The end of the earnings season is always a good time to take a step back and see who shined (and who not so much). Let’s take a look at how content delivery stocks fared in Q3, starting with Akamai Technologies (NASDAQ: AKAM).

The amount of content on the internet is exploding, whether it is music, movies and or e-commerce stores. Consumer demand for this content creates network congestion, much like a digital traffic jam which drives demand for specialized content delivery networks (CDN) services that alleviate potential network bottlenecks.

The 4 content delivery stocks we track reported a very strong Q3. As a group, revenues beat analysts’ consensus estimates by 2.7% while next quarter’s revenue guidance was in line.

Thankfully, share prices of the companies have been resilient as they are up 9.4% on average since the latest earnings results.

Akamai Technologies (NASDAQ: AKAM)

With a massive distributed network spanning 4,100+ points of presence in nearly 130 countries, Akamai Technologies (NASDAQ: AKAM) provides a global distributed cloud platform that helps businesses deliver, secure, and optimize their digital experiences online.

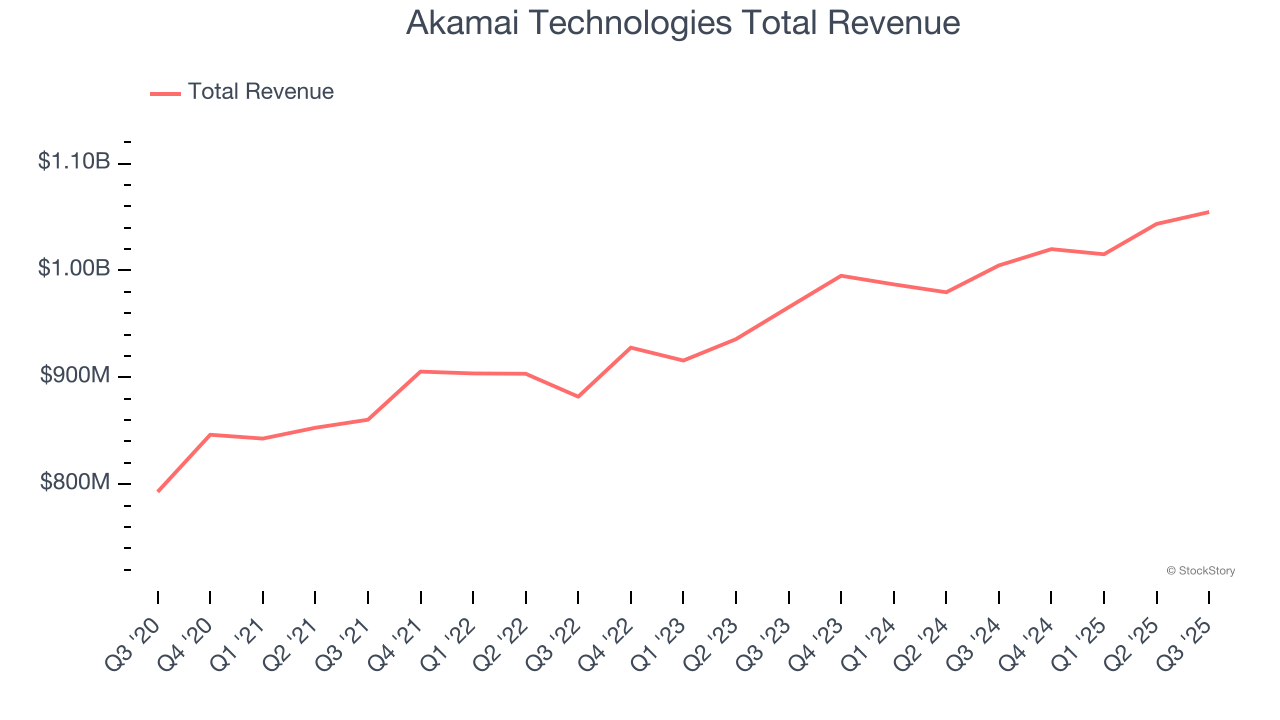

Akamai Technologies reported revenues of $1.05 billion, up 5% year on year. This print exceeded analysts’ expectations by 1%. Overall, it was a very strong quarter for the company with EPS guidance for next quarter exceeding analysts’ expectations and full-year EPS guidance exceeding analysts’ expectations.

"Akamai delivered a strong quarter, with solid top-line performance and excellent bottom-line results – highlighted by outperformance on margins and significant year-over-year EPS growth. We were particularly pleased by the continued success of our high-growth security products and the momentum in Cloud Infrastructure Services, where revenue growth accelerated to 39% year-over-year," said Dr. Tom Leighton, Akamai's Chief Executive Officer.

Akamai Technologies pulled off the highest full-year guidance raise but had the weakest performance against analyst estimates and weakest performance against analyst estimates of the whole group. Unsurprisingly, the stock is up 20.1% since reporting and currently trades at $87.70.

Is now the time to buy Akamai Technologies? Access our full analysis of the earnings results here, it’s free for active Edge members.

Best Q3: Fastly (NYSE: FSLY)

Taking its name from the core advantage it delivers to customers, Fastly (NYSE: FSLY) operates an edge cloud platform that processes, secures, and delivers web content as close to end users as possible, enabling faster digital experiences.

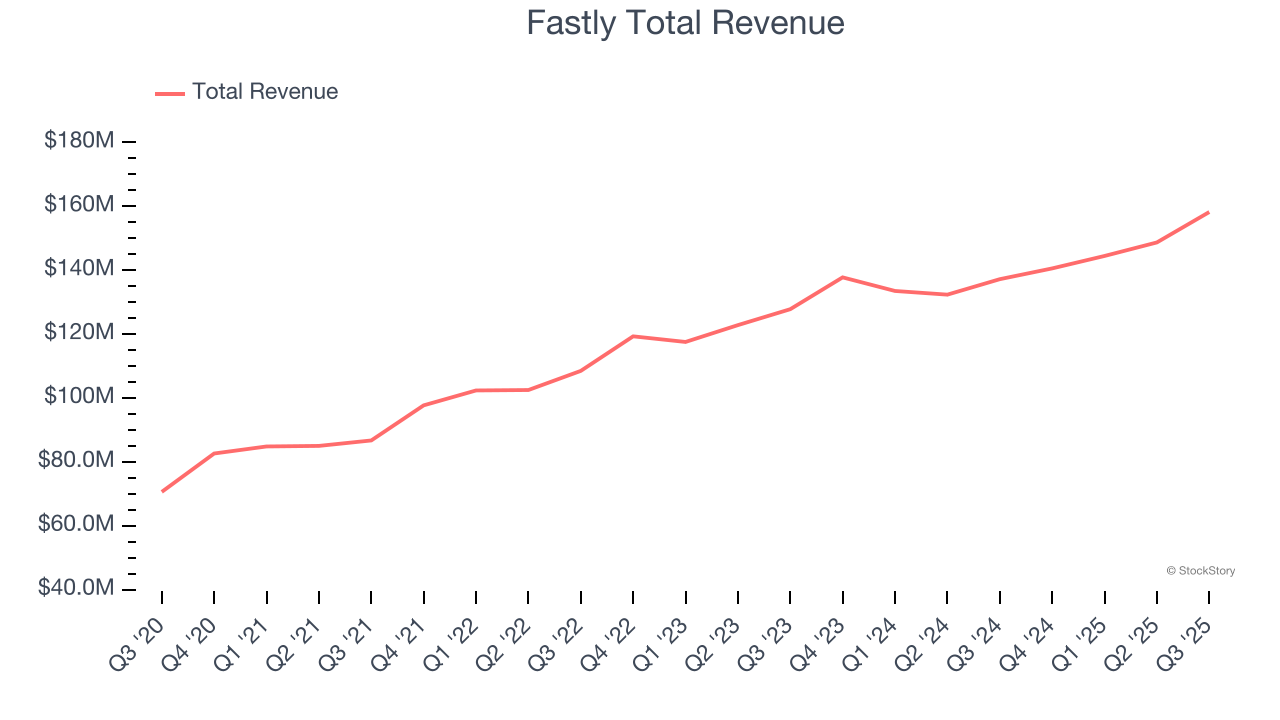

Fastly reported revenues of $158.2 million, up 15.3% year on year, outperforming analysts’ expectations by 4.7%. The business had an exceptional quarter with EPS guidance for next quarter exceeding analysts’ expectations and a solid beat of analysts’ EBITDA estimates.

Fastly achieved the biggest analyst estimates beat among its peers. The market seems happy with the results as the stock is up 45.7% since reporting. It currently trades at $11.76.

Is now the time to buy Fastly? Access our full analysis of the earnings results here, it’s free for active Edge members.

Weakest Q3: F5 (NASDAQ: FFIV)

Originally named after the F5 tornado, the most powerful on the meteorological scale, F5 (NASDAQ: FFIV) provides security and delivery solutions that protect applications across cloud, data center, and edge environments for large organizations.

F5 reported revenues of $810.1 million, up 8.5% year on year, exceeding analysts’ expectations by 2%. Still, it was a slower quarter as it posted full-year EPS guidance missing analysts’ expectations significantly and revenue guidance for next quarter missing analysts’ expectations significantly.

As expected, the stock is down 17.7% since the results and currently trades at $238.98.

Read our full analysis of F5’s results here.

Cloudflare (NYSE: NET)

With a massive network spanning more than 310 cities in over 120 countries, Cloudflare (NYSE: NET) provides a global network that delivers security, performance and reliability services to protect websites, applications, and corporate networks.

Cloudflare reported revenues of $562 million, up 30.7% year on year. This print beat analysts’ expectations by 3.2%. Overall, it was an exceptional quarter as it also put up an impressive beat of analysts’ billings estimates and EPS guidance for next quarter exceeding analysts’ expectations.

Cloudflare achieved the fastest revenue growth among its peers. The stock is down 10.7% since reporting and currently trades at $198.31.

Read our full, actionable report on Cloudflare here, it’s free for active Edge members.

Market Update

In response to the Fed’s rate hikes in 2022 and 2023, inflation has been gradually trending down from its post-pandemic peak, trending closer to the Fed’s 2% target. Despite higher borrowing costs, the economy has avoided flashing recessionary signals. This is the much-desired soft landing that many investors hoped for. The recent rate cuts (0.5% in September and 0.25% in November 2024) have bolstered the stock market, making 2024 a strong year for equities. Donald Trump’s presidential win in November sparked additional market gains, sending indices to record highs in the days following his victory. However, debates continue over possible tariffs and corporate tax adjustments, raising questions about economic stability in 2025.

Want to invest in winners with rock-solid fundamentals? Check out our Strong Momentum Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory’s analyst team — all seasoned professional investors — uses quantitative analysis and automation to deliver market-beating insights faster and with higher quality.