The end of an earnings season can be a great time to discover new stocks and assess how companies are handling the current business environment. Let’s take a look at how Alignment Healthcare (NASDAQ: ALHC) and the rest of the health insurance providers stocks fared in Q4.

Upfront premiums collected by health insurers lead to reliable revenue, but profitability ultimately depends on accurate risk assessments and the ability to control medical costs. Health insurers are also highly sensitive to regulatory changes and economic conditions such as unemployment. Going forward, the industry faces tailwinds from an aging population, increasing demand for personalized healthcare services, and advancements in data analytics to improve cost management. However, continued regulatory scrutiny on pricing practices, the potential for government-led reforms such as expanded public healthcare options, and inflation in medical costs could add volatility to margins. One big debate among investors is the long-term impact of AI and whether it will help underwriting, fraud detection, and claims processing or whether it may wade into ethical grey areas like reinforcing biases and widening disparities in medical care.

The 11 health insurance providers stocks we track reported a satisfactory Q4. As a group, revenues beat analysts’ consensus estimates by 2.3% while next quarter’s revenue guidance was in line.

In light of this news, share prices of the companies have held steady as they are up 2.6% on average since the latest earnings results.

Alignment Healthcare (NASDAQ: ALHC)

Founded in 2013 with a mission to transform healthcare for seniors, Alignment Healthcare (NASDAQ: ALHC) provides Medicare Advantage health plans for seniors with features like concierge services, transportation benefits, and technology-driven care coordination.

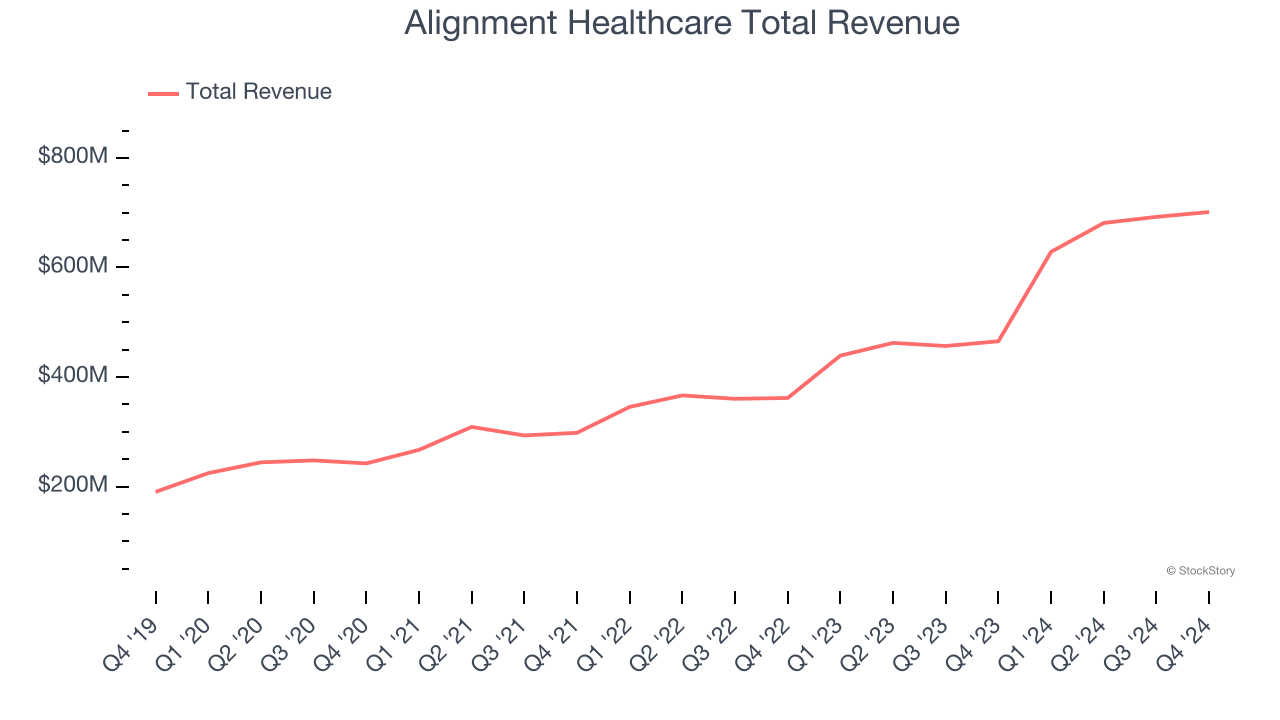

Alignment Healthcare reported revenues of $701.2 million, up 50.7% year on year. This print exceeded analysts’ expectations by 3.6%. Overall, it was a very strong quarter for the company with EBITDA guidance for next quarter exceeding analysts’ expectations.

“2024 was a milestone year that proved health plans can win by providing more care, not less,” said John Kao, founder and CEO.

Alignment Healthcare scored the fastest revenue growth and highest full-year guidance raise of the whole group. The company added 6,800 customers to reach a total of 189,100. Unsurprisingly, the stock is up 14.1% since reporting and currently trades at $15.36.

Best Q4: Progyny (NASDAQ: PGNY)

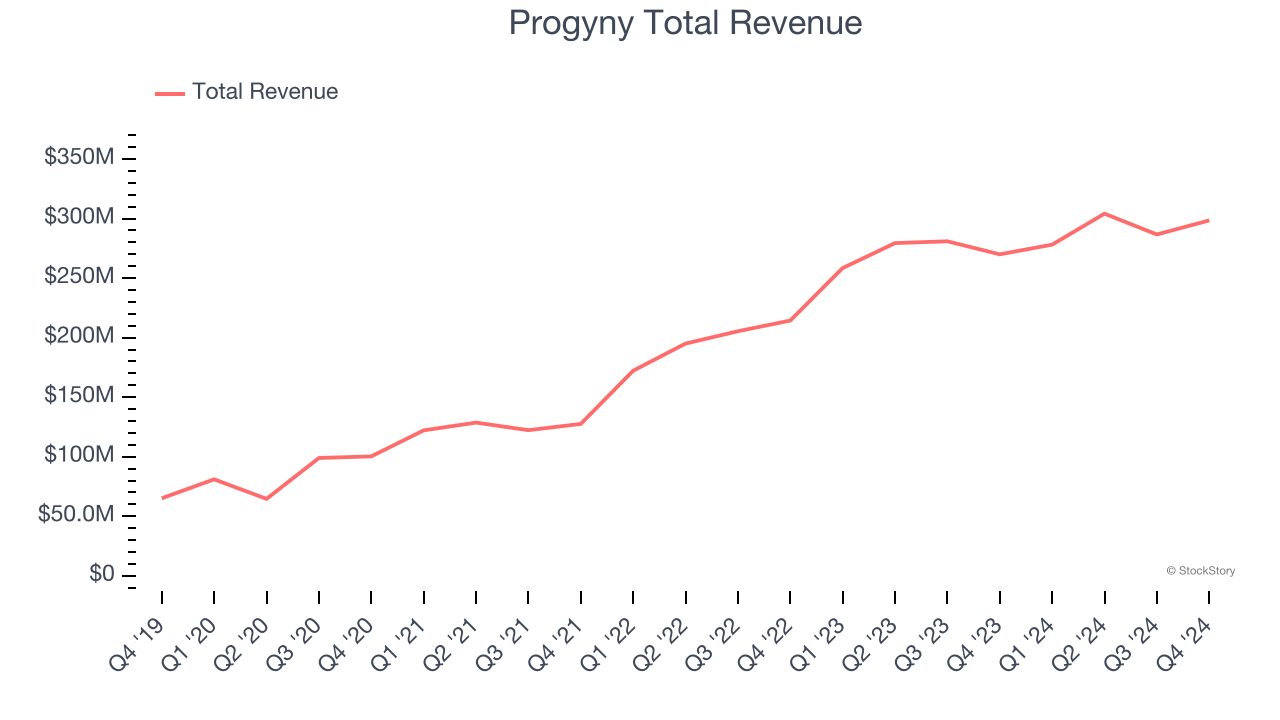

Pioneering a data-driven approach to family building that has achieved an industry-leading patient satisfaction score of +80, Progyny (NASDAQ: PGNY) provides comprehensive fertility and family building benefits solutions to employers, helping employees access quality fertility treatments and support services.

Progyny reported revenues of $298.4 million, up 10.6% year on year, outperforming analysts’ expectations by 7.6%. The business had a very strong quarter with an impressive beat of analysts’ sales volume estimates and EBITDA guidance for next quarter exceeding analysts’ expectations.

Progyny achieved the biggest analyst estimates beat among its peers. Although it had a fine quarter compared to its peers, the market seems unhappy with the results as the stock is down 6.7% since reporting. It currently trades at $21.31.

Is now the time to buy Progyny? Access our full analysis of the earnings results here, it’s free.

Weakest Q4: Molina Healthcare (NYSE: MOH)

Founded in 1980 as a provider for underserved communities in Southern California, Molina Healthcare (NYSE: MOH) provides managed healthcare services primarily to low-income individuals through Medicaid, Medicare, and Marketplace insurance programs across 21 states.

Molina Healthcare reported revenues of $10.5 billion, up 16% year on year, exceeding analysts’ expectations by 1.9%. Still, it was a slower quarter as it posted a significant miss of analysts’ full-year EPS guidance estimates.

Interestingly, the stock is up 2.1% since the results and currently trades at $324.07.

Read our full analysis of Molina Healthcare’s results here.

Cencora (NYSE: COR)

Formerly known as AmerisourceBergen until its 2023 rebranding, Cencora (NYSE: COR) is a global pharmaceutical distribution company that connects manufacturers with healthcare providers while offering logistics, data analytics, and consulting services.

Cencora reported revenues of $81.49 billion, up 12.8% year on year. This result beat analysts’ expectations by 5.2%. Overall, it was a very strong quarter as it also recorded a narrow beat of analysts’ full-year EPS guidance estimates.

The stock is up 9.1% since reporting and currently trades at $274.50.

Read our full, actionable report on Cencora here, it’s free.

Centene (NYSE: CNC)

Serving nearly 1 in 15 Americans through its government healthcare programs, Centene (NYSE: CNC) is a healthcare company that manages government-sponsored health insurance programs like Medicaid and Medicare for low-income and complex-needs populations.

Centene reported revenues of $40.81 billion, up 3.4% year on year. This number topped analysts’ expectations by 4.4%. It was a very strong quarter as it also put up an impressive beat of analysts’ EPS estimates and a narrow beat of analysts’ customer base estimates.

Centene had the slowest revenue growth among its peers. The company lost 39,400 customers and ended up with a total of 28.6 million. The stock is down 6.4% since reporting and currently trades at $60.66.

Read our full, actionable report on Centene here, it’s free.

Want to invest in winners with rock-solid fundamentals? Check out our Strong Momentum Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.