Earnings results often indicate what direction a company will take in the months ahead. With Q4 behind us, let’s have a look at Smith & Wesson (NASDAQ: SWBI) and its peers.

Leisure products cover a wide range of goods in the consumer discretionary sector. Maintaining a strong brand is key to success, and those who differentiate themselves will enjoy customer loyalty and pricing power while those who don’t may find themselves in precarious positions due to the non-essential nature of their offerings.

The 13 leisure products stocks we track reported a mixed Q4. As a group, revenues beat analysts’ consensus estimates by 1.6% while next quarter’s revenue guidance was 1.7% below.

Amidst this news, share prices of the companies have had a rough stretch. On average, they are down 26.4% since the latest earnings results.

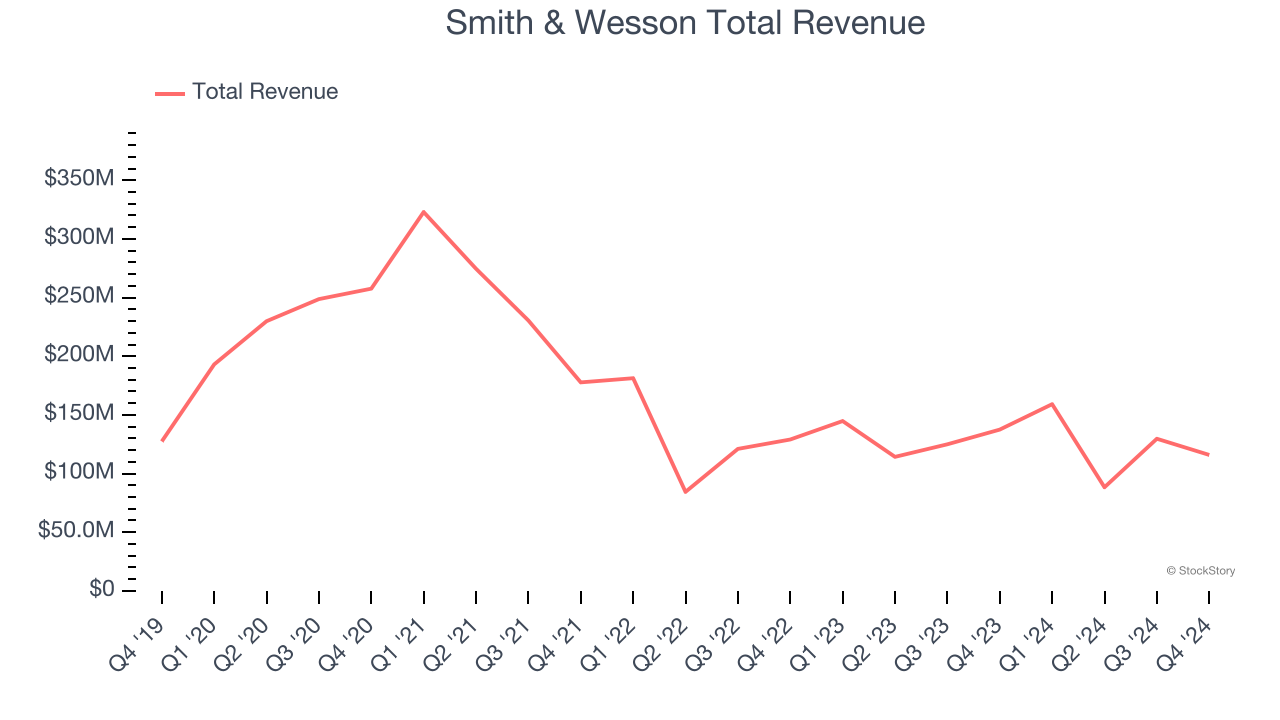

Smith & Wesson (NASDAQ: SWBI)

With a history dating back to 1852, Smith & Wesson (NASDAQ: SWBI) is a firearms manufacturer known for its handguns and rifles.

Smith & Wesson reported revenues of $115.9 million, down 15.7% year on year. This print fell short of analysts’ expectations by 3%. Overall, it was a slower quarter for the company with some shareholders anticipating a better outcome.

The stock is down 15.9% since reporting and currently trades at $9.29.

Read our full report on Smith & Wesson here, it’s free.

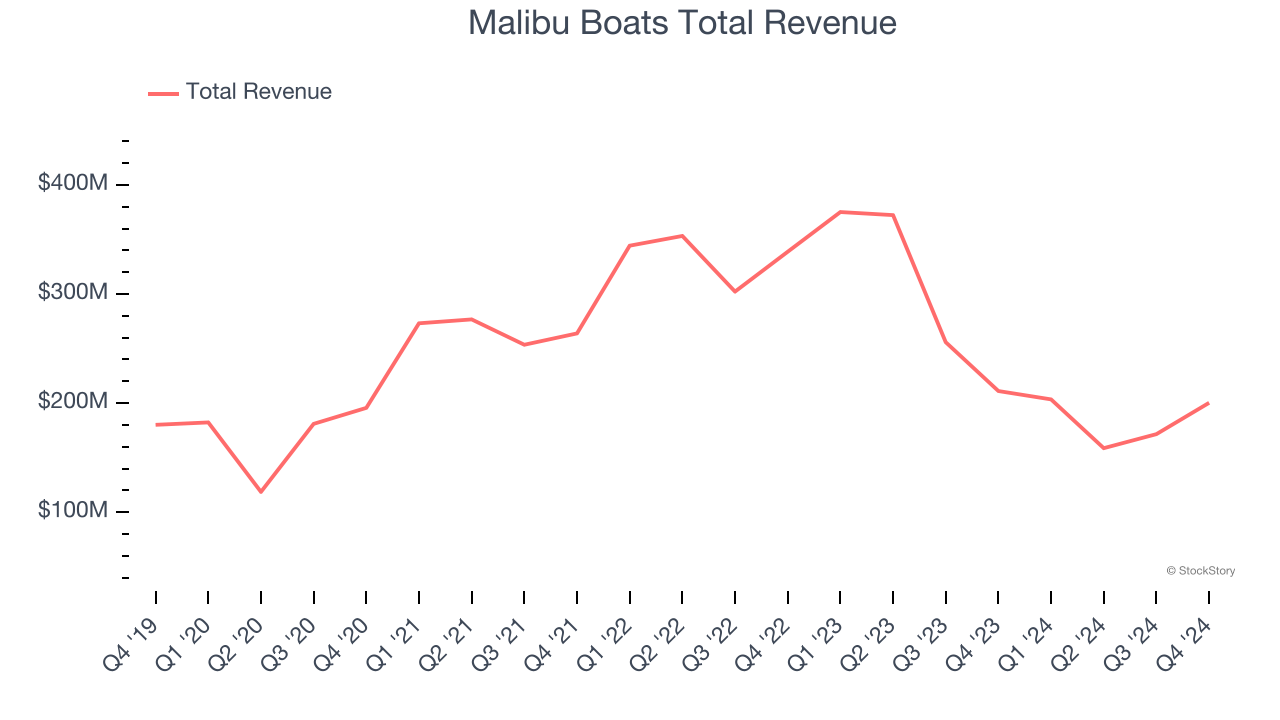

Best Q4: Malibu Boats (NASDAQ: MBUU)

Founded in California in 1982, Malibu Boats (NASDAQ: MBUU) is a manufacturer of high-performance sports boats and luxury watercrafts.

Malibu Boats reported revenues of $200.3 million, down 5.1% year on year, outperforming analysts’ expectations by 4.8%. The business had an exceptional quarter with a solid beat of analysts’ EPS estimates and an impressive beat of analysts’ adjusted operating income estimates.

The stock is down 33% since reporting. It currently trades at $25.71.

Is now the time to buy Malibu Boats? Access our full analysis of the earnings results here, it’s free.

Weakest Q4: Harley-Davidson (NYSE: HOG)

Founded in 1903, Harley-Davidson (NYSE: HOG) is an American motorcycle manufacturer known for its heavyweight motorcycles designed for cruising on highways.

Harley-Davidson reported revenues of $687.6 million, down 34.7% year on year, falling short of analysts’ expectations by 3.8%. It was a disappointing quarter as it posted a miss of analysts’ motorcycles sold estimates and a significant miss of analysts’ adjusted operating income estimates.

Harley-Davidson delivered the slowest revenue growth in the group. As expected, the stock is down 17.1% since the results and currently trades at $22.25.

Read our full analysis of Harley-Davidson’s results here.

Ruger (NYSE: RGR)

Founded in 1949, Ruger (NYSE: RGR) is an American manufacturer of firearms for the commercial sporting market.

Ruger reported revenues of $145.8 million, up 11.6% year on year. This result topped analysts’ expectations by 5.8%. More broadly, it was a mixed quarter as it produced a significant miss of analysts’ EBITDA estimates.

Ruger delivered the fastest revenue growth among its peers. The stock is up 7.6% since reporting and currently trades at $38.15.

Read our full, actionable report on Ruger here, it’s free.

MasterCraft (NASDAQ: MCFT)

Started by a waterskiing instructor, MasterCraft (NASDAQ: MCFT) specializes in designing, manufacturing, and selling sport boats.

MasterCraft reported revenues of $63.37 million, down 29.4% year on year. This print beat analysts’ expectations by 4.4%. Aside from that, it was a mixed quarter as it also produced a solid beat of analysts’ EPS estimates but EBITDA guidance for next quarter missing analysts’ expectations significantly.

The stock is down 11.7% since reporting and currently trades at $16.09.

Read our full, actionable report on MasterCraft here, it’s free.

Market Update

Thanks to the Fed’s series of rate hikes in 2022 and 2023, inflation has cooled significantly from its post-pandemic highs, drawing closer to the 2% goal. This disinflation has occurred without severely impacting economic growth, suggesting the success of a soft landing. The stock market thrived in 2024, spurred by recent rate cuts (0.5% in September and 0.25% in November), and a notable surge followed Donald Trump’s presidential election win in November, propelling indices to historic highs. Nonetheless, the outlook for 2025 remains clouded by potential trade policy changes and corporate tax discussions, which could impact business confidence and growth. The path forward holds both optimism and caution as new policies take shape.

Want to invest in winners with rock-solid fundamentals? Check out our Top 5 Growth Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.