Global talent agency and entertainment company Endeavor (NYSE: EDR) announced better-than-expected revenue in Q4 CY2024, but sales were flat year on year at $1.57 billion. Its GAAP loss of $0.64 per share was significantly below analysts’ consensus estimates.

Is now the time to buy Endeavor? Find out by accessing our full research report, it’s free.

Endeavor (EDR) Q4 CY2024 Highlights:

- Revenue: $1.57 billion vs analyst estimates of $1.52 billion (flat year on year, 2.9% beat)

- EPS (GAAP): -$0.64 vs analyst estimates of $0.19 (significant miss)

- Adjusted EBITDA: $277.1 million vs analyst estimates of $367 million (17.7% margin, 24.5% miss)

- Operating Margin: -3.3%, down from -0.5% in the same quarter last year

- Market Capitalization: $9.49 billion

“We closed out 2024 with continued momentum reflecting strong demand for premium content and live events,” said Ariel Emanuel, CEO, Endeavor.

Company Overview

Owner of the UFC, WWE, and a client roster including Christian Bale, Endeavor (NYSE: EDR) is a diversified global entertainment, sports, and content company known for its talent representation and involvement in the entertainment industry.

Media

The advent of the internet changed how shows, films, music, and overall information flow. As a result, many media companies now face secular headwinds as attention shifts online. Some have made concerted efforts to adapt by introducing digital subscriptions, podcasts, and streaming platforms. Time will tell if their strategies succeed and which companies will emerge as the long-term winners.

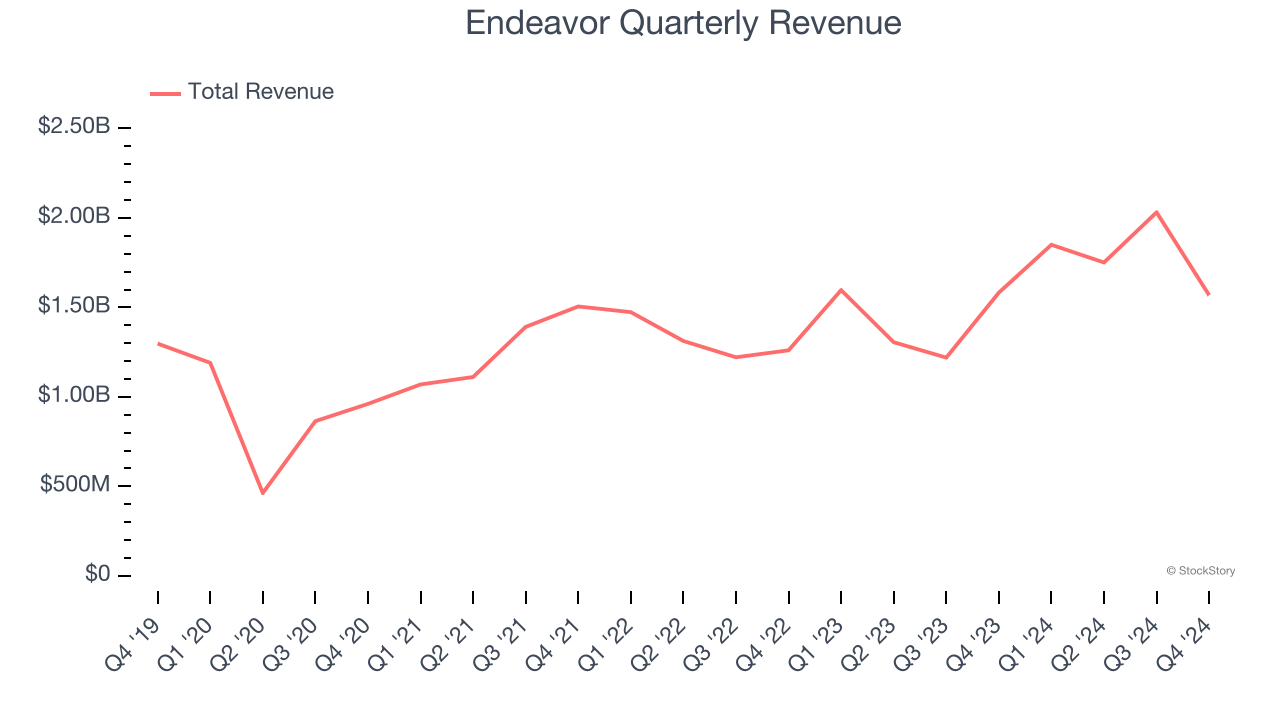

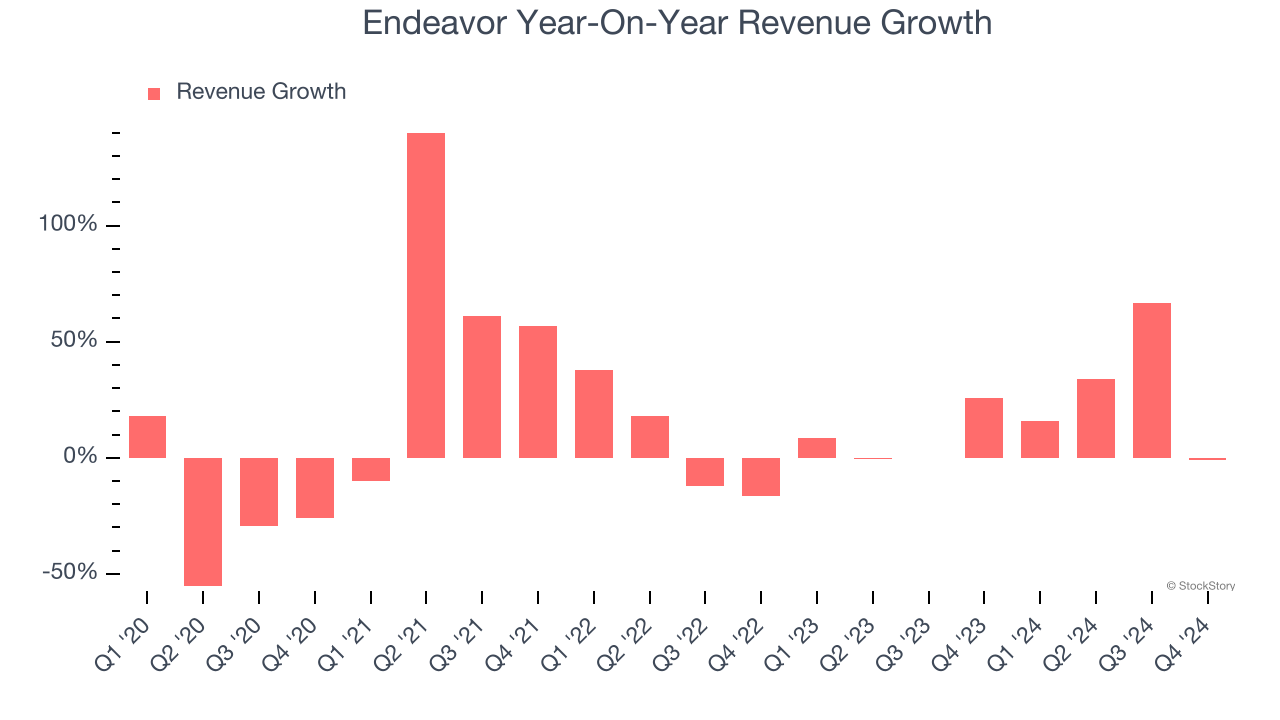

Sales Growth

A company’s long-term performance is an indicator of its overall quality. While any business can experience short-term success, top-performing ones enjoy sustained growth for years. Unfortunately, Endeavor’s 9.5% annualized revenue growth over the last five years was tepid. This fell short of our benchmark for the consumer discretionary sector and is a rough starting point for our analysis.

Long-term growth is the most important, but within consumer discretionary, product cycles are short and revenue can be hit-driven due to rapidly changing trends and consumer preferences. Endeavor’s annualized revenue growth of 16.9% over the last two years is above its five-year trend, suggesting some bright spots.

We can better understand the company’s revenue dynamics by analyzing its three most important segments: Events, Sports, and Representation, which are 26.3%, 42.7%, and 32% of revenue. Over the last two years, Endeavor’s revenues in all three segments increased. Its Events revenue (live events) averaged year-on-year growth of 11.2% while its Sports (UFC, Euroleague) and Representation (WME talent agency, IMG Models) revenues averaged 58.6% and 5.5%.

This quarter, Endeavor’s $1.57 billion of revenue was flat year on year but beat Wall Street’s estimates by 2.9%.

Looking ahead, sell-side analysts expect revenue to remain flat over the next 12 months, a deceleration versus the last two years. This projection is underwhelming and indicates its products and services will face some demand challenges.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) stock benefiting from the rise of AI. Click here to access our free report one of our favorites growth stories.

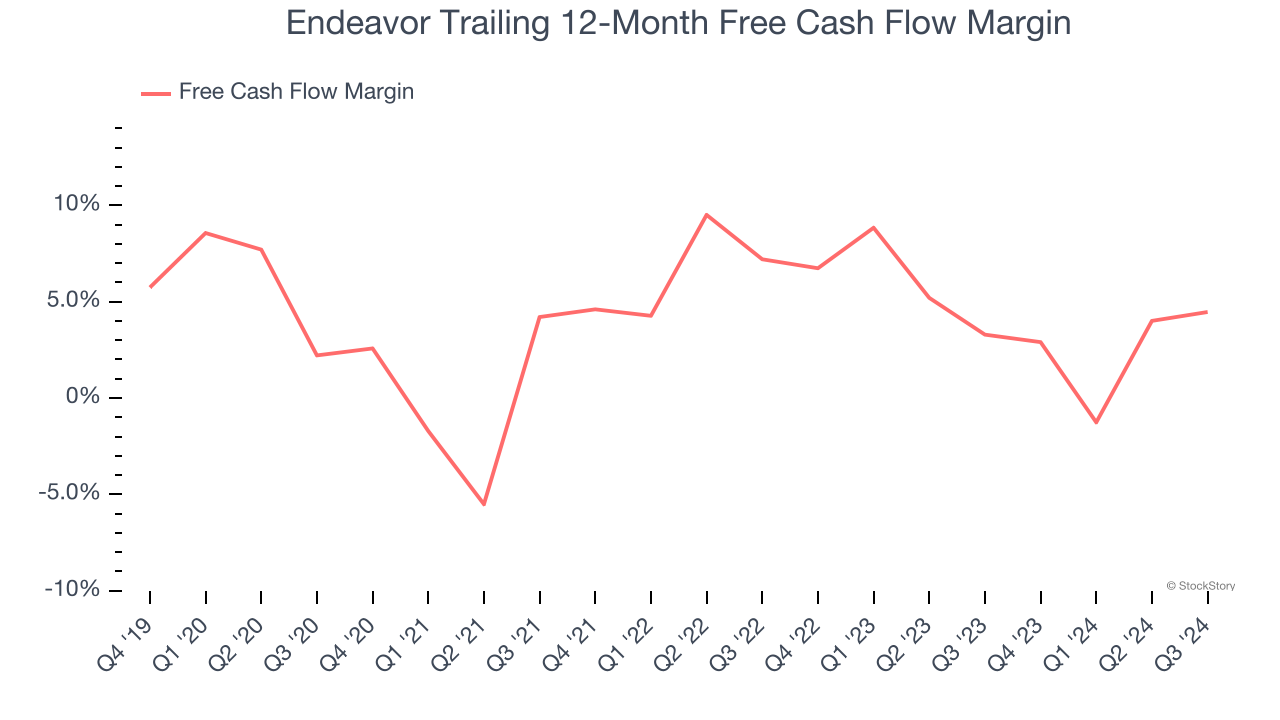

Cash Is King

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

Endeavor has shown poor cash profitability over the last two years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 4%, lousy for a consumer discretionary business.

Key Takeaways from Endeavor’s Q4 Results

It was encouraging to see Endeavor beat analysts’ revenue expectations this quarter. On the other hand, its EPS missed Wall Street’s estimates. Overall, this was a mixed quarter. The stock traded up 2.2% to $32 immediately following the results.

Is Endeavor an attractive investment opportunity at the current price? We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.