Over the past six months, AT&T’s stock price fell to $25.38. Shareholders have lost 8.6% of their capital, which is disappointing considering the S&P 500 has climbed by 15.3%. This might have investors contemplating their next move.

Is now the time to buy AT&T, or should you be careful about including it in your portfolio? See what our analysts have to say in our full research report, it’s free for active Edge members.

Why Do We Think AT&T Will Underperform?

Despite the more favorable entry price, we're swiping left on AT&T for now. Here are three reasons you should be careful with T and a stock we'd rather own.

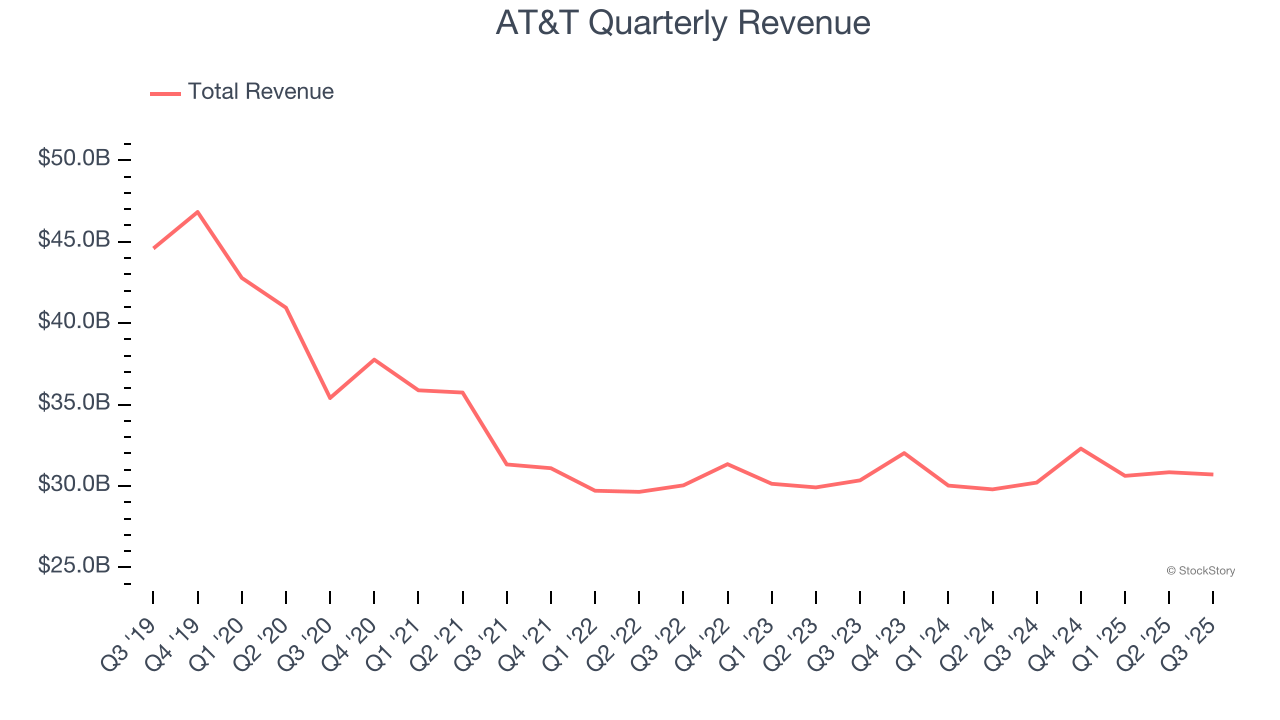

1. Revenue Spiraling Downwards

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. AT&T’s demand was weak over the last five years as its sales fell at a 5.6% annual rate. This wasn’t a great result and is a sign of poor business quality.

2. Cash Flow Margin Set to Decline

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

Over the next year, analysts predict AT&T’s cash conversion will fall. Their consensus estimates imply its free cash flow margin of 16% for the last 12 months will decrease to 15.6%.

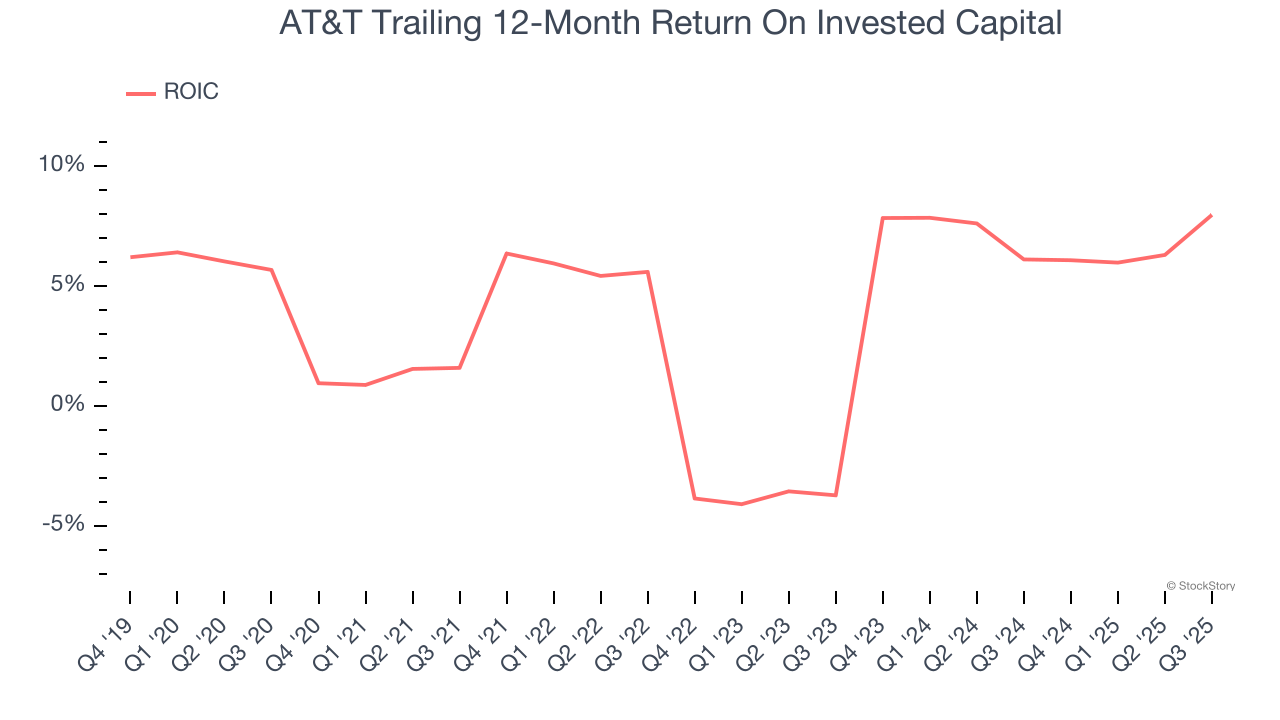

3. New Investments Bear Fruit as ROIC Jumps

A company’s ROIC, or return on invested capital, shows how much operating profit it makes compared to the money it has raised (debt and equity).

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Over the last few years, AT&T’s ROIC averaged 3.5 percentage point increases each year. This is a good sign, and we hope the company can continue improving.

Final Judgment

AT&T falls short of our quality standards. Following the recent decline, the stock trades at 11.7× forward P/E (or $25.38 per share). This valuation multiple is fair, but we don’t have much confidence in the company. There are more exciting stocks to buy at the moment. We’d suggest looking at the most entrenched endpoint security platform on the market.

High-Quality Stocks for All Market Conditions

The market’s up big this year - but there’s a catch. Just 4 stocks account for half the S&P 500’s entire gain. That kind of concentration makes investors nervous, and for good reason. While everyone piles into the same crowded names, smart investors are hunting quality where no one’s looking - and paying a fraction of the price. Check out the high-quality names we’ve flagged in our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-micro-cap company Tecnoglass (+1,754% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.