As the Q4 earnings season wraps, let’s dig into this quarter’s best and worst performers in the shelf-stable food industry, including Hormel Foods (NYSE: HRL) and its peers.

As America industrialized and moved away from an agricultural economy, people faced more demands on their time. Packaged foods emerged as a solution offering convenience to the evolving American family, whether it be canned goods or snacks. Today, Americans seek brands that are high in quality, reliable, and reasonably priced. Furthermore, there's a growing emphasis on health-conscious and sustainable food options. Packaged food stocks are considered resilient investments. People always need to eat, so these companies can enjoy consistent demand as long as they stay on top of changing consumer preferences. The industry spans from multinational corporations to smaller specialized firms and is subject to food safety and labeling regulations.

The 21 shelf-stable food stocks we track reported a mixed Q4. As a group, revenues were in line with analysts’ consensus estimates while next quarter’s revenue guidance was 0.5% above.

While some shelf-stable food stocks have fared somewhat better than others, they have collectively declined. On average, share prices are down 3.4% since the latest earnings results.

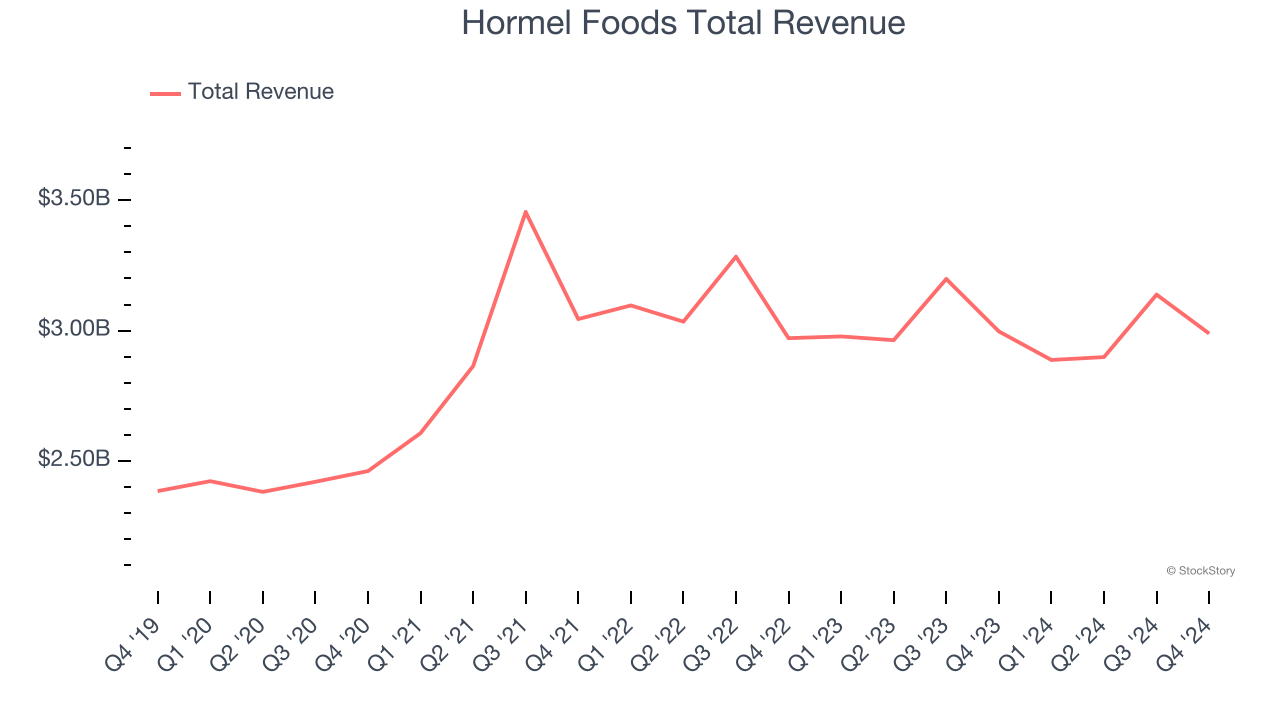

Hormel Foods (NYSE: HRL)

Best known for its SPAM brand, Hormel (NYSE: HRL) is a packaged foods company with products that span meat, poultry, shelf-stable foods, and spreads.

Hormel Foods reported revenues of $2.99 billion, flat year on year. This print exceeded analysts’ expectations by 1.3%. Despite the top-line beat, it was still a slower quarter for the company with a significant miss of analysts’ EBITDA and gross margin estimates.

The stock is up 2.8% since reporting and currently trades at $29.54.

Read our full report on Hormel Foods here, it’s free.

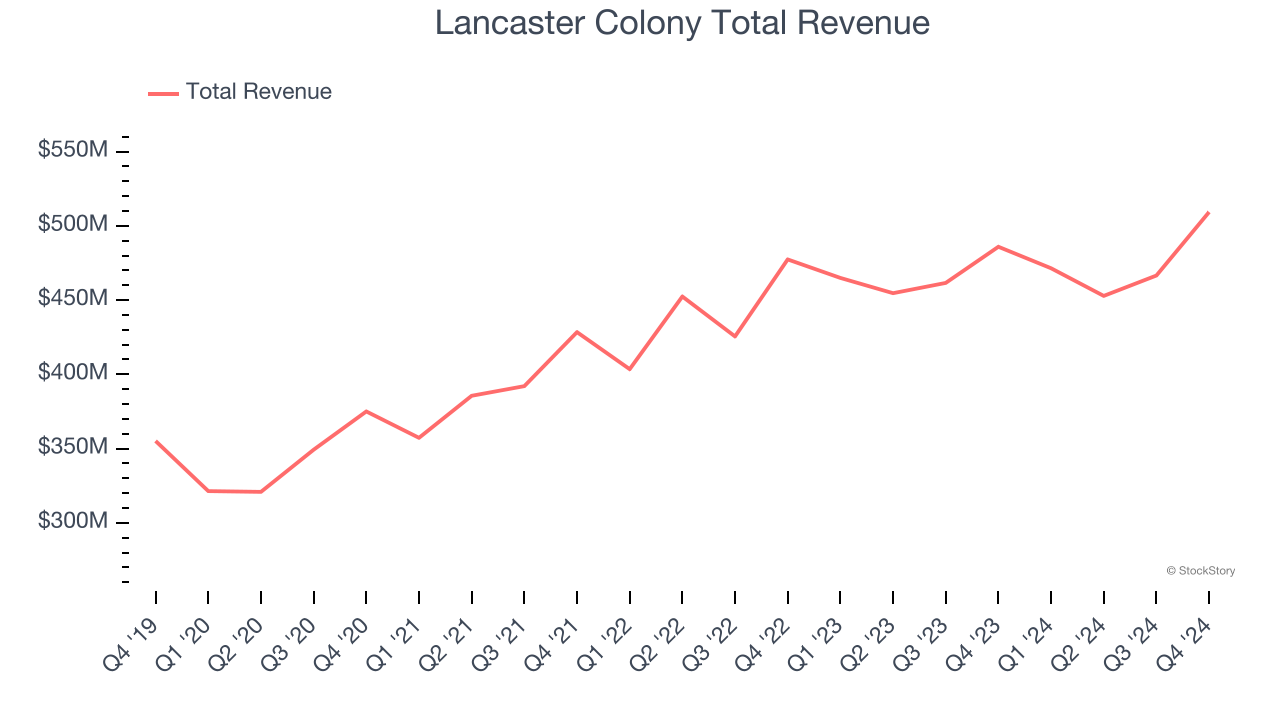

Best Q4: Lancaster Colony (NASDAQ: LANC)

Known for its frozen garlic bread and Parkerhouse rolls, Lancaster Colony (NASDAQ: LANC) sells bread, dressing, and dips to the retail and food service channels.

Lancaster Colony reported revenues of $509.3 million, up 4.8% year on year, outperforming analysts’ expectations by 2.8%. The business had a very strong quarter with a solid beat of analysts’ EBITDA estimates.

Lancaster Colony achieved the biggest analyst estimates beat among its peers. The market seems happy with the results as the stock is up 7.8% since reporting. It currently trades at $179.52.

Is now the time to buy Lancaster Colony? Access our full analysis of the earnings results here, it’s free.

Weakest Q4: Lamb Weston (NYSE: LW)

Best known for its Grown in Idaho brand, Lamb Weston (NYSE: LW) produces and distributes potato products such as frozen french fries and mashed potatoes.

Lamb Weston reported revenues of $1.60 billion, down 7.6% year on year, falling short of analysts’ expectations by 4.3%. It was a disappointing quarter as it posted full-year revenue guidance missing analysts’ expectations.

Lamb Weston delivered the weakest full-year guidance update in the group. As expected, the stock is down 35% since the results and currently trades at $50.80.

Read our full analysis of Lamb Weston’s results here.

B&G Foods (NYSE: BGS)

Started as a small grocery store in New York City, B&G Foods (NYSE: BGS) is an American packaged foods company with a diverse portfolio of more than 50 brands.

B&G Foods reported revenues of $551.6 million, down 4.6% year on year. This number beat analysts’ expectations by 1.2%. Aside from that, it was a mixed quarter as it also recorded a narrow beat of analysts’ EBITDA estimates but full-year revenue guidance meeting analysts’ expectations.

The stock is up 6% since reporting and currently trades at $7.25.

Read our full, actionable report on B&G Foods here, it’s free.

McCormick (NYSE: MKC)

The classic red Heinz ketchup bottle’s competitor, McCormick (NYSE: MKC) sells food-flavoring products like condiments, spices, and seasoning mixes.

McCormick reported revenues of $1.80 billion, up 2.6% year on year. This print topped analysts’ expectations by 1.2%. Taking a step back, it was a mixed quarter as it also logged a decent beat of analysts’ EPS estimates.

The stock is up 9.3% since reporting and currently trades at $80.03.

Read our full, actionable report on McCormick here, it’s free.

Want to invest in winners with rock-solid fundamentals? Check out our Top 5 Quality Compounder Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.