Shareholders of Erie Indemnity would probably like to forget the past six months even happened. The stock dropped 20.2% and now trades at $288.16. This was partly driven by its softer quarterly results and may have investors wondering how to approach the situation.

Following the pullback, is now a good time to buy ERIE? Find out in our full research report, it’s free for active Edge members.

Why Are We Positive On Erie Indemnity?

Operating under a unique business model dating back to 1925, Erie Indemnity (NASDAQ: ERIE) serves as the attorney-in-fact for Erie Insurance Exchange, managing policy issuance, claims handling, and investment services for this reciprocal insurer.

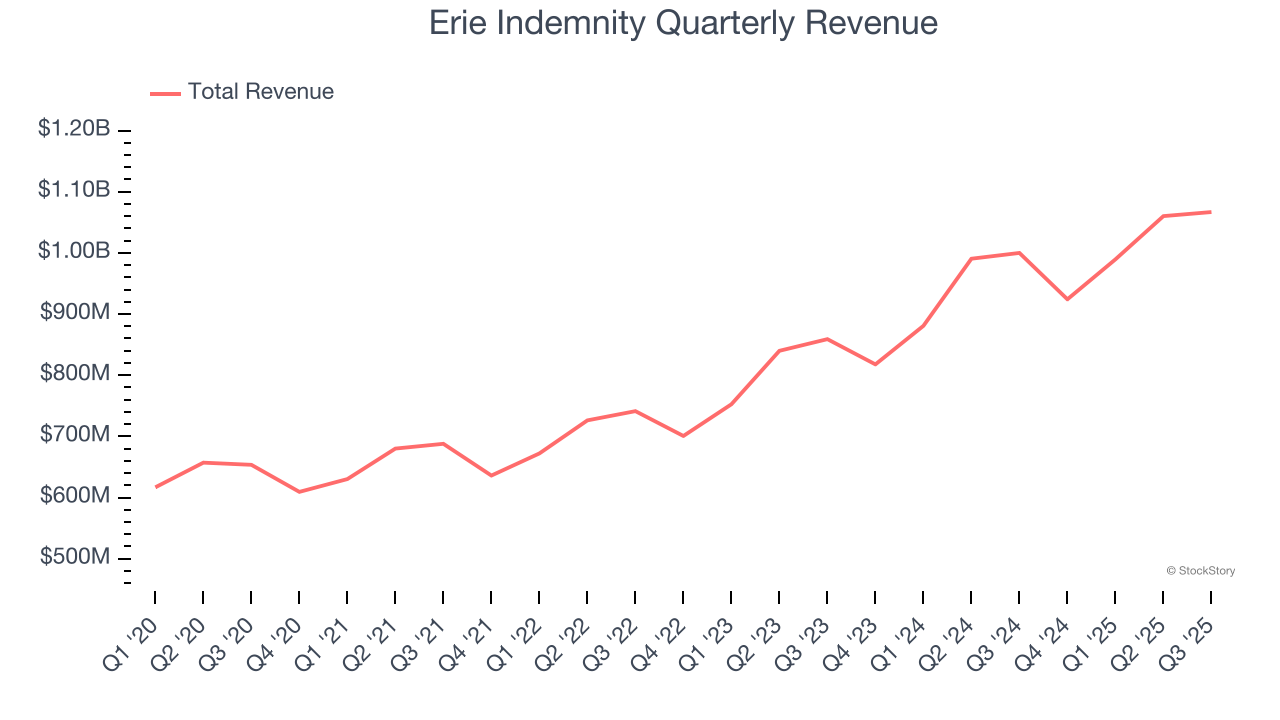

1. Long-Term Revenue Growth Shows Strong Momentum

Big picture, insurers generate revenue from three key sources. The first is the core business of underwriting policies. The second source is income from investing the “float” (premiums collected upfront not yet paid out as claims) in assets such as fixed-income assets and equities. The third is fees from various sources such as policy administration, annuities, or other value-added services.

Luckily, Erie Indemnity’s revenue grew at a solid 10.1% compounded annual growth rate over the last five years. Its growth surpassed the average insurance company and shows its offerings resonate with customers.

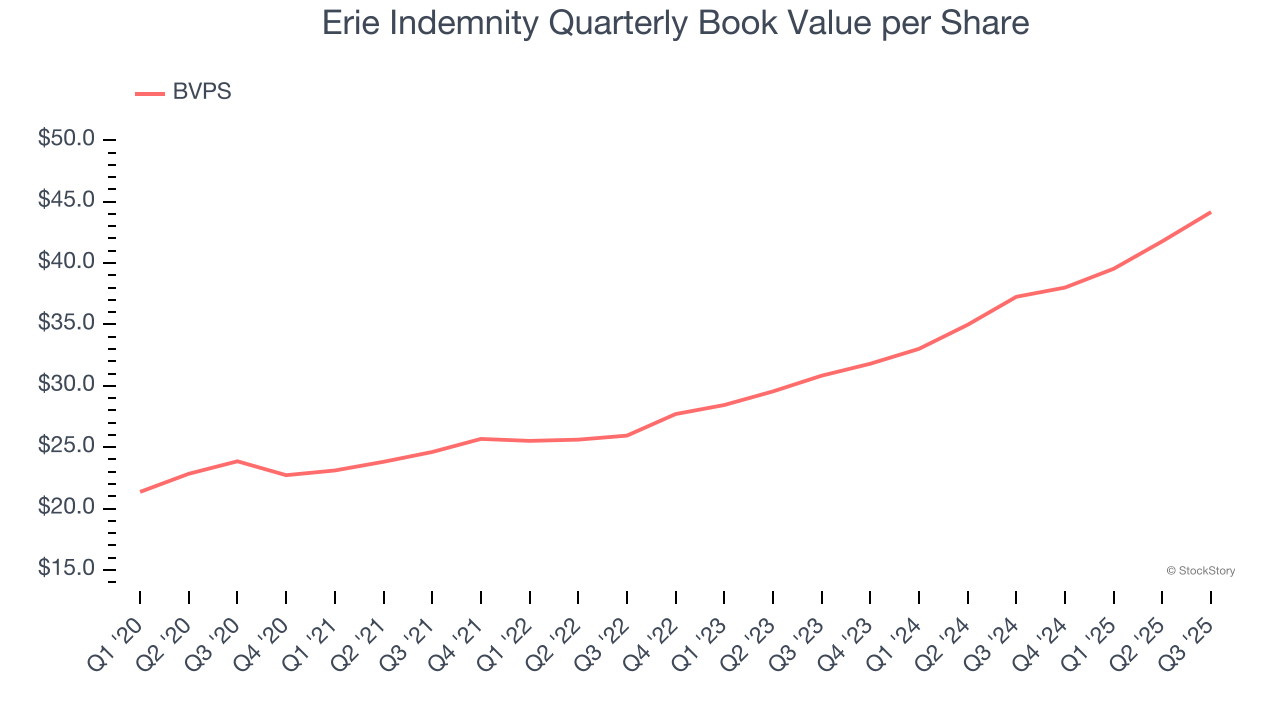

2. Growing BVPS Reflects Strong Asset Base

We consider book value per share (BVPS) a critical metric for insurance companies. BVPS represents the total net worth per share, providing insight into a company’s financial strength and ability to meet policyholder obligations.

Erie Indemnity’s BVPS increased by 13.1% annually over the last five years, and growth has recently accelerated as BVPS grew at an impressive 19.7% annual clip over the past two years (from $30.83 to $44.16 per share).

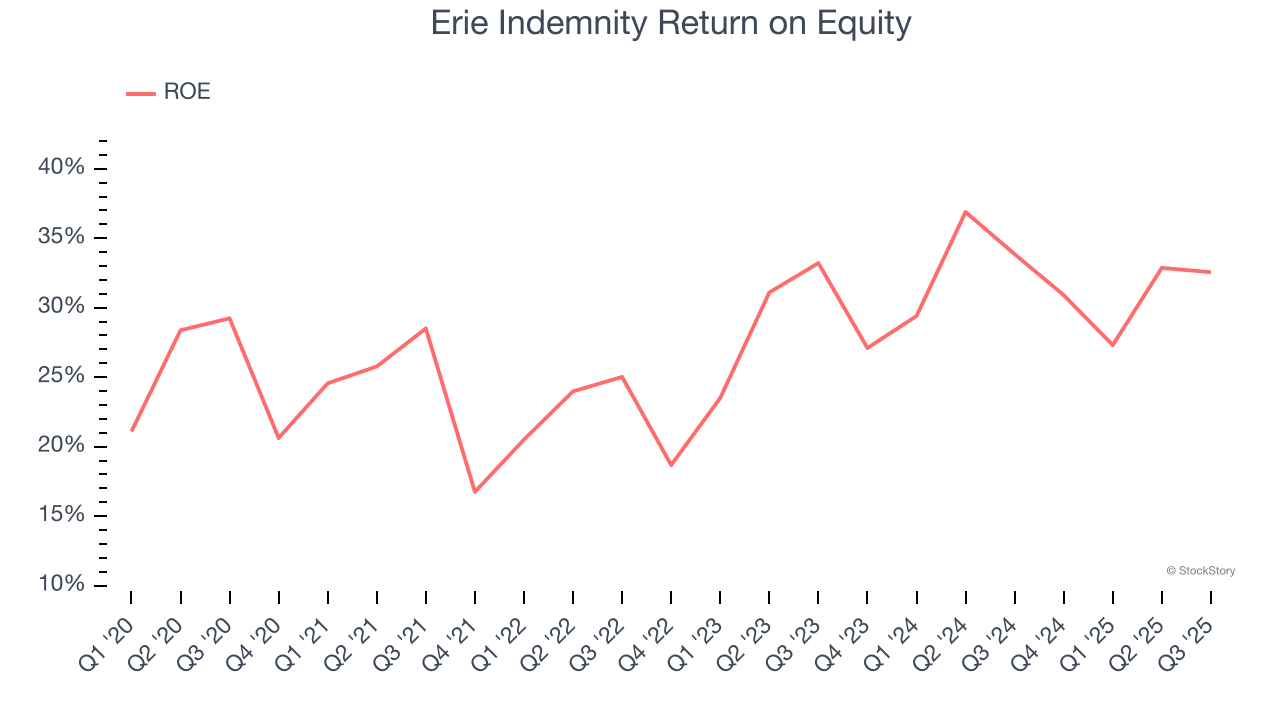

3. Stellar ROE Showcases Lucrative Growth Opportunities

Return on equity (ROE) serves as a comprehensive measure of an insurer's performance, showing how efficiently it converts shareholder capital into profits. Strong ROE performance typically translates to better returns for investors through a combination of earnings retention, share repurchases, and dividend distributions.

Over the last five years, Erie Indemnity has averaged an ROE of 27.2%, exceptional for a company operating in a sector where the average shakes out around 12.5% and those putting up 20%+ are greatly admired. This shows Erie Indemnity has a strong competitive moat.

Final Judgment

These are just a few reasons why we think Erie Indemnity is an elite insurance company. After the recent drawdown, the stock trades at 21× forward P/E (or $288.16 per share). Is now the time to initiate a position? See for yourself in our full research report, it’s free for active Edge members.

High-Quality Stocks for All Market Conditions

Donald Trump’s April 2025 "Liberation Day" tariffs sent markets into a tailspin, but stocks have since rebounded strongly, proving that knee-jerk reactions often create the best buying opportunities.

The smart money is already positioning for the next leg up. Don’t miss out on the recovery - check out our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-small-cap company Comfort Systems (+782% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.