.6%.

The 1999 book Gorilla Game predicted Microsoft and Apple would dominate tech before it happened. Its thesis? Identify the platform winners early. Today, enterprise software companies embedding generative AI are becoming the new gorillas. a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Key Takeaways from Sixth Street Specialty Lending’s Q3 Results

It was encouraging to see Sixth Street Specialty Lending beat analysts’ revenue expectations this quarter. On the other hand, its EPS missed. Overall, this quarter could have been better. The stock traded down 1.9% to $21.87 immediately following the results.

Sixth Street Specialty Lending’s latest earnings report disappointed. One quarter doesn’t define a company’s quality, so let’s explore whether the stock is a buy at the current price. We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free for active Edge members.