Casual restaurant chain Noodles & Company (NASDAQ: NDLS) fell short of the market’s revenue expectations in Q4 CY2024, with sales falling 2% year on year to $121.8 million. On the other hand, the company’s full-year revenue guidance of $507.5 million at the midpoint came in 2.6% above analysts’ estimates. Its non-GAAP loss of $0.15 per share was 21.6% below analysts’ consensus estimates.

Is now the time to buy Noodles? Find out by accessing our full research report, it’s free.

Noodles (NDLS) Q4 CY2024 Highlights:

- Revenue: $121.8 million vs analyst estimates of $123.4 million (2% year-on-year decline, 1.3% miss)

- Adjusted EPS: -$0.15 vs analyst expectations of -$0.12 (21.6% miss)

- Adjusted EBITDA: $4.01 million vs analyst estimates of $4.17 million (3.3% margin, relatively in line)

- Management’s revenue guidance for the upcoming financial year 2025 is $507.5 million at the midpoint, beating analyst estimates by 2.6% and implying 2.9% growth (vs -2% in FY2024)

- Operating Margin: -6%, down from -3.7% in the same quarter last year

- Locations: 463 at quarter end, down from 470 in the same quarter last year

- Same-Store Sales were flat year on year (-4.2% in the same quarter last year)

- Market Capitalization: $61.21 million

Company Overview

Offering pasta, mac and cheese, pad thai, and more, Noodles & Company (NASDAQ: NDLS) is a casual restaurant chain that serves all manner of noodles from around the world.

Modern Fast Food

Modern fast food is a relatively newer category representing a middle ground between traditional fast food and sit-down restaurants. These establishments feature an expanded menu selection priced above traditional fast food options, often incorporating fresher and cleaner ingredients to serve customers prioritizing quality. These eateries are capitalizing on the perception that your drive-through burger and fries joint is detrimental to your health because of inferior ingredients.

Sales Growth

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can put up a good quarter or two, but many enduring ones grow for years.

With $493.3 million in revenue over the past 12 months, Noodles is a small restaurant chain, which sometimes brings disadvantages compared to larger competitors benefiting from better brand awareness and economies of scale.

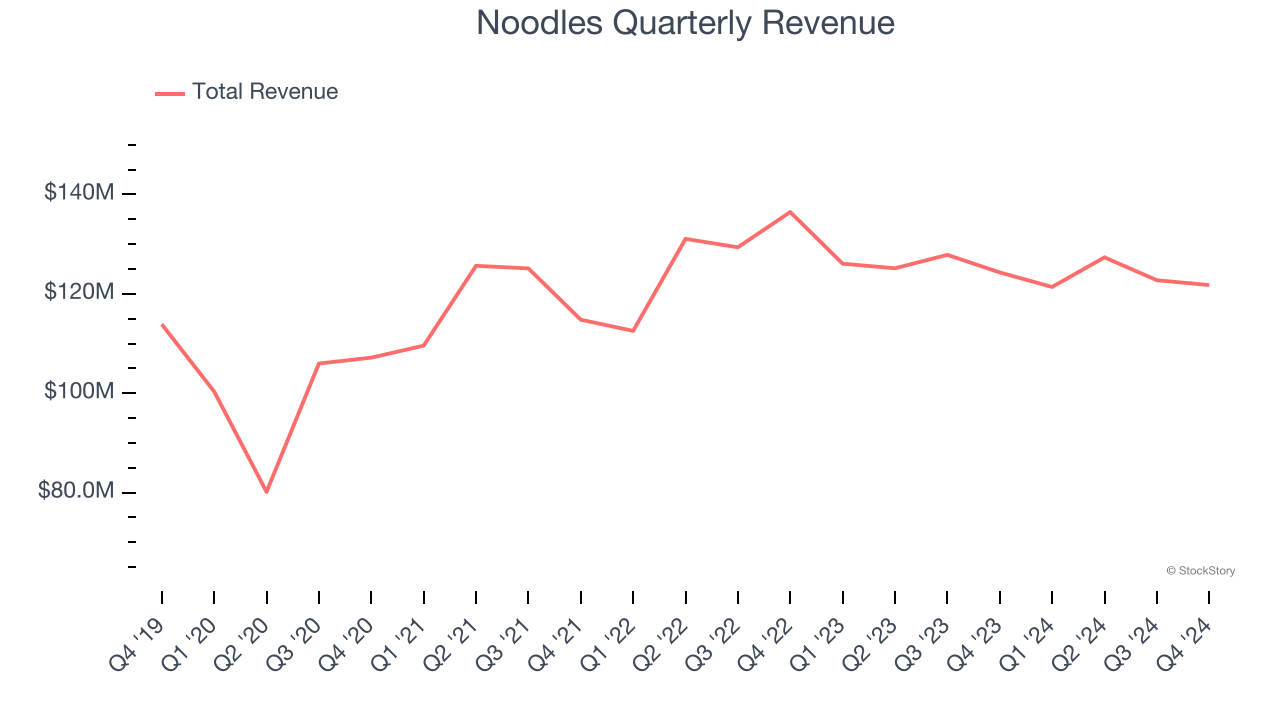

As you can see below, Noodles grew its sales at a weak 1.3% compounded annual growth rate over the last five years (we compare to 2019 to normalize for COVID-19 impacts).

This quarter, Noodles missed Wall Street’s estimates and reported a rather uninspiring 2% year-on-year revenue decline, generating $121.8 million of revenue.

Looking ahead, sell-side analysts expect revenue to remain flat over the next 12 months. This projection is underwhelming and suggests its menu offerings will face some demand challenges.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefiting from the rise of AI, available to you FREE via this link.

Restaurant Performance

Number of Restaurants

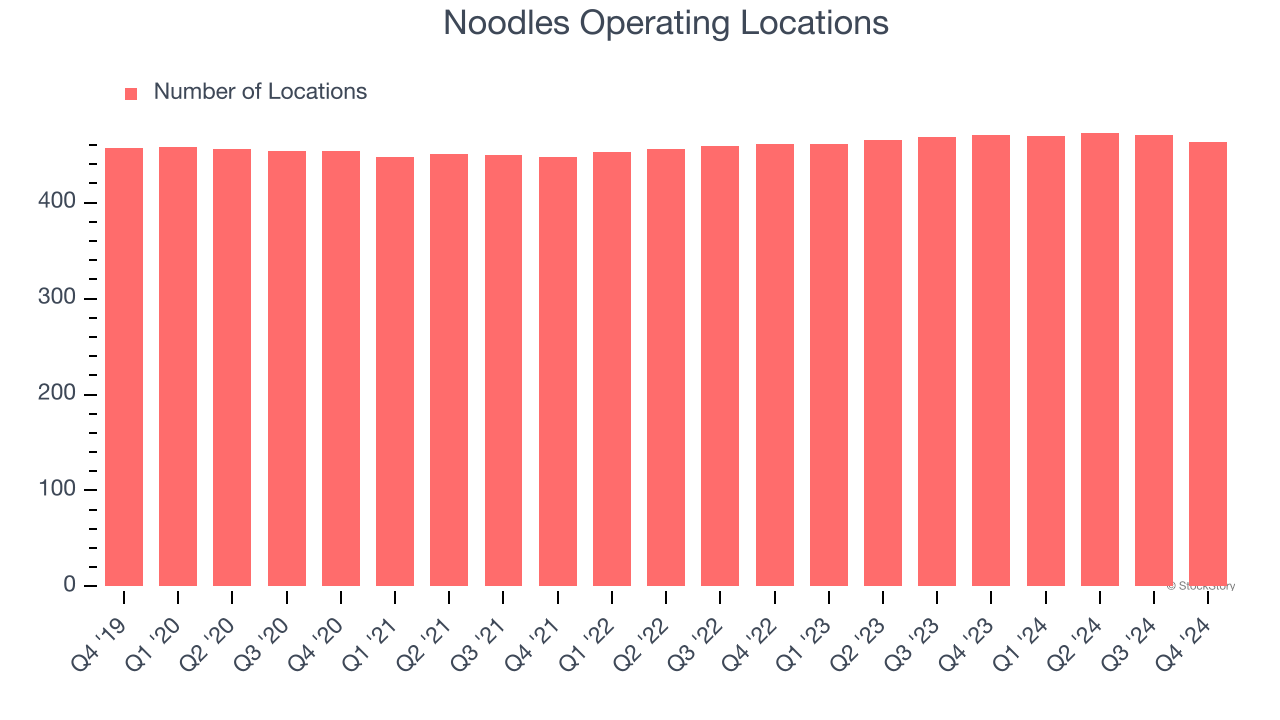

A restaurant chain’s total number of dining locations influences how much it can sell and how quickly revenue can grow.

Noodles sported 463 locations in the latest quarter. Over the last two years, it has generally opened new restaurants, averaging 1.3% annual growth. This was faster than the broader restaurant sector.

When a chain opens new restaurants, it usually means it’s investing for growth because there’s healthy demand for its meals and there are markets where its concepts have few or no locations.

Same-Store Sales

A company's restaurant base only paints one part of the picture. When demand is high, it makes sense to open more. But when demand is low, it’s prudent to close some locations and use the money in other ways. Same-store sales gives us insight into this topic because it measures organic growth at restaurants open for at least a year.

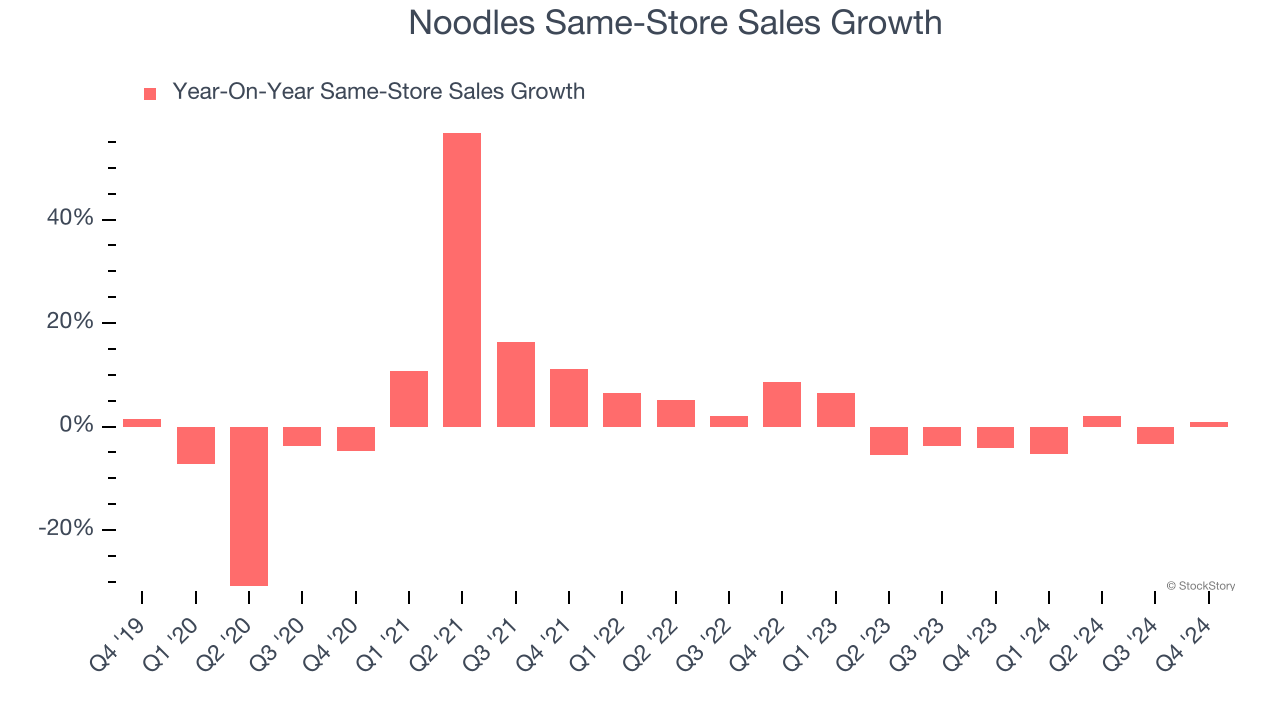

Noodles’s demand has been shrinking over the last two years as its same-store sales have averaged 1.6% annual declines. This performance is concerning - it shows Noodles artificially boosts its revenue by building new restaurants. We’d like to see a company’s same-store sales rise before it takes on the costly, capital-intensive endeavor of expanding its restaurant base.

In the latest quarter, Noodles’s year on year same-store sales were flat. This performance was a well-appreciated turnaround from its historical levels, showing the business is improving.

Key Takeaways from Noodles’s Q4 Results

It was great to see Noodles’s full-year revenue guidance top analysts’ expectations. On the other hand, its revenue and EPS fell short of Wall Street’s estimates. Overall, this was a weaker quarter. The stock traded down 4.8% to $1.18 immediately following the results.

Noodles may have had a tough quarter, but does that actually create an opportunity to invest right now? When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free.