Wrapping up Q4 earnings, we look at the numbers and key takeaways for the agricultural machinery stocks, including AGCO (NYSE: AGCO) and its peers.

Agricultural machinery companies are investing to develop and produce more precise machinery, automated systems, and connected equipment that collects analyzable data to help farmers and other customers improve yields and increase efficiency. On the other hand, agriculture is seasonal and natural disasters or bad weather can impact the entire industry. Additionally, macroeconomic factors such as commodity prices or changes in interest rates–which dictate the willingness of these companies or their customers to invest–can impact demand for agricultural machinery.

The 6 agricultural machinery stocks we track reported a mixed Q4. As a group, revenues missed analysts’ consensus estimates by 6.7% while next quarter’s revenue guidance was 1.9% above.

In light of this news, share prices of the companies have held steady as they are up 2.3% on average since the latest earnings results.

Weakest Q4: AGCO (NYSE: AGCO)

With a history that features both organic growth and acquisitions, AGCO (NYSE: AGCO) designs, manufactures, and sells agricultural machinery and related technology.

AGCO reported revenues of $2.89 billion, down 24% year on year. This print fell short of analysts’ expectations by 8.5%. Overall, it was a slower quarter for the company with a significant miss of analysts’ EPS and organic revenue estimates.

"AGCO delivered strong fourth quarter results with an adjusted operating margin of 9.9%, even with challenging market dynamics and aggressive production cuts," said Eric Hansotia, AGCO's Chairman, President and Chief Executive Officer.

The market was likely pricing in the results, and the stock is flat since reporting. It currently trades at $102.62.

Read our full report on AGCO here, it’s free.

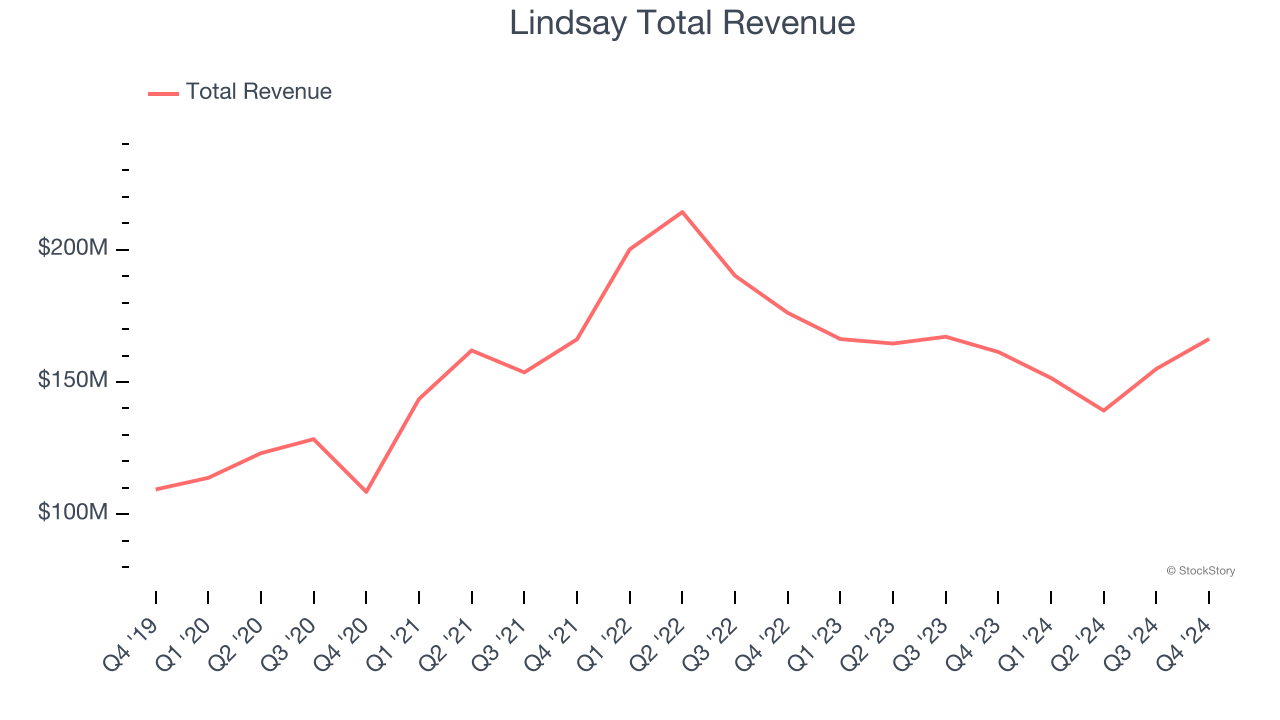

Best Q4: Lindsay (NYSE: LNN)

A pioneer in the field of center pivot and lateral move irrigation, Lindsay (NYSE: LNN) provides a variety of proprietary water management and road infrastructure products and services.

Lindsay reported revenues of $166.3 million, up 3.1% year on year, in line with analysts’ expectations. The business had a very strong quarter with a solid beat of analysts’ EBITDA estimates.

Lindsay pulled off the biggest analyst estimates beat and fastest revenue growth among its peers. The market seems happy with the results as the stock is up 11.5% since reporting. It currently trades at $130.91.

Is now the time to buy Lindsay? Access our full analysis of the earnings results here, it’s free.

The Toro Company (NYSE: TTC)

Ceasing all production to support the war effort during World War II, Toro (NYSE: TTC) offers outdoor equipment for residential, commercial, and agricultural use.

The Toro Company reported revenues of $995 million, flat year on year, falling short of analysts’ expectations by 1%. Still, it was a satisfactory quarter as it posted a solid beat of analysts’ adjusted operating income estimates.

As expected, the stock is down 2.4% since the results and currently trades at $76.20.

Read our full analysis of The Toro Company’s results here.

Alamo (NYSE: ALG)

Expanding its markets through acquisitions since its founding, Alamo (NSYE:ALG) designs, manufactures, and services vegetation management and infrastructure maintenance equipment for governmental, industrial, and agricultural use.

Alamo reported revenues of $385.3 million, down 7.7% year on year. This print came in 2.9% below analysts' expectations. All in all, it was a softer quarter for the company.

The stock is up 2.2% since reporting and currently trades at $187.99.

Read our full, actionable report on Alamo here, it’s free.

Titan International (NYSE: TWI)

Acquiring Goodyear’s farm tire business in 2005, Titan (NSYE:TWI) is a manufacturer and supplier of wheels, tires, and undercarriages used in off-highway vehicles such as construction vehicles.

Titan International reported revenues of $383.6 million, down 1.7% year on year. This result missed analysts’ expectations by 2.7%. Taking a step back, it was still a strong quarter as it logged an impressive beat of analysts’ EPS estimates and a solid beat of analysts’ EBITDA estimates.

The stock is flat since reporting and currently trades at $8.79.

Read our full, actionable report on Titan International here, it’s free.

Want to invest in winners with rock-solid fundamentals? Check out our Hidden Gem Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.