Over the past six months, Shake Shack’s shares (currently trading at $88.30) have posted a disappointing 13.2% loss while the S&P 500 was down 1.6%. This might have investors contemplating their next move.

Is now the time to buy Shake Shack, or should you be careful about including it in your portfolio? Dive into our full research report to see our analyst team’s opinion, it’s free.

Despite the more favorable entry price, we're sitting this one out for now. Here are three reasons why there are better opportunities than SHAK and a stock we'd rather own.

Why Is Shake Shack Not Exciting?

Started as a hot dog cart in New York City's Madison Square Park, Shake Shack (NYSE: SHAK) is a fast-food restaurant known for its burgers and milkshakes.

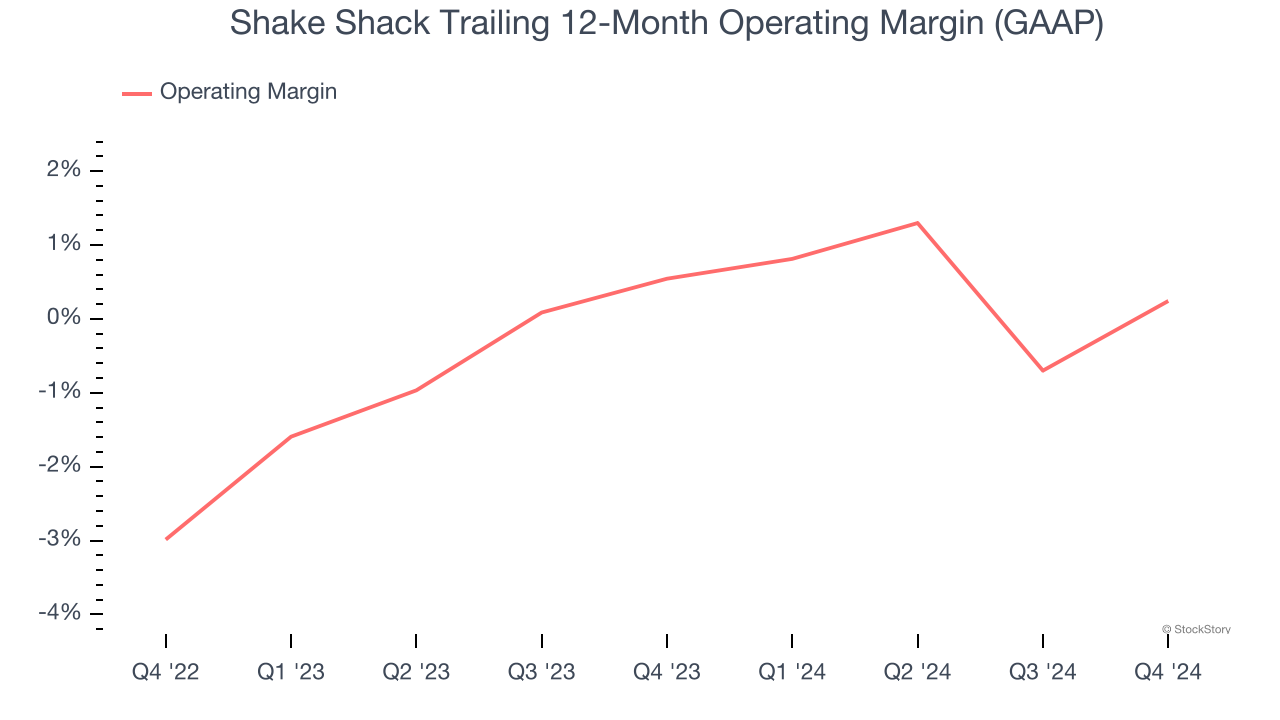

1. Breakeven Operating Raises Questions

Operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses – everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

Shake Shack was roughly breakeven when averaging the last two years of quarterly operating profits, inadequate for a restaurant business. This result is surprising given its high gross margin as a starting point.

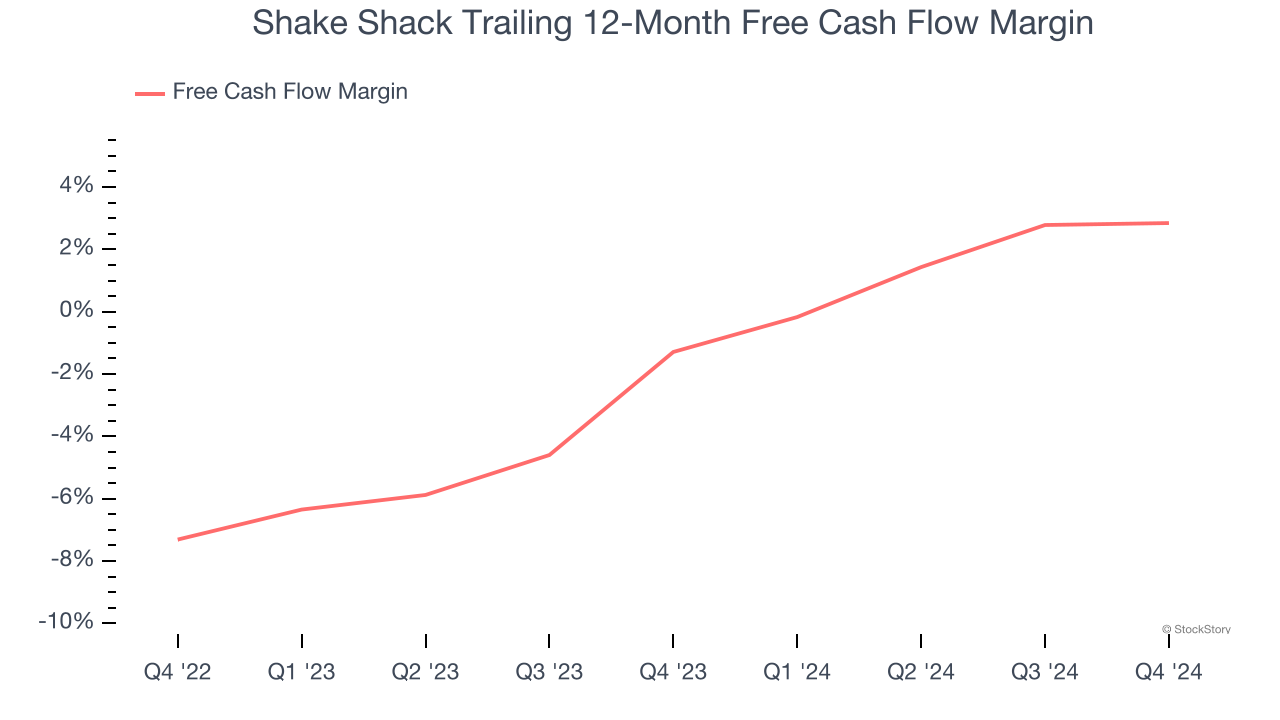

2. Breakeven Free Cash Flow Limits Reinvestment Potential

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

Shake Shack broke even from a free cash flow perspective over the last two years, giving the company limited opportunities to return capital to shareholders.

3. Previous Growth Initiatives Have Lost Money

Growth gives us insight into a company’s long-term potential, but how capital-efficient was that growth? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

Shake Shack’s five-year average ROIC was negative 2.9%, meaning management lost money while trying to expand the business. Its returns were among the worst in the restaurant sector.

Final Judgment

Shake Shack isn’t a terrible business, but it doesn’t pass our bar. Following the recent decline, the stock trades at 70.8× forward price-to-earnings (or $88.30 per share). This valuation tells us it’s a bit of a market darling with a lot of good news priced in - you can find better investment opportunities elsewhere. Let us point you toward one of Charlie Munger’s all-time favorite businesses.

Stocks We Would Buy Instead of Shake Shack

The Trump trade may have passed, but rates are still dropping and inflation is still cooling. Opportunities are ripe for those ready to act - and we’re here to help you pick them.

Get started by checking out our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Sterling Infrastructure (+1,096% five-year return). Find your next big winner with StockStory today for free.