Over the last six months, IPG Photonics shares have sunk to $63.58, producing a disappointing 13.1% loss - worse than the S&P 500’s 1.6% drop. This may have investors wondering how to approach the situation.

Is now the time to buy IPG Photonics, or should you be careful about including it in your portfolio? Dive into our full research report to see our analyst team’s opinion, it’s free.

Even with the cheaper entry price, we don't have much confidence in IPG Photonics. Here are three reasons why IPGP doesn't excite us and a stock we'd rather own.

Why Do We Think IPG Photonics Will Underperform?

Both a designer and manufacturer of its products, IPG Photonics (NASDAQ: IPGP) is a provider of high-performance fiber lasers used for cutting, welding, and processing raw materials.

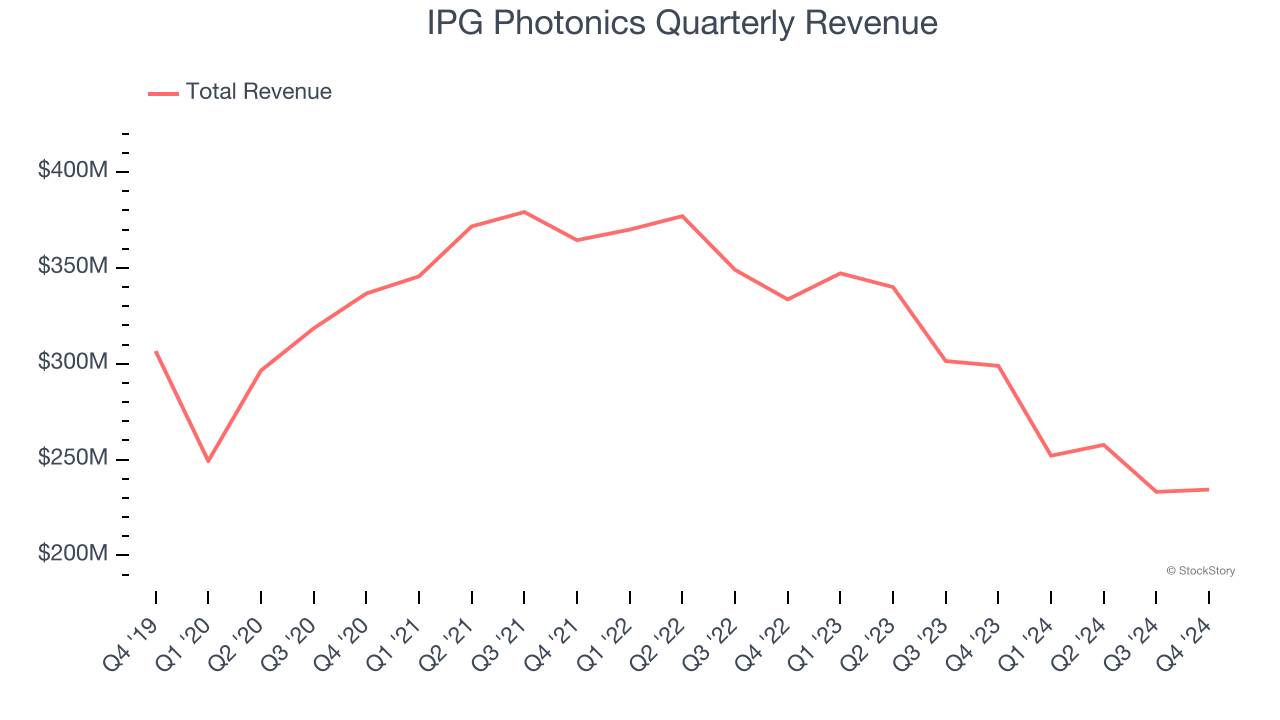

1. Revenue Spiraling Downwards

A company’s long-term performance is an indicator of its overall quality. Any business can have short-term success, but a top-tier one grows for years. IPG Photonics struggled to consistently generate demand over the last five years as its sales dropped at a 5.8% annual rate. This wasn’t a great result and signals it’s a low quality business. Semiconductors are a cyclical industry, and long-term investors should be prepared for periods of high growth followed by periods of revenue contractions.

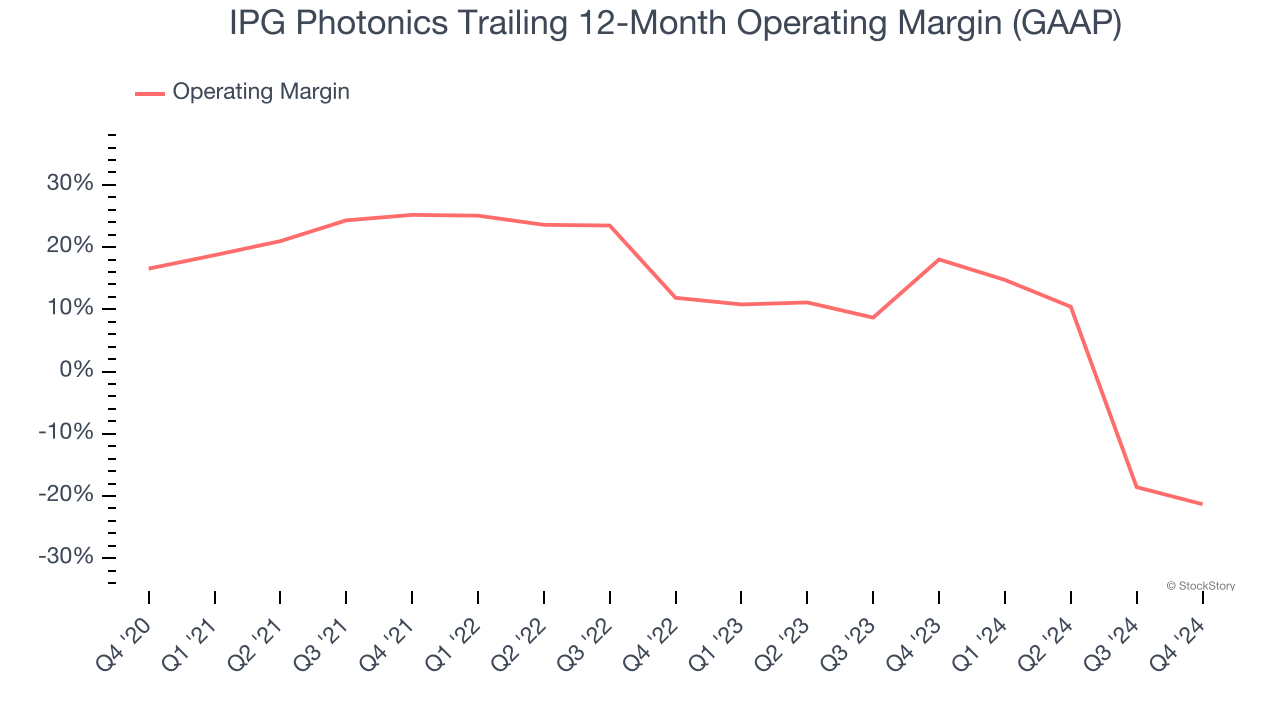

2. Shrinking Operating Margin

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

Looking at the trend in its profitability, IPG Photonics’s operating margin decreased by 37.9 percentage points over the last five years. IPG Photonics’s performance was poor no matter how you look at it - it shows that costs were rising and it couldn’t pass them onto its customers. Its operating margin for the trailing 12 months was negative 21.3%.

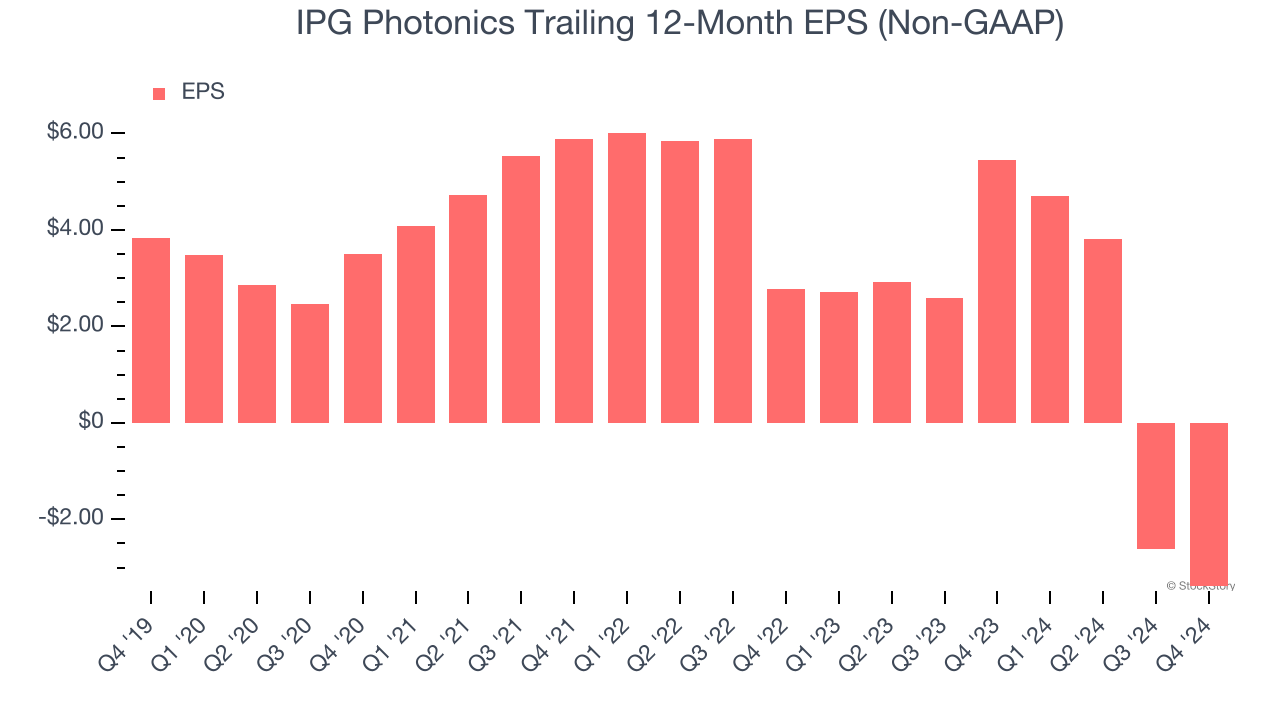

3. EPS Trending Down

Analyzing the long-term change in earnings per share (EPS) shows whether a company's incremental sales were profitable – for example, revenue could be inflated through excessive spending on advertising and promotions.

Sadly for IPG Photonics, its EPS declined by 23.6% annually over the last five years, more than its revenue. This tells us the company struggled because its fixed cost base made it difficult to adjust to shrinking demand.

Final Judgment

IPG Photonics falls short of our quality standards. After the recent drawdown, the stock trades at 31.9× forward price-to-earnings (or $63.58 per share). This valuation tells us a lot of optimism is priced in - you can find better investment opportunities elsewhere. We’d recommend looking at one of Charlie Munger’s all-time favorite businesses.

Stocks We Like More Than IPG Photonics

Market indices reached historic highs following Donald Trump’s presidential victory in November 2024, but the outlook for 2025 is clouded by new trade policies that could impact business confidence and growth.

While this has caused many investors to adopt a "fearful" wait-and-see approach, we’re leaning into our best ideas that can grow regardless of the political or macroeconomic climate. Take advantage of Mr. Market by checking out our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Comfort Systems (+751% five-year return). Find your next big winner with StockStory today for free.