Let’s dig into the relative performance of Hims & Hers Health (NYSE: HIMS) and its peers as we unravel the now-completed Q4 healthcare technology earnings season.

Healthcare Technology

The 9 healthcare technology stocks we track reported a slower Q4. As a group, revenues beat analysts’ consensus estimates by 2.3% while next quarter’s revenue guidance was in line.

Amidst this news, share prices of the companies have had a rough stretch. On average, they are down 17.7% since the latest earnings results.

Hims & Hers Health (NYSE: HIMS)

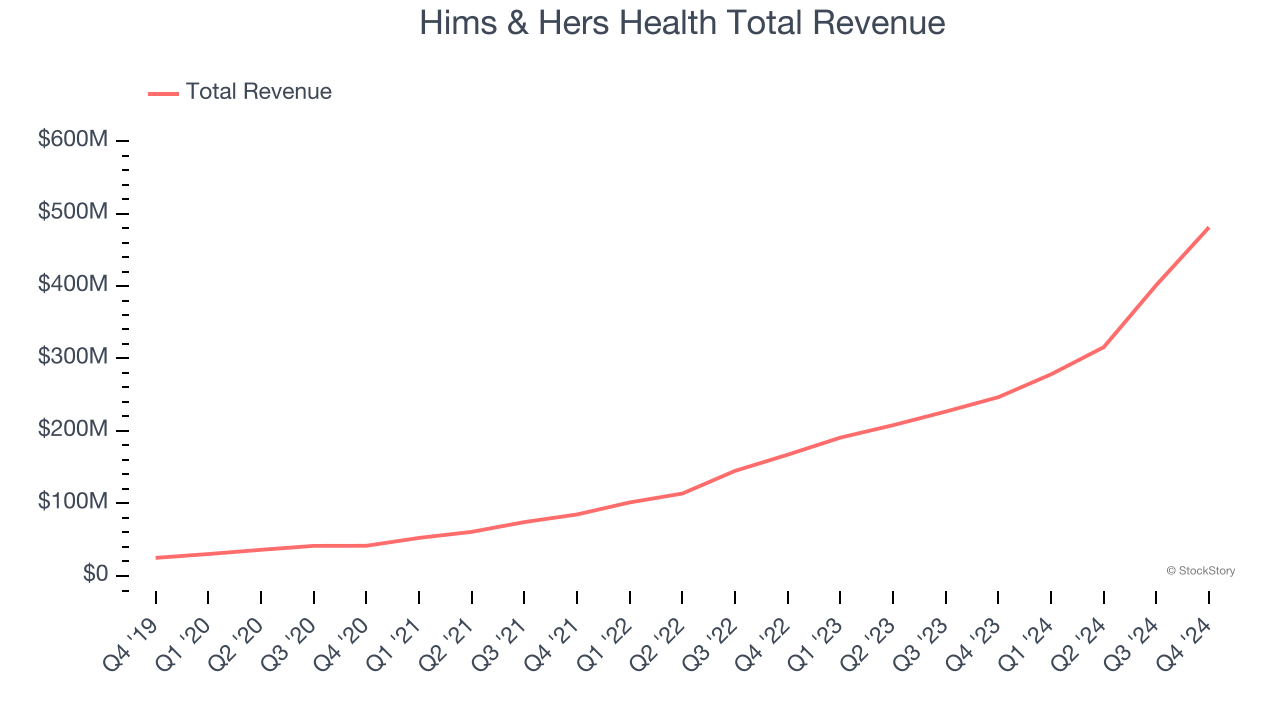

Originally launched with a focus on stigmatized conditions like hair loss and sexual health, Hims & Hers Health (NYSE: HIMS) operates a consumer-focused telehealth platform that connects patients with healthcare providers for prescriptions and wellness products.

Hims & Hers Health reported revenues of $481.1 million, up 95.1% year on year. This print exceeded analysts’ expectations by 2.2%. Overall, it was a satisfactory quarter for the company with full-year revenue guidance exceeding analysts’ expectations.

“2024 was a fantastic year at Hims and Hers as we continue to build a platform that leverages personalization and technology unlike any traditional healthcare system,” said Andrew Dudum, co-founder and CEO.

Hims & Hers Health achieved the fastest revenue growth and highest full-year guidance raise of the whole group. The company added 182,000 customers to reach a total of 2.23 million. Even though it had a relatively good quarter, the market seems discontent with the results. The stock is down 0.6% since reporting and currently trades at $27.49.

Is now the time to buy Hims & Hers Health? Access our full analysis of the earnings results here, it’s free.

Best Q4: Phreesia (NYSE: PHR)

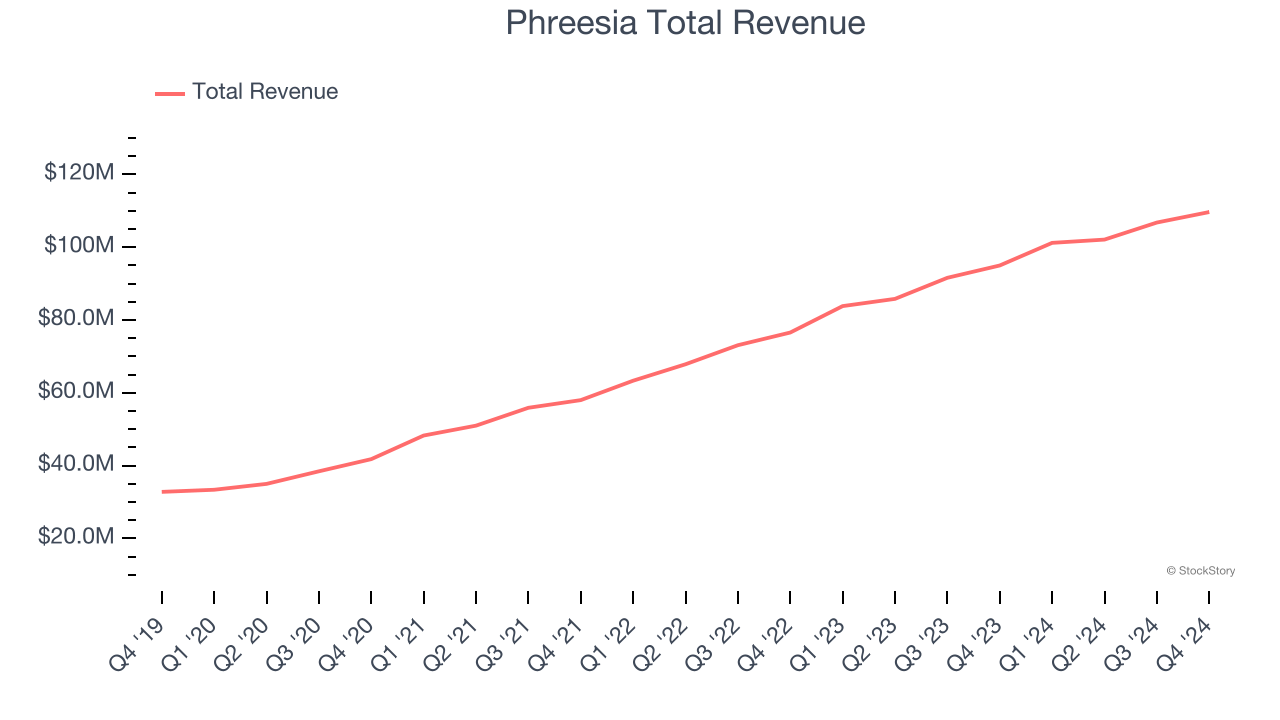

Founded in 2005 to streamline the traditionally paper-heavy patient check-in process, Phreesia (NYSE: PHR) provides software solutions that automate patient intake, registration, and payment processes for healthcare organizations while improving patient engagement in their care.

Phreesia reported revenues of $109.7 million, up 15.4% year on year, outperforming analysts’ expectations by 0.7%. The business had a strong quarter with an impressive beat of analysts’ EPS estimates and full-year EBITDA guidance topping analysts’ expectations.

However, the results were likely priced into the stock as it’s traded sideways since reporting. Shares currently sit at $24.03.

Is now the time to buy Phreesia? Access our full analysis of the earnings results here, it’s free.

Weakest Q4: Evolent Health (NYSE: EVH)

Founded in 2011 to transform how healthcare is delivered to patients with complex needs, Evolent Health (NYSE: EVH) provides specialty care management services and technology solutions that help health plans and providers deliver better care for patients with complex conditions.

Evolent Health reported revenues of $646.5 million, up 16.3% year on year, falling short of analysts’ expectations by 0.7%. It was a softer quarter as it posted a significant miss of analysts’ EPS estimates and EBITDA guidance for next quarter missing analysts’ expectations.

Evolent Health delivered the weakest performance against analyst estimates and weakest full-year guidance update in the group. As expected, the stock is down 15.8% since the results and currently trades at $9.04.

Read our full analysis of Evolent Health’s results here.

Astrana Health (NASDAQ: ASTH)

Formerly known as Apollo Medical Holdings until early 2024, Astrana Health (NASDAQ: ASTH) operates a technology-powered healthcare platform that enables physicians to deliver coordinated care while successfully participating in value-based payment models.

Astrana Health reported revenues of $665.2 million, up 88.4% year on year. This print topped analysts’ expectations by 6.9%. Zooming out, it was a mixed quarter as it also logged full-year revenue guidance beating analysts’ expectations.

The stock is down 3.7% since reporting and currently trades at $33.39.

Read our full, actionable report on Astrana Health here, it’s free.

GoodRx (NASDAQ: GDRX)

Started in 2011 to tackle the problem of high prescription drug costs in America, GoodRx (NASDAQ: GDRX) operates a digital platform that helps consumers find lower prices on prescription medications through price comparison tools and discount codes.

GoodRx reported revenues of $198.6 million, flat year on year. This result lagged analysts' expectations by 0.6%. It was a slower quarter as it also recorded a significant miss of analysts’ EPS estimates.

The company added 100,000 customers to reach a total of 6.6 million. The stock is down 4.2% since reporting and currently trades at $4.67.

Read our full, actionable report on GoodRx here, it’s free.

Market Update

Thanks to the Fed’s rate hikes in 2022 and 2023, inflation has been on a steady path downward, easing back toward that 2% sweet spot. Fortunately (miraculously to some), all this tightening didn’t send the economy tumbling into a recession, so here we are, cautiously celebrating a soft landing. The cherry on top? Recent rate cuts (half a point in September 2024, a quarter in November) have propped up markets, especially after Trump’s November win lit a fire under major indices and sent them to all-time highs. However, there’s still plenty to ponder — tariffs, corporate tax cuts, and what 2025 might hold for the economy.

Want to invest in winners with rock-solid fundamentals? Check out our Top 5 Quality Compounder Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.