Let’s dig into the relative performance of monday.com (NASDAQ: MNDY) and its peers as we unravel the now-completed Q2 productivity software earnings season.

Rising employee costs and the shift to more remote work has increased the ever-present pressure to improve corporate productivity, which in turn has driven rising demand for productivity software that enables remote work, streamline project management and automate business tasks.

The 17 productivity software stocks we track reported a strong Q2. As a group, revenues beat analysts’ consensus estimates by 2.9% while next quarter’s revenue guidance was in line.

Thankfully, share prices of the companies have been resilient as they are up 5.6% on average since the latest earnings results.

monday.com (NASDAQ: MNDY)

With its colorful interface of boards, columns, and automation that replaced the chaos of spreadsheets, monday.com (NASDAQ: MNDY) is a cloud-based work operating system that helps teams manage projects, track tasks, and streamline workflows through customizable interfaces.

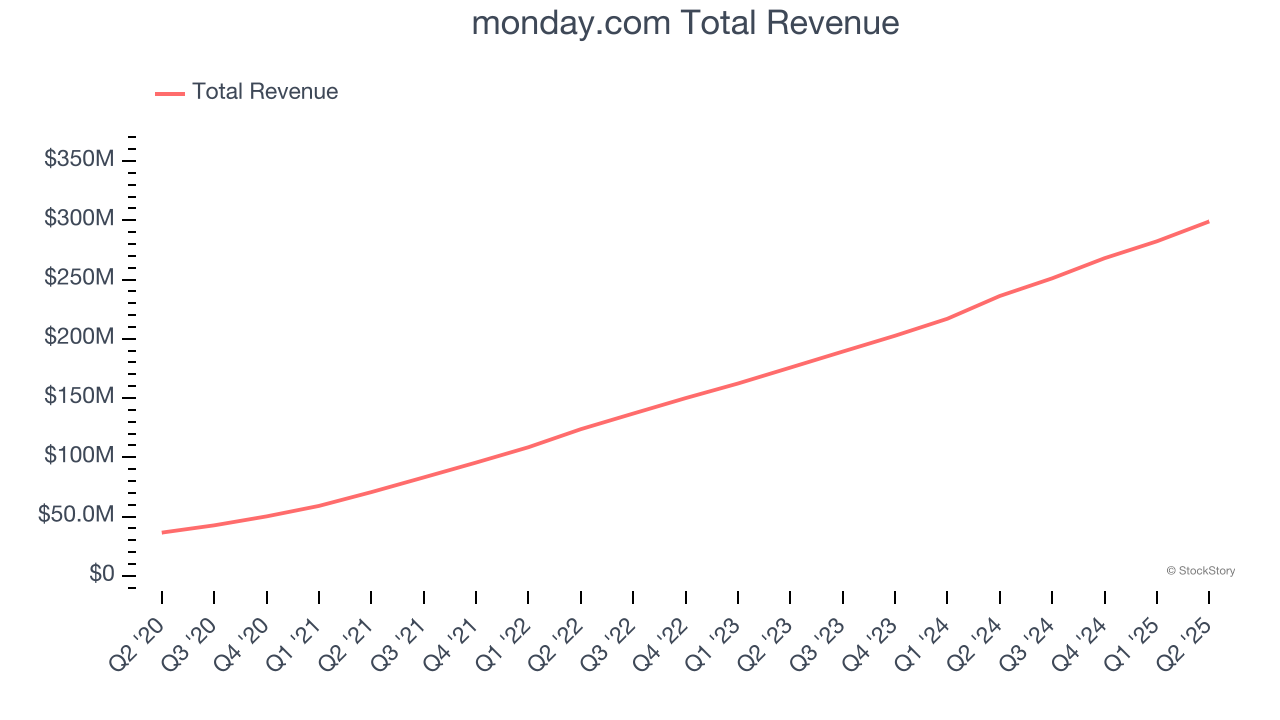

monday.com reported revenues of $299 million, up 26.6% year on year. This print exceeded analysts’ expectations by 1.8%. Overall, it was a strong quarter for the company with an impressive beat of analysts’ EBITDA estimates and a decent beat of analysts’ annual recurring revenue estimates.

“This quarter demonstrated our relentless focus on driving highly efficient growth at scale, and I’m energized by the momentum in our business and the opportunities we see ahead,” said Eliran Glazer, monday.com CFO.

Unsurprisingly, the stock is down 26.6% since reporting and currently trades at $182.

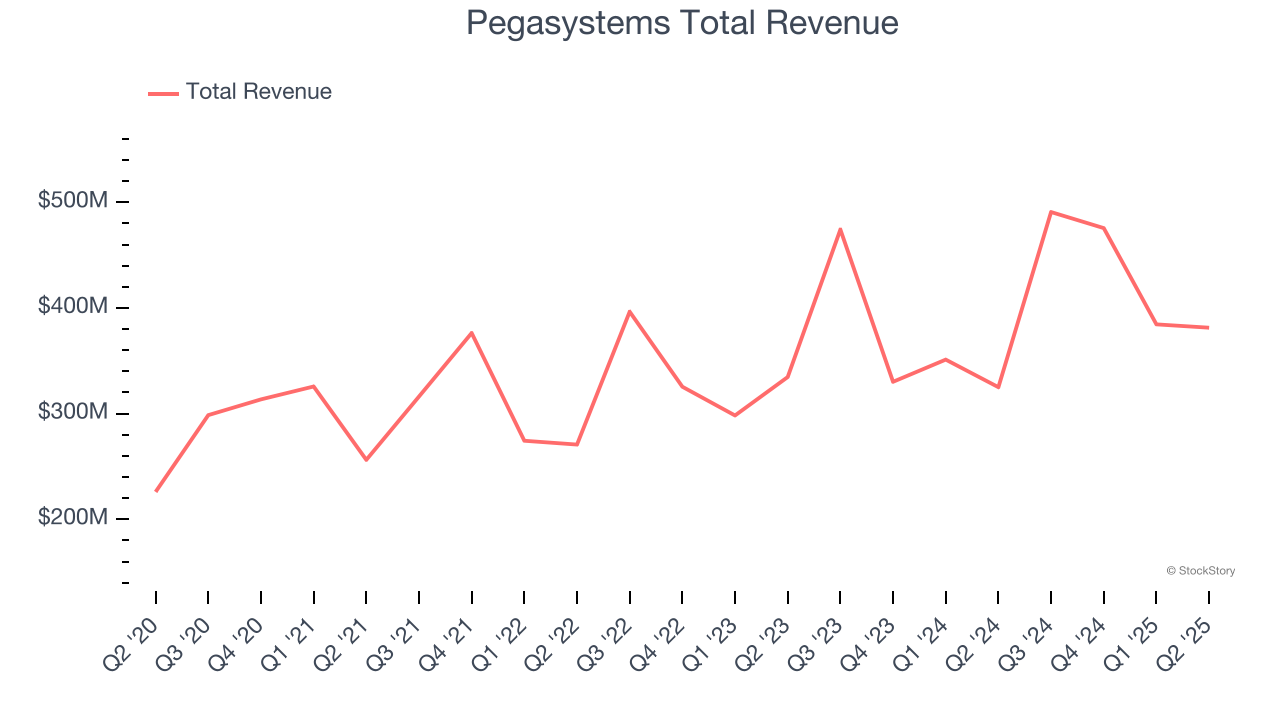

Best Q2: Pegasystems (NASDAQ: PEGA)

With a "Center-out Business Architecture" approach that transcends organizational silos, Pegasystems (NASDAQ: PEGA) develops software that helps organizations automate workflows and use artificial intelligence to improve customer experiences and business processes.

Pegasystems reported revenues of $381.4 million, up 17.3% year on year, outperforming analysts’ expectations by 8.5%. The business had a stunning quarter with a solid beat of analysts’ billings estimates and an impressive beat of analysts’ EBITDA estimates.

Pegasystems pulled off the biggest analyst estimates beat among its peers. The market seems content with the results as the stock is up 3.9% since reporting. It currently trades at $59.30.

Is now the time to buy Pegasystems? Access our full analysis of the earnings results here, it’s free for active Edge members.

SoundHound AI (NASDAQ: SOUN)

Born from the idea that machines should understand human speech as naturally as people do, SoundHound AI (NASDAQ: SOUN) develops voice recognition and conversational intelligence technology that enables businesses to integrate voice assistants into their products and services.

SoundHound AI reported revenues of $42.05 million, up 67.6% year on year, exceeding analysts’ expectations by 2.7%. Still, it was a slower quarter as it posted a significant miss of analysts’ EBITDA estimates.

The stock is flat since the results and currently trades at $14.25.

Read our full analysis of SoundHound AI’s results here.

Jamf (NASDAQ: JAMF)

With its name playfully derived from "Just Another Management Framework," Jamf (NASDAQ: JAMF) provides software that helps organizations deploy, manage, and secure Apple devices across their workforce while maintaining a seamless user experience.

Jamf reported revenues of $176.5 million, up 15.3% year on year. This number surpassed analysts’ expectations by 4.7%. It was a very strong quarter as it also put up a solid beat of analysts’ annual recurring revenue estimates and an impressive beat of analysts’ billings estimates.

The stock is up 74.7% since reporting and currently trades at $12.86.

Read our full, actionable report on Jamf here, it’s free for active Edge members.

Atlassian (NASDAQ: TEAM)

Started by two Australian university friends who funded their startup with credit cards, Atlassian (NASDAQ: TEAM) provides software tools that help teams plan, track, collaborate, and share knowledge across organizations.

Atlassian reported revenues of $1.43 billion, up 20.6% year on year. This print beat analysts’ expectations by 2.2%. Aside from that, it was a slower quarter as it logged full-year revenue guidance missing analysts’ expectations significantly and a significant miss of analysts’ billings estimates.

Atlassian had the weakest full-year guidance update among its peers. The stock is down 2.3% since reporting and currently trades at $157.

Read our full, actionable report on Atlassian here, it’s free for active Edge members.

Market Update

Thanks to the Fed’s series of rate hikes in 2022 and 2023, inflation has cooled significantly from its post-pandemic highs, drawing closer to the 2% goal. This disinflation has occurred without severely impacting economic growth, suggesting the success of a soft landing. The stock market thrived in 2024, spurred by recent rate cuts (0.5% in September and 0.25% in November), and a notable surge followed Donald Trump’s presidential election win in November, propelling indices to historic highs. Nonetheless, the outlook for 2025 remains clouded by potential trade policy changes and corporate tax discussions, which could impact business confidence and growth. The path forward holds both optimism and caution as new policies take shape.

Want to invest in winners with rock-solid fundamentals? Check out our Top 6 Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.