Quarterly earnings results are a good time to check in on a company’s progress, especially compared to its peers in the same sector. Today we are looking at Cardinal Health (NYSE: CAH) and the best and worst performers in the healthcare providers & services industry.

The healthcare providers and services sector, encompassing insurers to hospitals to outpatient care facilities, benefit from the consistent demand for healthcare services. Stable or even recurring revenues can be earned through insurance premiums, patient care contracts, and testing services agreements. However, the business models face challenges such as high operational costs especially if significant labor is involved. Reimbursement pressures from public and private payers can impact margins and an evolving regulatory landscape adds uncertainty to it all. Looking forward, this sector is poised to benefit from tailwinds such as the aging population, which means rising prevalence of chronic diseases. There is also broad demand for value-based care models, which emphasize cost efficiency and patient outcomes. Advances in telehealth, data analytics, and personalized medicine are likely to create new revenue opportunities for companies that can successfully digitize. However, headwinds abound, including labor shortages in clinical settings, continued reimbursement cuts, and regulatory scrutiny over pricing and care quality.

The 40 healthcare providers & services stocks we track reported a satisfactory Q4. As a group, revenues beat analysts’ consensus estimates by 1.6% while next quarter’s revenue guidance was in line.

In light of this news, share prices of the companies have held steady. On average, they are relatively unchanged since the latest earnings results.

Cardinal Health (NYSE: CAH)

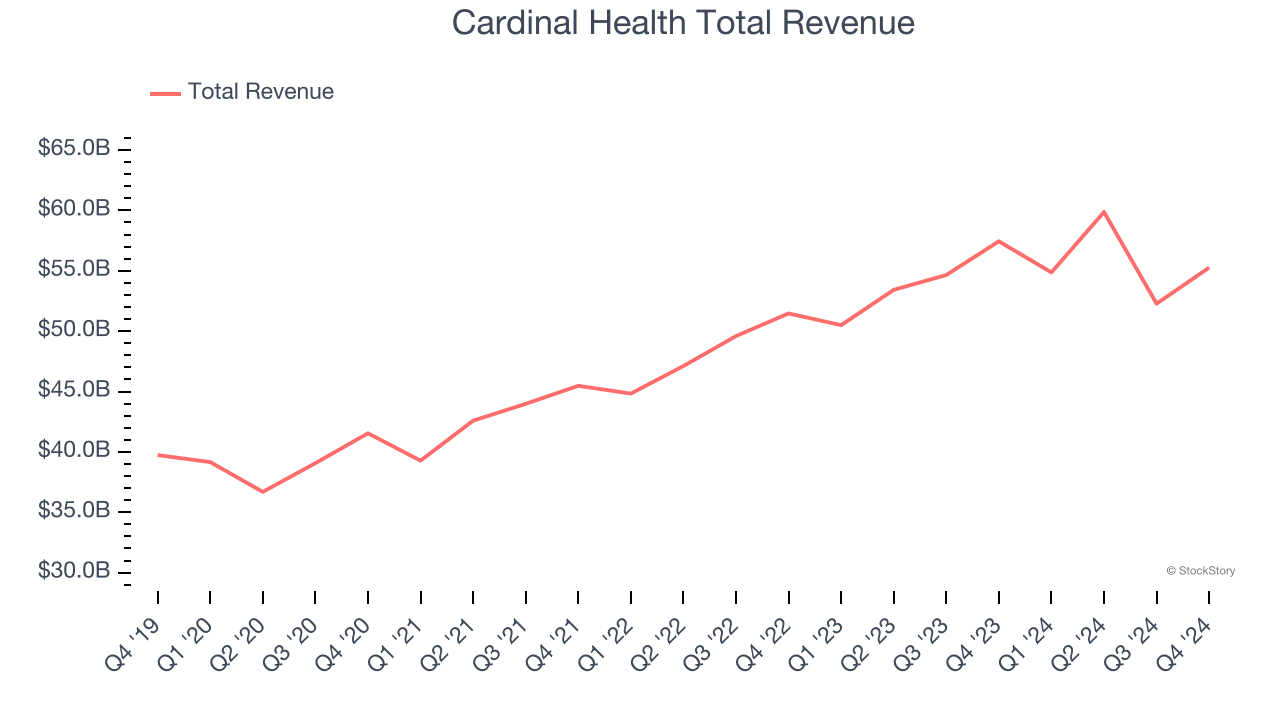

Operating as a critical link in the healthcare supply chain since 1979, Cardinal Health (NYSE: CAH) distributes pharmaceuticals and manufactures medical products for hospitals, pharmacies, and healthcare providers across the global healthcare supply chain.

Cardinal Health reported revenues of $55.26 billion, down 3.8% year on year. This print exceeded analysts’ expectations by 0.9%. Overall, it was a strong quarter for the company with a decent beat of analysts’ EPS estimates.

"We delivered strong second quarter financial results while taking significant strategic and operational actions to position us for future growth," said Jason Hollar, CEO of Cardinal Health.

The stock is up 3.9% since reporting and currently trades at $132.59.

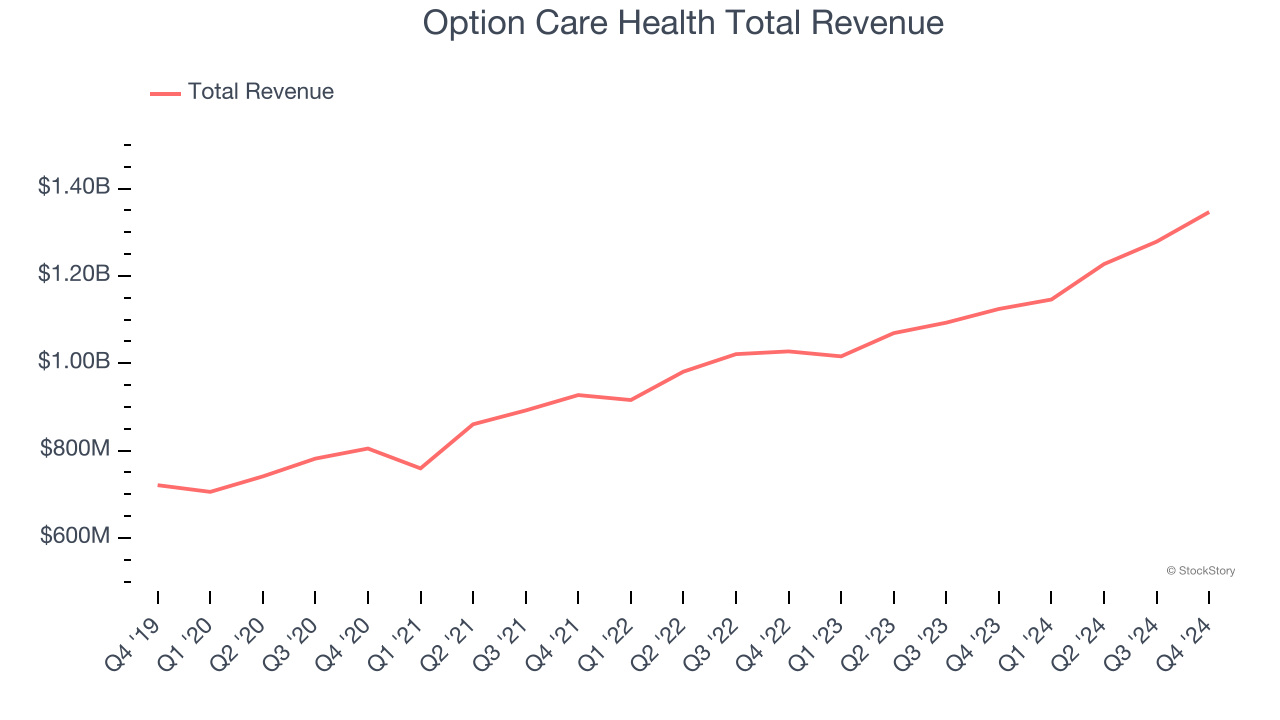

Best Q4: Option Care Health (NASDAQ: OPCH)

With a nationwide network of 177 locations serving 43 states and a team of over 4,500 clinicians, Option Care Health (NASDAQ: OPCH) is the largest independent provider of home and alternate site infusion services, delivering medications and clinical support to patients across the United States.

Option Care Health reported revenues of $1.35 billion, up 19.7% year on year, outperforming analysts’ expectations by 4.9%. The business had an exceptional quarter with an impressive beat of analysts’ full-year EPS guidance estimates and a solid beat of analysts’ EPS estimates.

The market seems happy with the results as the stock is up 5.8% since reporting. It currently trades at $34.53.

Is now the time to buy Option Care Health? Access our full analysis of the earnings results here, it’s free.

Weakest Q4: agilon health (NYSE: AGL)

Transforming how doctors care for seniors by shifting financial incentives from volume to outcomes, agilon health (NYSE: AGL) provides a platform that helps primary care physicians transition to value-based care models for Medicare patients through long-term partnerships and global capitation arrangements.

agilon health reported revenues of $1.52 billion, up 44.2% year on year, in line with analysts’ expectations. It was a softer quarter as it posted full-year EBITDA guidance missing analysts’ expectations and a significant miss of analysts’ EPS estimates.

agilon health delivered the weakest full-year guidance update in the group. The company added 2,000 customers to reach a total of 527,000. Interestingly, the stock is up 11.6% since the results and currently trades at $4.04.

Read our full analysis of agilon health’s results here.

Alignment Healthcare (NASDAQ: ALHC)

Founded in 2013 with a mission to transform healthcare for seniors, Alignment Healthcare (NASDAQ: ALHC) provides Medicare Advantage health plans for seniors with features like concierge services, transportation benefits, and technology-driven care coordination.

Alignment Healthcare reported revenues of $701.2 million, up 50.7% year on year. This number topped analysts’ expectations by 3.6%. Overall, it was a very strong quarter as it also recorded EBITDA guidance for next quarter exceeding analysts’ expectations and full-year revenue guidance exceeding analysts’ expectations.

Alignment Healthcare delivered the fastest revenue growth and highest full-year guidance raise among its peers. The company added 6,800 customers to reach a total of 189,100. The stock is up 28.2% since reporting and currently trades at $17.25.

Read our full, actionable report on Alignment Healthcare here, it’s free.

HCA Healthcare (NYSE: HCA)

With roots dating back to 1968 and a network spanning 20 states, HCA Healthcare (NYSE: HCA) operates a network of 190 hospitals and 150+ outpatient facilities providing a full range of medical services across the US and England.

HCA Healthcare reported revenues of $18.29 billion, up 5.7% year on year. This result beat analysts’ expectations by 0.7%. Taking a step back, it was a mixed quarter as it also produced a narrow beat of analysts’ EPS estimates but same-store sales in line with analysts’ estimates.

The stock is up 1.9% since reporting and currently trades at $331.48.

Read our full, actionable report on HCA Healthcare here, it’s free.

Want to invest in winners with rock-solid fundamentals? Check out our 9 Best Market-Beating Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.